Many years ago, one of my sons, who is mildly autistic, always liked to quiz me about things he knew something about, hoping I knew very little or nothing about same. He was always trying to stump me. He would take great joy in finding out that I did not know the population of the Island Nation of Palau or couldn’t accurately describe the flag of Papua New Guinea. He would be shocked and dismayed that I did not know the origin and name of the language spoken by the indigenous Paraguay people (Guaraní was the preferred response….there are about a half dozen other languages that he would accepted as correct answers). Oh how he would laugh when he stumped me….and he would stump me often. When he did, he would triumphantly proclaim:

“See Dad….just because you are smart…it doesn’t mean that you are right!”

This simple phrase, repeated often, profoundly changed my life and indeed, shaped the way I look at the world today. I learned, from my son, no matter how much I thought I knew….there was always much more that I didn’t. But I digress….

As always….Really Important “Theme Bullets” are in RED…if you are pressed for time feel free to skip past all of my mildly entertaining, slightly hilarious “Non-Red” econ-techno-babble banter.

Given that preamble, let’s start today’s discussion about the April 1st expiration of the FED’s exemption of Treasury Securities and Reserve inclusion in the denominator of the calculation of US Globally Systemically Important Bank’s (GSIB) Supplemental Liquidity Ratio (SLR) and why it matters.

(With that Preamble I’ve probably just lost most of you….Please don’t stop reading…skip to the RED bullets if you feel you must….this is really important!)

To start the discussion, in my humble opinion, there is no better source of information than a brilliant young man by the name of Zoltan Poszar (Credit Suisse), who I (and many of us) would consider one of the preeminent public authorities on this topic, and dare I say just about anything related to international banking and monetary policy.

Zoltan of Swing…

As you can see, he’s an amazing guy, he and his fellow bankers are really talented…

Crap, I’m sorry ….that’s the wrong dude…here’s what Zoltan had to say about the April 1st SLR calculation…

Here’s the link to his full report….

https://plus.credit-suisse.com/rpc4/ravDocView?docid=V7qjPE2AN-VHSK

I’ll freely admit that Mr. Poszar has likely forgotten more about the global debt markets, banking and capital flow than I’ll ever know. That said, the below Bullet Points are my layman’s version of what Zoltan is saying. Again, referencing my son’s way of looking at things, if I’m wrong here please let me know…

Here’s what Zoltan is telling us….

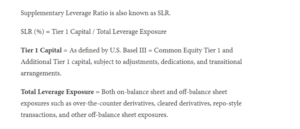

1.) Big Banks (GSIBs) have regulatory liquidity and capital ratios that they need to maintain for the health and safety their bank and the global financial system. One of the key ratios is the “Supplementary Leverage Ratio” or SLR where the numerator is Tier 1 Capital or “Equity” and the denominator is the Bank’s total Balance Sheet Assets (both the “Equity” and the “Total Assets” have a bunch of adjustments, but that’s basically it). The ratio to be “safe” is generally 5% depending on the Banks Operations. In other words, again generally, if a Big Bank has $200 Billion in “Equity/Capital” and $2 Trillion in Assets it’s SLR is 10% and it would be considered safe. If the same Bank pays dividends and/or buys back stock and equity capital decreases to $100 Billion, that bank would be considered less safe and would likely be in a “raise capital” or “sell assets” (trim the balance sheet) mode. Makes sense? Here’s the definition…

2.) Last year when the FED, because it wanted to give some temporary COVID relief, announced that, because Treasury Securities and Reserves are “good as gold”, the Big Banks didn’t need to include these Assets in the SLR ratio for a while, or at least until 3/31/21. This generally made the ratios for these banks look a little better (by 1% or so) than they would have been without the adjustment. This, theoretically allowed these banks to buy all of the US Bonds, Bills & Notes they wanted to without putting them in danger of flunking the ratio test. i.e.) they could buy/own all sorts of “other stuff” as well as Treasuries without busting the ratio.

