As you all know there’s much discussion, hand-wringing and consternation surrounding of all the complex goings-on at Silicon Valley Bank, Credit Suisse, Signature, First Republic, et al, et al.

Authors Note: Since I know my readers are busy folks and pressed for time, I understand that many of you might not want to struggle through this longwinded tome, so, as always, the particularly important concepts, pithy commentary, selected pearls of wisdom and “Holy cats are you kidding me?” data/stats ….are all highlighted in Red throughout this masterpiece, which I whipped up over the weekend….carry on..

The current banking debacle is actually quite harrowing and extremely complex….so much so, that in the spirit of this blog, I wanted to take a few minutes of your valuable time, as I often do, to “dumb it down” and try to sum it all up in an easy-to-understand package….hey…it’s been done before…

“Speak to me as you might, to a young child, a golden retriever, or a bank regulator…”

So….in one (horribly constructed) sentence I’ll describe exactly what happened at SVB….and what’s going to be happening all over America, in fits and starts at first….and in seemingly tsunami-like, accelerating random waves as we muddle our way through this mess… at least until 1.) Our leadership understands exactly what’s happening and takes drastic, targeted measures to stop it…or 2.) We are all living in our cars trying to outrun the repo-man…..whichever comes first…

Here goes…here’s my one sentence, layman’s summary:

“Silicon Valley Bank experienced huge amounts of money coming in (deposit inflows) of unknown/questionable origin over the last three years, forcing management to ‘invest’ this cash…and because of our wonderfully safe, highly regulated fractional reserve banking system, they were allowed to keep only about 5%+/- of deposits in cash (2%) and ‘equivalents’ (3%) on hand to maximize their returns/leverage, and they ‘invested’ the rest.. which, unfortunately, they often ‘invested’ in less than liquid ‘stuff’ that they could try to sell if they needed money….but, sadly they couldn’t sell this ‘stuff’ for what they paid for it, and …so when (almost all) of their depositors wanted their money back in a big hurry, they had to sell a bunch of ‘stuff’ at gigantic losses, and that was that….. and even after all of that, they still couldn’t pay the depositors their money back ….and the FDIC came in all pissy, yelled at everybody for a little while, and closed ’em down and paid all of the depositors and sold off what was left to other banks and dudes for pennies on the dollar.”

There you have it….that’s exactly what happened….one poorly constructed sentence…explained in a way that you and I…. and a bank regulator or Central Banker can understand it.

It’s kinda’ like when you get that great job, you go out and buy new cars and a great big new house with 5% down and you lose your job cuz’ you don’t know what you are doing….the bank takes your house away….you get nuthin’ and the bank sells your house to somebody else for whatever they can get… ‘cuz you ran out of money to pay the bank back….

So WHY did this Happen?

There are all kinds of theories here…the usual suspects, greed, incompetence, systemic imbalances, regulatory failure, inadequate laws, Joe Biden’s dog, Stormy Daniels, yada yada yada….

For those of you who’ve been following my work for a while, I’d like to proffer my own little theory, which, as you know, I’ve been discussing in some form or another for a number of years now…

“This wasn’t an accident….Silicon Valley Bank was MURDERED!”

So, If I were a global supervillain, with virtually unlimited resources, and wanted to make sure that Silicon Valley Bank was soon to be sleeping with the fishes…how would I go about it? How would I pull it off and get away with it? In simple terms I’d want to generate and have control over a flood of incoming deposits, have some input on how these deposits are “invested” and I’d want to be sure I’m able to synchronize the withdrawals at a point in time when they could do the most harm/damage. I’d also want to make sure that my true identity remained a big fat secret so that the authorities couldn’t pin this caper on me. I’d want to be a financial ghost.

The plan would be as follows:

1.) Recruit loyal henchmen and teams of eager lawyers, accountants and bankers to establish LLCs, both foreign and US.

2.) Each LLC or individual would have multiple US and foreign bank relationships particularly in the Eurozone, Switzerland, Luxembourg, Hong Kong, the Netherlands, Singapore and the Cayman Islands. Fortunately, it’s easy enough to comply with the most basic KYC (Know Your Customer) rules at many of these prestigious institutions. All you need is some sort of acceptable ID, a lawyer/accountant adept at setting up these accounts/relationships, and a seven or eight figure deposit, just to show good faith. With any luck, your bank will assign a personal “Wealth Manager” who will assist you in moving your money around and occasionally pick up the tab at the strip club.

3.) The key to this “Covert Opp” is to select a target, preferably a hubris/sales driven organization where people are paid a ton of money for growth and are willing to look the other way…and not ask too many questions, as to why everyone seems to want to hand them “big money” deposits at a breakneck pace….these wealth managers, accountants and lawyers will think that they are really good at what they do. No need to dig too deeply into where the money is coming from, or God forbid…it might stop flowing.

4.) As a Global-Super-Villain, I’d bide my time and keep watching the management, and perhaps give them ideas as to what to invest in, after all, wealthy movers and shakers (like my team), with seven, eight, nine or even ten figures on deposit/invested must know what they are doing….the customer is always right!