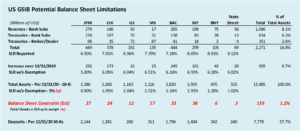

3.) Zoltan calculates, correctly so, that because of the way the 8 GSIB Banks have handled the Exemption, that they will not have to sell any Treasuries or raise Capital to remain in conformance with the SLR ratio requirements. I’ve assembled Zoltan’s numbers in a handy table which helps me understand the scale of what’s happening, in aggregate. Here are the numbers in a slightly different format.

4.) What his Charts (and my table) describe, based on 12/31/2020 figures, is that even with the exemptions removed, with the reinstated requirement to “count” the Reserves and Treasuries in the denominator of the SLR, the 8 GSIB Banks (JP Morgan, Citi, Goldman Sachs, Morgan Stanley, Bank of America, Wells Fargo, Bank of NY and State Street) would have been over the minimum 5% ratio by $159 Billion in aggregate. In other words, if the exemption had been removed as of 12/31/2020 these banks, in aggregate, would have had a cushion of $159 Billion before they would either have to reduce their Balance Sheet or raise Capital. (i.e. They could absorb $3.180 Trillion of Treasuries and reserves calculated as $159 Billion divided by 5%). This “margin of safety” is calculated using the Balance Sheet Assets as a surrogate for the denominator since the Financial Statements for these Banks, though voluminous, don’t (with the exception of JPM) describe the actual calculation of the ratio and/or “risk weighted assets” within the filings (….or at least that I could easily locate within the 1,000 pages or so of filings which nobody reads). For expediency I’ve used the “Total Asset” figure as a surrogate to calculate the “margin of safety”. Moreover, to put this in perspective, the “margin of safety” would represent the ability to absorb another $3.180 Trillion of Treasuries and Reserves (or any assets their little hearts desired) in addition to the current $13.485 Trillion in combined Assets of these Banks. i.e.) a 23.5% increase in Assets up to $16.615 Trillion, if, of course, we’ve all come to the conclusion that it’s a good idea to have our entire financial system leveraged at 20:1. Also note that deposits at these Banks, the most fluid of bank liabilities, which can be moved to just about any bank on the planet with a customer click or a phone call, are $7.8 Trillion and represent 57.7% of US GSIB Assets as of 12/31/2020. Hopefully, the Balance Sheets have “shrunk” a bit since year end, and/or all of these deposits are locked-in and rock solid and the customers are committed to keeping the money in their particular US bank for the foreseeable future, but, honestly, I have my doubts.

5.) In any case, as Zoltan described, it seems as though there is indeed at least some room at these Banks to absorb additional Treasury Securities and there should be no need for the GSIBs to sell Treasuries based on these figures. Whether it’s prudent or not is an entirely different question. Steady as she goes.

Perspective….

So we’ve established with certainty that the eight biggest, Global, Systemically Important Banks (GSIBs) in America already have combined assets of more than $13 Trillion and have at least some capacity to absorb some additional Treasury Securities without having ratio problems or a need to raise capital. So now let’s see what’s coming down the pike.

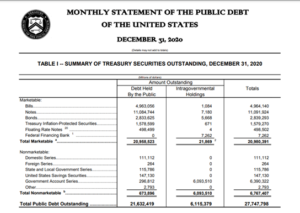

Up to this point Uncle Sam has issued roughly $28 Trillion in Bonds, Notes and Bills with about $21 Trillion of them currently in circulation (i.e. “marketable” and not owned by government agencies) with $7.4 Trillion owned by the Federal Reserve as of 12/31/20. As you also recall from the above schedule US GSIBs own about $1.2 Trillion, or about 4% of the total outstanding.

https://www.treasurydirect.gov/govt/reports/pd/mspd/2020/opds122020.pdf

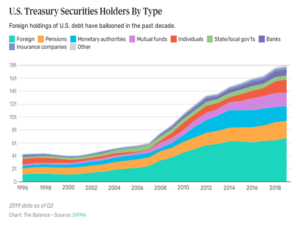

….and what’s the breakdown?….who owns the rest of the debt?