6.) So let’s say that my team, over time has deposits of $20 Billion at SVB (That’s just 2,000, seemingly unrelated, henchmen controlled LLCs with $10 million each under their direction). They’d keep gathering intel on the bank until I was confident that when my team presses the “wire transfer button” to my other banks, SVIB would be no more. (By the way….$20 Billion is a mere pittance, spare change from the couch cushions, for an Oligarch Global-Super Villain)

7.) When we look at SVIB’s recent 10-K we can get a good idea as to how much deposit/wire-out firepower I might need (if I were a Global Super-Villain) to kill ’em. On 12/31/22 SVB had a Balance Sheet of roughly $211 Billion in Assets (sounds like a lot…at the time they were the 16th largest bank in America), which was primarily offset by $173 Billion of deposit “liabilities” (i.e. All of SVBs wonderful loyal customers could theoretically “demand” all of that money and request that this $173 Billion be wired out immediately…..but what are the odds that this could happen?”). This is especially problematic since there was only $13.8 Billion of actual cash and “equivalents” on hand at the time. See what I’m sayin?….My henchmen ask to withdraw $20 Billion but they only have $13.8 Billion on hand….everyone finds out about it and all of a sudden everybody and their brother-in-law wants $42 Billion (like what happened on March 8th) and that was that.

8.) Of course, as an experienced “Global Super-Villain“, intimately familiar with how these things work, once I got the ball rolling, I’d make sure that lots of my Western “Helpers” got word of the bank run and they, in turn would make sure to get their deposits out of the bank, while loudly trumpeting their concerns. May SVB rest in peace. (…by the way…blaming Peter Theil, or any one person for all of this is just silly…it takes a village)

9.) Now, just a quick word about FASB 115….FASB 115 is a really cool accounting/banking rule that says (generally) if you have both the “intent” and the “ability” to hold a security to “maturity” and it drops in value, you don’t have to report the loss in your financial statements, even if you are pretty sure the aforementioned security could turn out to be doggy-turds. For example, I can absolutely have both the “intent” and the “ability” to meet Beyonce’ for sausage and biscuits at Cracker Barrel every Sunday morning, hoping she’ll show up….see how “intent” and “ability” work? FASB 115 allows a banker to circumvent reality and cook the books until, at some point in the future, it slaps him in the face with a vengeance. i.e.) Beyonce’ ain’t gonna show…

10.) So once SVB bankers realized that they couldn’t satisfy the stack of wire transfers piling up, and they no longer had the “intent or ability” to hold all of those FASB 115 securities and had to write off probably about 3x to 5x Shareholder equity of $16 Billion….that was all she wrote …..and they were using the last of their petty cash to buy coffee and donuts for the FDIC regulators who would be busy spending the next couple of days yelling at them, closing them down and auctioning off “stuff”.

Here’s the link to the 10-K

So that’s how a Global Super-Villain can wreck one teeny-tiny little $200 Billion pre-collapse asset value bank….child’s play…

So What about the Big Gorilla?

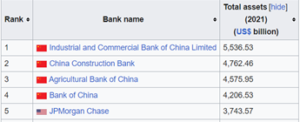

So, as a Global-Super-Villain, and I’ve experienced a little bit of success here with my assassination of SVB….now that I’m feeling my oats….I’m going to set my sights a bit higher and do some big game hunting. So, I wonder , ponder and calculate…what it would take to put the Big Gorilla of American Banking, JP Morgan/Chase out of business?

Let’s take a look at the numbers…..

Here’s the 12/31/22 10-K:

Interestingly enough, JPM has about the same amount of cash on hand (available for immediate wire out) as SVB did when it blew up….$27.7 Billion. So if more withdrawal requests show up than that, they’ll have to “do something” to get the money. Not to worry though, since JPM is a “GSIB” or Global Systemically Important Bank , they can get any amount of money they need from the FED, all they have to do is ask. Talk about your competitive advantage! But, lets just say, for whatever reason, they don’t want to go to the FED yet, perhaps uncle Jay is a bit testy today, or he just can’t be bothered for the “little things”. The next place JPM would probably look to satisfy daily cash requirements is toward the other deposits ($540 Billion) that they have at other branch banks, etc., and the $316 Billion in Reverse Repo which should be (we hope) immediately available so they don’t have to take on significant “fire sale” losses. So a total of about $884 Billion that’s available before they need to start selling other “stuff”….(which might have some of those nasty FASB 115 losses attached to ’em). So $884 Billion sounds like a lot….doesn’t it? Until you put it in perspective. JPM also has about $2.34 Trillion, hair trigger Deposit liabilities (gulp) on the books (about 15% of the total $16T deposits sitting on the books of the 2,135 US Banks with assets over $300 million) , that can move anywhere in the world with a few mouse clicks. But that’s sooooo much money you say….how and why would all that money want to move out of the JPM Banking system?….where would it go?

Well, it could go lotsa places. It could flood into other US Banks in a giant game of overnight “bust the bank whack-a-mole”. It could end up at LLC brokerage accounts invested in “target pump and dump risk assets” awaiting the next rug pull. It could go to Eurozone, British or Japanese Banks, with a request to convert US Dollars to another currency, potentially putting enormous pressure on the dollar (selling it) and increasing demand for and driving up the value of the Euro, Sterling and the Yen…or any other currency for that matter…ready to rug pull other banks/institutions…..fleeing depositors might suddenly start selling US Dollars and buying foreign currency …Turkish Lira, Russian Rubles or even that silly Chinese currency that nobody uses.

Speaking of “target pump and dump risk assets awaiting the next rug pull”…

There is no question, at least in my mind, that there is an incomprehensible, horiffic level of mis-rep’ed, silly securities sitting in American Equity Markets trading on American Equity Exchanges today. Manipulated by the “ShellCo Army”… trillions of dollars of Chinese ADRs and related Chinese influenced/controlled businesses masquerading as “the next big thing”, at enormous, volatile, whimsical prices, with little relationship, if any, to traditional security valuation metrics. They’ve been brought to our shores by our friendly, “helper” Investment Banks looking to make a quick buck selling this cancer. The charts of these businesses are beginning to resemble rolling ocean waves, “pumping and dumping” along, on their way to delisting….enriching the “ShellCo Army” at both the trough and the crest of each wave, routinely taking the dumb money (and the banks they use) out to the woodshed along the way.

I had discussed the ramifications of these systemic interconnections, between shadow entities, fake securities and passive flows a few years ago when I wrote….

The “GameStop Narrative” and Post Mortem vs. “Hypothetical Reality”

Again, reading the “Gamestop Narrative” isn’t necessary to grasp what we’re discussing here today, but you may find it to be a worthwhile, deep-dive diversion, and perhaps broaden your appreciation as to what we’re up against.

In any case….Let’s press forward….shall we?

Really, when you think about it, with our interconnected world, the money can go anywhere, and be exchanged for just about anything, in the blink of an eye. That said, something like this would look like an enormous Chinese Fire Drill to the FED and FDIC….running all over the place… closing some banks down and pouring funds/liquidity into the survivors. Only to do it all over again somewhere else the next day. To be honest, I’m not familiar with the FED/FDIC/SEC HR Departments, but I’d bet you dollars to donuts that they don’t have nearly enough staff to handle something like this.

I know what you’re thinking…

“DT ….this is crazy talk….reckless, wild speculation…no Global-Super-Villain has the resources, cunning and ingenuity to pull something like this off….there’s no possible way this could happen…”

Let me continue….perhaps you are right….but as I was saying…

More Perspective….

Macro Scope:

JPM/Chase along with Bank of America, Citi, Wells Fargo, State Street, BNY Mellon, etc. might look like the big gorillas of American Finance, but in the grand scheme of things, JPM and these banks are the USS Arizona and the other warships neatly moored along battleship row in Pearl Harbor on December 6th 1941. In other words, $884 Billion of cash/equivalents and liquid assets are a pittance when compared to what could suddenly be a seismic demand for dollar withdrawals/wires. Not because there is any real economic, business or commercial need for the funds, but because the funds have been weaponized against the Western Financial system.

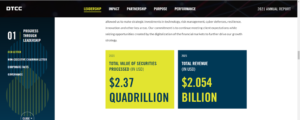

Courtesy of DTCC, the global engine of Western finance, during 2021, $2.37 Quadrillion of securities value changed hands…put another way, $9.5 Trillion (about 50% of US GDP) changes hands around the globe every day. Stocks, bonds, cash, derivatives, options, etc. etc. all changing title with mouse clicks in nano-seconds. I’m anxiously awaiting the 2022 report since it’s due out any day and I’m expecting a number north of $2.5 Quadrillion ($10 Trillion a day) for total securities cleared in 2022.

You can get a feel for what DTCC actually does and how they do it from this piece I wrote a few years ago if your time permits. But a complete understanding of the DTCC function isn’t necessary to continue on. In fact, I’d guess that there are very few people on the planet who have a complete understanding of what DTCC actually does.

DTCC….and other really, really HUGE!, complex, totally related stuff

More Macro Scope:

So now that we have a feel for how much money/value/ownership can move around the planet on any given day/minute/nanosecond, lets discuss where it is (mostly) and why it’s there.

The information in this section is gleaned from the Financial Stability Board’s (FSB) annual Global Monitoring Report on Non-Bank Financial Intermediation

So, what’s the total value of Global Financial Assets scattered around the planet, as of 2021? What are they? and Where are they ?

https://www.fsb.org/2022/12/global-monitoring-report-on-non-bank-financial-intermediation-2022/

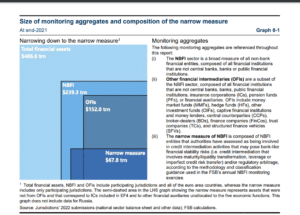

The above represents the breakdown of what types of institutions hold financial assets. Since the FSB is always publishing their reports a year in arrears, based on expected growth from 2021 we can take a SWAG and say that today, Total Financial Assets (for reporting jurisdictions) have grown from $486.6T at the end of 2021 to about $500T+ today (that’s probably a conservative estimate). Note also that this $486T figure does not include most of China’s shadow bank assets since they don’t report them.

For the purpose of this discussion, I’d like to focus on Other Financial Intermediaries (OFIs), a subset of “Total Financial Assets” which include Money Market Funds (MMFs), Hedge Funds (HFs), Other Investment Funds (OIFs), Captive Financial Institutions and Money Lenders, Central Counterparties (CCPs), Broker-Dealers (BDs), Finance Companies (FinCos), Trust Companies (TCs), and Structured Finance vehicles (SFVs). This is quite a mouthful, but it’s the FSB definition.

Generally, what we’re talking about here is unregulated (or lightly regulated), uninsured investors, LLCs, Funds and privately controlled “Shadow Banking” assets. In 2021, these OFI Assets scattered around the planet amounted to $152.0 Trillion (Again, not including China’s non reported OFI) or roughly 172 x JP Morgan’s relatively miniscule $884 Billion of Cash and Equivalents immediately available to liquidate/sell/wire-out without generating a FASB 115 loss.

I hope this simple calculation puts the JP Morgan/Chase “fortress like” Balance Sheet in perspective. JP Morgan/Chase, America’s biggest bank, through our own, expansive, monetary policy, has become but a pimple on the global financial system’s buttocks.

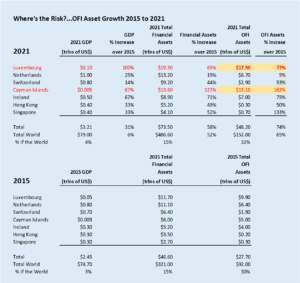

The next thing we must ask ourselves is: where are all of these assets and why are they there? The table below describes the rapid, odd and disturbing growth of Financial Assets and Shadow Assets in Offshore financial havens. We can define these jurisdictions as “financially friendly” environments where anonymity, legal protections and access to Western money center institutions is paramount. It’s the primary activity in these jurisdictions. (i.e. Financial Asset domicile and transaction level are only loosely related to, and often dwarf “real” economic activity and GDP. The Jurisdictions we will focus on are Luxembourg, Netherlands, Switzerland, the Caymans, Ireland, Hong Kong and Singapore….or as I refer to them… “The Magnificent Seven”.