https://www.thebalance.com/who-owns-the-u-s-national-debt-3306124

The above data gleaned from SIFMA (Securities Industry and Financial Markets Association) through Q2 2019 (before the rapid monetary expansion) is a nice, interactive illustration of “who owns US Treasury Debt”. The above chart excludes Treasury Bills, Notes & Bonds owned by the FED. At that time (Q2 2019) we had roughly $22 Trillion of Treasury Debt owned primarily by the FED ($4 Trillion – not included in the above SIFMA Chart) Foreign Entities ($7 Trillion) Monetary Authorities/Central Banks ($2 Trillion) and “Banks, Mutual Funds & ETFs” ($3 Trillion). In simple terms, 72% of the US Government Debt was in the hands of these institutions at that time. Fast forward to today and we have $29 Trillion of Treasury Debt, presumably on a path to $32+ Trillion soon, based on recent American Rescue Plan and proposed infrastructure legislation as well as unspent funding remaining from the CARES Act. With declining Foreign enthusiasm for US Debt (at least at these yields) with the enthusiasm declining more precipitously on the long end of the curve, we begin to wonder exactly who is going to purchase this debt. For details and statistics on this “lack of enthusiasm for long dated US Treasury Debt” phenomenon. I’d suggest you refer to a recent (3/18/21) Yardini Research Document charting and describing the trending of same.

Going Once…Going Twice…sold to the highest bidder!….What?…there are no bids?

So now that we’ve described/assessed the burgeoning size of the US Government Securities Market compared to the eight (8) US GSIBs, let’s put it in context with the remaining GSIBS as defined and described by the Financial Stability Board (FSB). Per the FSB, these 30 banks, including the 8 US Banks Zoltan discusses above, are the entities which are systemically important, and by definition are the primary foreign participants in the US Treasury Market.

https://www.fsb.org/2020/11/fsb-publishes-2020-g-sib-list/

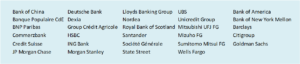

It used to be that, in the good old days, pre GFC, in terms of Financial Assets, US Bank Balance Sheets were of little concern to the world, but in an effort to explain what had happened, and possibly prevent losing future horses long after the livestock had left the barn, as regulators are often known to do, in 2011 the FSB completed an exhaustive study of the banks that survived the financial crisis, and determined that, going forward, because of their interconnected nature, there were, at the time, 29 banks that perhaps needed a little more special attention. I’ve listed them below in no particular order:

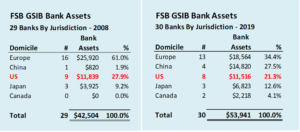

So now let’s take a look at the Asset Levels at these Banks prior to the GFC, by jurisdiction, and fast forward to 2019 (2020 values were not yet available for the foreign banks without a lot of work, but for the purpose of this illustration, 2019 Asset Values will suffice) comparing the Asset Values by Jurisdiction of the banks currently on the FSB GSIB list:

We can see that America’s GSIB Balance Sheet is actually a bit less than in 2008. Our 8 GSIB banks actually make up a smaller proportion (21.3%) of GSIB Assets today than they did back in 2008. (27.9%) Europe’s GSIB Balance Sheets have actually shrunk by more than $7.5 Trillion (from 61% down to 34.4%) while the Chinese Communist Party Banks were finally allowed/determined to join the party, accounting for $14.8 Trillion (27.5%) of the GSIB Bank Balance sheet, even though, remarkably, nobody actually uses the RMB outside of mainland China. The Chinese Banks made the list because they use Western Currency exclusively for their trade and Foreign Asset Purchases Please memorize this schedule in the context of “who is going to buy US Treasuries?”….we’ll delve further into this question shortly.

So now….let’s do the Macro-ena‘

Crap….that’s actually Andre’ Rieu….I’ve gotta’ try to keep these videos straight….