Aggregate GDP in these jurisdictions is a paltry 4% ($3T) of Global GDP for FSB reporting jurisdictions, yet Financial Assets amount to 15% ($72.5T) of total Financial Assets ($486.6T) ….moreover, and more concerning, roughly 1/3 ($46.2T) of privately managed, stealth “shadow assets” i.e.) Global OFI Assets ($152T) are hiding in these (virtually unregulated) jurisdictions.

What’s happening here is that Investors, Funds, Shadow LLCs, Oligarchs, Drug Cartels, Congressmen/Senators, etc. as well as the occasional legitimate business, all use these jurisdictions to “park”, launder, wash and move anonymous funds in and out of banks, brokerages and OFIs all over the world, in the blink of an eye….to their advantage, with, generally, no questions asked. Because, the “trust” and the “relationship” has long been established (solely by the existence of a large account balance) …so the wires go in/out without any review. Here at home in “America” if I wire out six figures from an account, I almost immediately get a call from my account manager, asking me if there’s a problem with the “relationship”, and I need to have the sort of discussion that I was often forced to resort to when dating in college, that “Of course there’s nothing wrong…I just need more space”, which would usually suffice. I’d also note that when I wire 6 figures “in” (rather than out) my banker sends me an automated “thank you email”, acknowledging his deep caring for my business. Apparently, Bankers don’t scrutinize money coming in nearly as much as they fear money going out…I would guess that this mindset/behavior is pretty typical.

To continue, the lions share of this OFI money is located in the Caymans ($13.1T) primarily for US deployment and Luxembourg ($17.5T)/Netherlands ($6.7T)/Switzerland ($2.9T) for access to the Eurozone banks and funds. Singapore and Hong Kong are more like “gate keepers” or facilitators providing the vehicles for Western currency/funds to flow in/out of Asia.

Think about thousands of networks like the one described below:

A Russian/Chinese/etc. Oligarch, princeling or “mover and shaker” owns a number of Hong Kong LLCs….each of these LLCs has relationships/interests in/with Luxembourg, Caymans, etc. entities. These LLC’s incorporate “on-shore” LLC’s/entiities in America, Europe, Japan, Australia, Canada, etc. etc. Once the web is created and the necessary relationship infrastructure is complete, money can move seamlessly from entity to entity and bank to bank. Nobody needs to ask any questions…because there’s no requirement that they do so. The Bankers, Lawyers and moneymen won’t ask these questions because if they do, they might jeopardize the relationship…..and we can’t have that. Thus we’ve designed a system where, all of the “customers” are known….but nobody knows the customers up the chain or the original source of the funds.

Most of this offshore OFI money (65%) is located in the Cayman Islands and Luxembourg. Total Financial Assets and OFI Assets in these jurisdictions have roughly doubled since 2015. Twenty years ago the entire Offshore/Tax Haven banking industry didn’t even exist. Oh how far we’ve come.

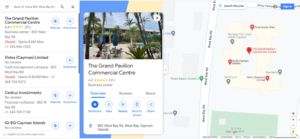

Today, every major Global Bank has “Branch Banks” in these offshore financial centers. There are no fancy buildings or office towers. Just as an example, If we check the address for the Cayman Islands branch bank for the Bank of China, which is, as you know, by Assets, the 4th biggest bank in the world (…as of 2021 – right behind 3 bigger Chinese Banks) yet, we can’t even find the location on Google maps…the only businesses listed at the address are, a salon, realtor, small investment offices, a tour company and a clinic. etc….that’s it. Perhaps the 4th Biggest Bank in the world moved and didn’t keep their website up to date? Even though they have (my guess) roughly 15,000 Chinese controlled entities registered in the Caymans? (Alibaba being the largest such entity, with many other related LLCs and VIEs registered there as well)…you’d think all of these customers would need to see a banker at some point? ….that said, the only thing that these “branches” located in all of these off-shore financial centers seem to have in common is a mailing address and a SWIFT # ….other than that…they don’t exist. They are ghosts…. wiring 10’s, perhaps hundreds of billions of dollars around the globe every day.

https://www.boc.cn/en/aboutboc/ab6/200812/t20081216_494260.html

Ok …back to the discussion, I apologize for the divergence from the task at hand, but I find it fascinating.

So, how does all of this Western currency get into these Offshore Money Centers? I had done this graphic years ago and it’s never been more relevant than it is today. I call it the Boomerang Greenback. Simply put, significant amounts of Western Currency “boomerang” back into Western Assets because it’s never exchanged for Chinese Currency. The Chinese collect Dollars/Euros/Yen/etc. as payment for their Exports, but they don’t pay for their goods or services in Yuan (…or RMB, or CNH, or CNY…or whatever they are calling it now). They “boomerang” Western currency, reinvesting it in Western Assets. Of course they can pick and choose where they’d like to invest since all of the major currencies float. Again, since the Yuan is a closed currency (and doesn’t float), the Yuan’s fake value is established and managed by the PBOC (China’s Central Bank) primarily by limiting the offshore supply (CNH) and managing the onshore supply (CNY). They can print whatever they need on the mainland (CNY) since, again, it’s closed. Moreover, this mechanism only works if the balance of trade (Exports minus Imports…their “paycheck”) keeps increasing, remains positive or is at least sufficient to pay the bills in Western Currency.

The above graphic illustrates what happens when Apple (for example) buys shipments of iPhones from Foxconn/China. All of the business names could be any entity/business, but the monikers were chosen to illustrate the flow. The key, for China, Russia, Middle East regimes, etc., is to set up these export relationships with legitimate Western Businesses, continually collect Western Currency, maintain a significant trade surplus, and reinvest the currency in Western Assets, while keeping the RMB/Yuan “walled off”.

1.) Apple takes delivery on a shipment of iPhones and has JPM wire USD to the Bank of China.

2.) The Bank of China (BOC) Pays Foxconn in RMB which Foxconn uses to pay it’s mainland expenses, keeping the remainder in the BOC/Mainland. BOC. of course, has unlimited financing from the Chinese Central Bank (PBOC)

3.) BOC loans/invests the USDs it collected from Apple/JPM with Offshore entities amenable to the whims of the Chinese Communist Party and these entities invest the dollars in Western Currency denominated assets, Stocks, Bonds, Treasuries, Real-estate, Artwork, Congressional “campaign contributions” and lobbyists, etc, etc.

Now let’s expand the concept to our network of anonymous ShellCos. Let’s replace Apple with any anonymous “importer” and/or a network of same, in any industry (Amazon immediately comes to mind). We can also substitute American businesses/importers with Eurozone, Japanese, British or virtually any business that wants to settle trade with China in Dollars, Euros, Pounds and Yen, again, because these currencies float, it makes no difference. We can substitute “China” with any regime aligned with Chinese oligarchic philosophies and methodologies and/or an embedded dogmatic hate for the West (Russia and certain Middle Eastern regimes immediately come to mind). Again, for emphasis: The goal is not “free trade”. The goal, from the Chinese-axis perspective, is the accumulation of Western currency and financial assets…and it’s been working beautifully for more than twenty-five years….and it will continue to work as long as the Chinese-axis Trade Surplus with the rest of the world continues to remain substantially positive.

Oddly enough, this whole mess likely began 30 years ago as an attempt to crackdown on Chinese capital flight. The CCP knew, at that time, that they had to keep their elite moving forward, creating wealth and a sense of satisfaction with their lot in life, but they also understood that they still needed to keep them on board with the party philosophy and under control. The closed RMB and capital controls were the hammer. Newly minted Chinese millionaire businessmen descended on the west knowing full well, with the mechanisms in place, it would be impossible for them to fail. They would creatively follow party guidance, doing their bidding, dutifully gathering and investing Dollars, Euros, Sterling and Yen…and become rich because of it….as long as they stay loyal to the party. As I often remark, because of the closed currency, there are no “financial defaults” on the Mainland….there are only “political defaults”. i.e.) If the Party member strays from Party instruction, he/she can expect to slip and fall off of an icy hotel balcony or mysteriously splash into the ocean from the deck of their super-yacht, or perhaps just “go missing” for a while for some reeducation. If all else fails, the Party always knows how to find a Party members loved ones, it’s just to gather family support in hope they’ll be able to convince the rogue Party member of the error of his or her ways.

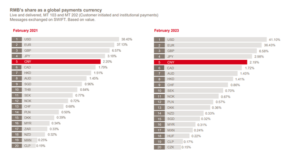

We know that the Party has been successful walling off the currency since there are no meaningful RMB/Yuan balances anywhere on the planet (other than the mainland). There’s no need…because nobody uses Chinese currency for commerce/investing (…again…other than on Mainland China). Today, the World’s 2nd Largest Economy only lets about 2% of global settlements occur in RMB/Yuan. This is probably just “walkin’ around money” for the 100 million or so Chinese citizens and Party members who travel abroad. Anyway, RMB in global circulation has never been much higher than it is now. In any case, no matter how much real Chinese economic activity explodes, the CNH (offshore RMB) in circulation hasn’t been increasing, and therefore, its use has been relatively insignificant in the grand scheme of things.

Here’s the SWIFT data (note that the scale is relatively hilarious):

It is indeed ironic that the whole trend began to accelerate post GFC, when Hank Paulson and his delegation(s) made nearly monthly trips to Beijing, looking for financial support and bail-outs. Richard McGregor describes these trips and negotiations in frightening detail in his epic work, “The Party“. The (abbreviated yet complex) result of these meetings was that America’s financial system received only token assistance from the Chinese government, while Hank accidentally spelled out the strengths and weaknesses of the ugly underbelly of Western finance and banking in his efforts to achieve bail-out velocity …these meetings were the genesis of the go-forward plan for the Chinese Communist government to destroy the Western Financial System. They now had the map….the rough macroeconomic-global financial equivalent of hand delivering detailed diagrams, specifications, troop strength, defense capabilities and equipment/naval/air deployment in the Western Pacific, to the Japanese Imperial Navy early in 1941.

(Authors Note: Hank Paulson was either incredibly naïve, or he sold America out for a few bucks….not sure which.)

The ShellCo Army…

So, remember the “web” of LLC’s I had described above? Oligarchs owning/controlling clusters of related ShellCos all over the world? How big could it be? We can only guess, but I’d suggest that the growth in the number of these entities has been mind boggling. As of 2021 there were 28,168 entities registered in the Cayman Islands, when 15 years ago this ShellCo cottage industry was virtually non-existent, a haven for the occasional drug runner, fugitive and tax cheat…a rounding error. All of these new accounts weren’t opened up for the first year “bonus interest” or the “free toasters and steak knives”. Oddly enough, that 2021 Quarter/YE report was the last report that the Cayman Islands Monetary Authority (CIMA) has produced. They’ve gone dark. Totally normal behavior for a Central Bank in charge of monitoring (probably) about $16 Trillion in Assets now. Did I mention that Cindy Scotland, the head of CIMA only has a few dozen people assigned to KYC/AML and compliance on 28,000 (many of them Chinese) entities and $16 Trillion of Financial Assets? You can’t make this stuff up.

We can only guess how many of these chains exist today. As a guide, there are roughly 95 million Chinese Communist Party Members and they all have passports. One need only visit New York City, San Francisco, Vancouver, Los Angeles, Luxembourg, London, Hong Kong, etc. to see the amount of Chinese and Chinese-axis wealth living abroad. So when we extrapolate, let’s say roughly 20 million or so Chinese/Russian/Axis operatives are running or participating in the management of these chains at the behest of the Party. Their mission, since they’ve decided to accept it, is to simply follow instructions and move CCP Money where and when directed. When you think about it, this is a pretty plumb assignment. Partying down in America, acting alike a big-wig getting “wined and dined” by lawyers and bankers…..beats the heck out of landing on a beach, getting shot at and/or running across a mine field to win a war. Moreover, it’s not like these operatives have any moral epiphany on the horizon, in their minds, they are saving the world from the tyranny of the West…it’s not like they are committing crimes against humanity, running gas chambers or blowing people and property to smithereens…..they are clicking a mouse, moving money from one account to another when told to do so…taking money from wealthy Americans, Europeans and Brits…getting rich at the same time. How could they possibly think that the Chinese Communist Party isn’t TOTALLY AWESOME!!

So How Exposed is JPM and the US Financial System to this Threat?

Let’s talk about that for a few minutes….

JPM’s $884 Billion of “liquid stuff” they can access/sell if there’s a run on their $2.34 Trillion of hair trigger deposits represents just 0.18% of estimated total global Financial Assets ($884B/$500,000B est.) and 8.8% of total DTCC daily volume. This $884B also represents only about 1% of global bank deposits, but somewhere near 4% of Total US Bank Assets. In other words, the concentration of assets, cash and deposits in a handful of banks here is in the United States is enormous, but relatively tiny in the “Globalized” grand scheme of things. So let’s take a look at US Banks for a minute.

As of 12/31/22, America’s banking industry consisted of 2,136 Banks with assets over $300 million. The rest, probably about 1,000 or so institutions, are so small that the FED, as far as I can tell, doesn’t even bother to track them or include them in their policy/decision process anymore. They give ’em a hearty “attaboy”, pat them on their little heads and wish them all the best, as they deploy policy positions which virtually guarantee the demise of these wonderful little businesses.

These 2,136 “Big” American Banks represent $21.7 Trillion of Consolidated Assets, of which $1.9 Trillion are “foreign assets”. These banks have 65,988 domestic branches with 258 “foreign” branches.

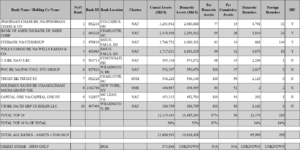

Now lets take a look at the concentration. Here are the same statistics on the “top 10” Banks per the Fed as of 12/31/22.

https://www.federalreserve.gov/releases/lbr/current/

When we examine the “Top 10” we note that the concentration is astounding. The “Top 10” Banks control $12.1 Trillion, or 56%, of Americas Bank Assets, and of that, the “Top 4” (JPM, BAC, C, WFC) control $9.1 Trillion, or42%, of all Bank Assets.

As an aside, the recently defunct Credit Suisse, which met a similar fate as SVB, but on a much grander scale, would have ranked 6th on the list. Confirming my suspicions, that if I were a diabolical Global-Super-Villain, no target is off limits or TBTMW (Too-Big-To-Mess-With) if the conditions are right.

https://www.credit-suisse.com/about-us/en/reports-research/annual-reports.html

For further reference, Deutsche Bank, another high value target, soon to be viscously under a “deposit flight liquidity attack”, is now testing the bounds of the FED’s “top secret” Foreign Swap line facility, as well as the patience/resolve of the Board of Governors to beat back systemic contagion. (Deutsche Bank, as of 12/31/22, had Balance Sheet assets of $1.337T in Assets, and would rank it 5th on the list of America’s Largest Banks, more than 2x the size of the current #5 PNC and #6 US Bank, and more that 3x the size of #7 Goldman Sachs).

Referring again to the FED’s “Top 10” Schedule above, the metric, which would seem to be mind-bogglingly misleading is the “% of foreign assets” residing in the Top 10 banks. This figure, per the FED is $1.6 Trillion, presumably cash and assets sitting in the foreign branch banks. ($12,115,483 – $10,485,284 = $1,630,199) That’s the calculation.

I suspect (actually I know), that this foreign concentration must be much higher…I suspect (know) that much of that $10.485 Trillion, which looks like “US Domestic Assets” is not controlled by who the FED believes it’s controlled by. I just have no definitive way of telling you how much or by who?….and unfortunately…nobody can. I’d presume it’s “Trillions”…(gulp). Remember the discussion of the “Army of ShellCos” and the systemic failure to “know your customer”? (re-pasted here so you don’t have to find it to reread it)

A Russian/Chinese/etc. Oligarch owns a number of Hong Kong LLCs, each of these LLCs has relationships/interests in/with Luxembourg, Caymans, etc. entities/bankers/lawyers. These LLC’s incorporate on shore LLC’s/entities in America, Europe, Japan, Australia, Canada, etc. etc. Once the web is created and the necessary relationship infrastructure is complete, money can move seamlessly from entity to entity and bank to bank. Nobody needs to ask any questions…because there’s no requirement that they do so. The Bankers, Lawyers and moneymen won’t ask these difficult questions because if they do, they might jeopardize the relationship…..and we can’t have that. Thus we’ve designed a system where, all of the “customers” are known….but nobody knows the “customers” up the chain or understands the source of the funds.

See the problem? The FED and FDIC believe they are backstopping random, panic-driver withdrawals by good American depositors, and can simply throw a bucket of funding on the outflow and either save the bank, or like SVB, put it out of business, sell of the skeleton, and minimize the damage. But, what if, the FED doesn’t understand that it’s not fighting to contain “random accidents” but they are up against predetermined coordinated attacks by embedded foreign actors on our financial system. If I were to take a SWAG at the amount of these embedded assets, controlled by coordinated bad actors, hiding in plain sight in America’s 10 biggest banks, it would be $1 or $2 Trillion, perhaps more, in addition to the $1.6 Trillion already disclosed.

Moreover, when we compare these “top 10” figures to “Magnificent Seven” Global Financial Assets ($73.5 Trillion) and offshore OFI Assets ($48.2 Trillion) the US Banking System seems, well, kind of “Puny”…and our big gorilla’s all look….well….like sitting ducks waiting for the next bombing run.

The Murder Weapons

The “murder weapons” of choice used to dispatch the late, great Credit Suisse, Silicon Valley Bank, Signature, et al…. and soon to be, if we don’t figure this out, a graveyard full of unsuspecting, naïve, “hey I’m making a ton of money for not asking questions” banks/bankers ….is not interest rates, inflation, mismanagement, or misjudgment. It was/is:

1.) An army of highly coordinated, stealthily disguised Chinese Communist Party-Axis sponsored/funded ShellCos,

2.) A closed RMB/Yuan allowing the CCP to underbid the rest of the world (booking revenue in “real” floating money while mainland costs are paid in onshore “monopoly money”), causing a colossal, consistent Chinese trade surplus…..and

3.) A failure of our bureaucratic/technocratic/globalized regulators and Central Banks to understand the threat and respond accordingly. They don’t see it because they are not looking for it.

So How Much firepower does the Chinese Communist Party Have?

I had first done this calculation years ago when the figure was only about $25 Trillion or so. Let me first describe the Chinese global trade surplus as simplistically as I can….I’ll refer to all Western Forex as “dollars” and I’ll call their “exports” their “paycheck” (in dollars). It’s the money coming in to their bank accounts (in dollars). Their “imports” are their “costs”…the money (dollars) they use to pay the offshore bills. The difference is their “savings ” (in dollars) or “surplus” which they can “invest” in Western assets….(stocks, bonds, real estate, etc..) Makes sense?

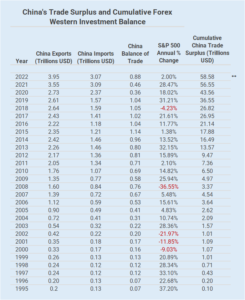

All of the trade (Import/Export) data in the table below was provided by The Observatory of Economic Complexity (OEC) https://oec.world/en/profile/country/chn

The simple premise of the table below is to calculate/estimate… “If the Chinese Communist Party took their entire annual trade surplus (Exports less Imports) and invested it in Western Currency Assets (which they must have done since there is no material Chinese currency anywhere, other than mainland China) …how much money would they have?”

I’ve used the S&P 500 annual return (including dividends) to approximate the growth and result, presuming that the Chinese are average/capable investors.

**Estimate by DTIPO

So, using this simple math, we can calculate that the Chinese MUST have accomplished constructive control of approximately $58.58 Trillion of Western Financial Assets, stealthily hiding in Western Financial Markets, likely in plain sight. This, figure of course could be much higher if they were more aggressive, particularly because, ever since the GFC they’ve learned and now fully understand how Western markets function and can actually impact direction and movement. i.e.) They’ve become so big, they can move the markets, or at least predict movement with reasonable accuracy once things get rolling…and perhaps selectively apply some leverage when the opportunity arises (Their American Bankers are happy to lend them money). After all, when you know, with relative certainty, which way things are going to go, you might do a little better than the average-Joe investor. The only “adjustment” I made to the S&P Index figures above, is that since the CCP was well aware of the financial distress that COVID (since it originated in Wuhan) would cause in Western financial markets, they likely went “risk off” for most of 2022. Therefore the table reflects a modest 2% gain rather than a 19% loss, as the rest of us uninformed investors might have experienced had we remained fully invested in 2022.

So the simple answer to the complex question: “Has the Chinese Communist Party accumulated enough firepower to sink America’s big banks and thus, the Western Financial System?”…is….

I’d suggest that, thanks to our friendly, helpful bankers and lawyers, who’ve set up all of these anonymous accounts and relationships, as well as the significant infrastructure build out provided by our Western IT folks, DTCC and the like, who’ve made it easy as pie to transfer trillions of dollars around the globe in the blink of an eye……. I’d have to say, that unless there is a Top Secret “covert ops” war room in the FED/FDIC/SEC/CIA/DOD etc. ready willing and able to spring a diabolically clever trap, that $58.58 Trillion, focused directly on select targets, because everything is woefully, frighteningly interconnected now, is more than enough to sink our previously thought unsinkable fleet of battleship banks.

I had published this silly little “guestimate” chart (below) years ago which is proving out to be at least directionally correct if not mildly clairvoyant, of course the usual caveat that “nobody can predict timing” applies. At the time, in mid 2019, the FED Balance Sheet was at about $4 Trillion (nobody except yours truly was forecasting a $10 Trillion FED Balance Sheet a few years out) and the little chart below illustrates the relationship between the FED Balance Sheet and the value of all US listed Equities, when the CCP starts its “Financial War Games”. I had believed , at the time, and still do, that they would and will, be moving money around, “hither and yon”….in coordinated “pump & dumps”. The FED as always, would/will be reacting with funding/liquidity and policy to plug holes, prevent failures, and generally, just try their best to keep the plates spinning, even in the face of an increasingly volatile political environment. i.e.) Voters will be concerned with what’s happening if they start losing their life savings… and Congressmen, Senators and Central Bankers understand all too well that a “Shut up and get to work platform” won’t get them reelected or reappointed. They’ll need to “fix it” and they will do it the only way technocrats trained at the school of Bernanke and Yellen understand…..they continually expand the Balance Sheet. It’s what they do…

In the end, the FED Balance Sheet skyrockets and Risk Assets plummet. Price discovery becomes a fond memory. US Financial Markets and Banks are crippled or destroyed. Unbelievable levels of wealth vanish and our Banks become shells of what they once were. We’ve entered the Great Depression, part duex …. the GFC was just a warm up.

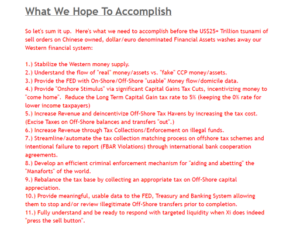

The only Way out of this Mess

Since I’ve been directionally correct over all these years, I thought I’d take the time to repost a little ditty from March of 2019, just four short years ago. A “Modest Proposal” to the Trump Administration…bullet points below…

https://deep-throat-ipo.blogspot.com/2019/03/a-modest-proposal.html

In a nutshell, the only way we are going to get out of this mess is, when a bank, stock, broker/dealer or exchange is “under attack” (to be defined on a case by case basis) we must:

1.) Immediately pause/shut down transaction activity (i.e. The wires don’t go out, SWIFT is unplugged, the trades are held, and under no circumstances, do funds move out of US Banks to offshore/non-US entities until we figure it out. We treat it like a crime scene…which it is.)

2.) Our Banks should NOT blindly wire out all of the current withdrawal requests (or accept the incoming wires) in the name of customer service (and fees), selling whatever they can sell (wires out), or haphazardly investing the funds (wires in) to meet the daily customer/cash commitments. We need to think about what we’re doing and understand it.

3.)We should not be keeping these issues a big fat secret until the bank actually fails, often “overnight” and the money is already gone. We cannot keep these attacks under raps. Whenever withdrawals or deposits breach normal daily volume by a significant amount, at any particular institution we need to stop. There must be a “red alert”, “circuit breaker”, “all hands on deck”, “air raid siren” going off…triggering a pause until we do some real forensic accounting, follow the money and figure out exactly why the money’s being withdrawn and exactly where it’s going to end up…..rather than blindly funding its exodus. There should be no stigma attached to asking for help….we are all American’s and our financial system depends on it.

4.) Today, whether it’s at a Brokerage, Exchange, Bank or Shadow Bank, we apparently process all of the transactions, close the books for the day and find out we are wiped out after the fact…that’s a hell of an Oopsie-daisy. We send the money all over the planet, bring in the FDIC or the SPIC, and they wind things down and clean up the mess, all the while throwing even more money at it….allowing the Chinese-Communist-Axis to regroup, reload and select another high value target. This must stop. We cannot continue to come to the nebulous conclusion that “Oh boy…it looks like we a need another systemic liquidity boost” and blindly provide it. We need to slow the entire process down.

I know I’m being woefully redundant here….but our leadership needs to “get it” and do something about it.

All of the Warning Signs are there….we just need to understand them

In the fog of financial war, soldiers and generals miss things, mistakes are made, strategy goes out the window, ships and banks get sunk….things aren’t what they seem to be.

The sun is rising over the New York Fed Open Market Desk, it’s a beautiful spring day, birds are chirping, children are playing in the park, when suddenly….. “Bank A” comes under a surprise dawn sneak-attack, tens of thousands of accounts, hundreds of billions of dollars are wired out of Bank A , Bank A is sunk, the army of sneak-attacking depositors move all of the money to their accounts at “Bank B“, the management of Bank B believe they are infallible marketing geniuses and they immediately deploy all of this new money into super-safe super-liquid UST Long Bonds. Shortly thereafter, Bank B comes under attack, the attackers move their money to “Bank C” and the Bankers at Bank B are forced to fire sale the super-safe-super-liquid bonds they bought taking on massive FASB 115 losses…regulators realize that Bank A, B & C are just flaming-SVB or Credit Suisse-esque clones, set ablaze by the relentless assault….the brutal, horiffic attacks continue in Europe and across the world until the US Treasury market is rocked, ablaze, teetering on the brink of freezing, there are no buyers, the NY FED trading desk is in a panic… buying what they can as fast as they can… and the Fed Balance sheet expands to $20 Trillion (only about 4% of current Global Financial Assets…but asset values are being torn apart). Foreign CB swap line facilities expand exponentially….and it finally becomes apparent to our leadership that we are at war….a day that will live in infamy…again….but the headlines will read:

“Don’t panic…these things are all transitory…nobody could have seen it coming.”.

So really, after all of the above….what do you think Xi and Vlad are talking about below? What is the “100 year change”? Are they discussing “the Climate”? a Trump Presidency redux? TicTok? Hunter Biden’s laptop? the LIV Golf tour? The pitch clock? Somehow helping their citizens achieve existential happiness? Mankind’s quest for the greater good? Personally, I doubt it… You decide….

Final Comments

For those of you who’ve not followed my work, I’ve attached links to both my current work and past efforts on blogger below (Note: For some reason Blogger has labeled much of my particular brand of economic/financial analysis as “disturbing content proceed with caution”….likely at the behest of the CCP. You can feel free to read it…it’s just numbers analysis and finance….no bad words, violence, hate speech or porn…I promise.)