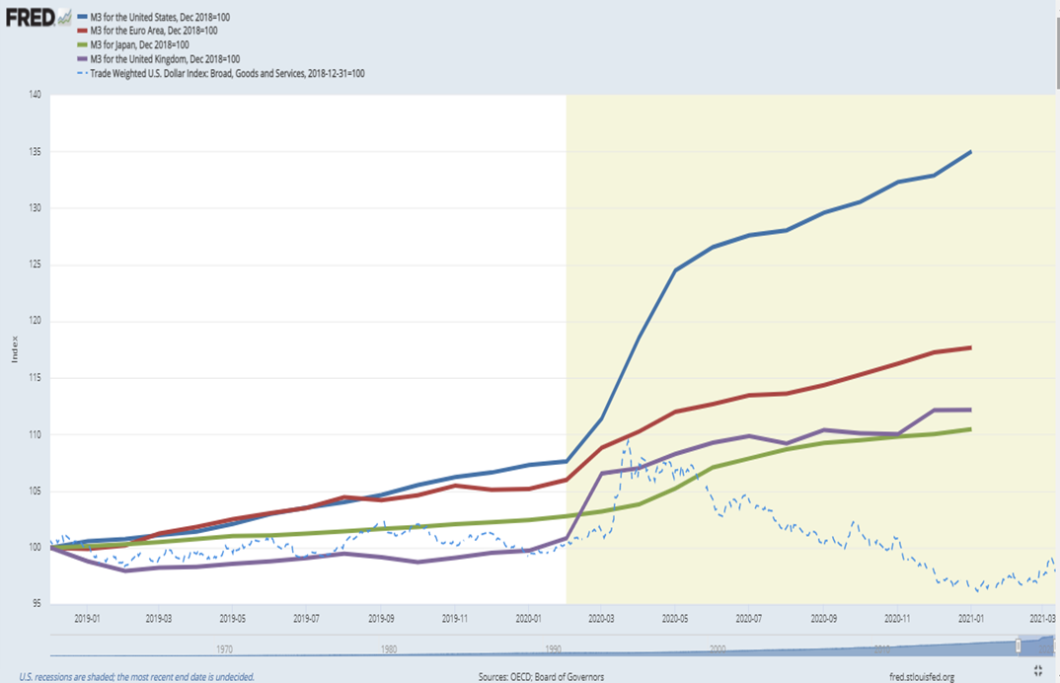

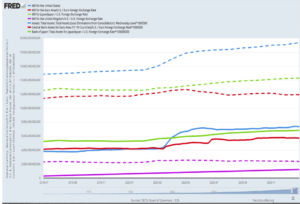

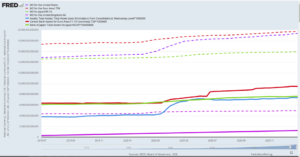

Anyway, the next chart is a bit wonky, but it, along with the associated table, is intended to illustrate the dramatic divergence of what’s happened with Monetary Policy in the US, Europe, Japan and the United Kingdom since 2019. All data, of course, is provided courtesy of my good friend FRED down in St. Louis (Federal Reserve Economic Data). FRED’s a good guy…straight shooter…tells it like it is. Unfortunately, as good as my old buddy FRED is at gathering data, he’s never been particularly good at analyzing it and interpreting it….like my son often pointed out to me as he was growing up, we all have our particular strengths and weaknesses.

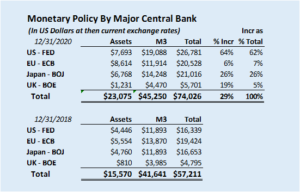

The Blue Solid Line Represents FED Balance Sheet Assets, the Blue “dashed” Line represents US M3. The Red Solid Line Represents ECB Balance Sheet Assets, the Red “dashed” Line represents EU M3. The Green Solid Line represents BOJ Balance Sheet Assets, the Green “dashed” Line represents Japan M3. The Purple Solid Line represents BOE Balance Sheet Assets, the Green “dashed” Line represents UK M3. All in of these values are shown in USDs converted at the then current exchange rate.

What the above FRED Chart and Table describe is the recent, stark divergence of monetary policy beginning in 2019. Over the last two years the world’s four primary Central Banks (those that control the money supply for substantially all global settlements/funding), in nominal US Dollar terms, have created/printed $16.8 Trillion of new M3 and Balance Sheet Assets, increasing the money supply by 29%, from $57.2 Trillion to $74.0 Trillion in just two years. Further, it becomes obvious, in dollar terms, the “money printing” was not evenly distributed, with the FED responsible for a $10 Trillion increase (64%), the BOJ pumping out roughly $6 Trillion (26%), the Bank of England increasing by $1 Trillion (19%) and ECB growth remaining relatively flat (6%). When we examine the far right column “% of the total” it’s clear that the drunken sailors of the group were the FED (64% of all “printing”) and the BOJ (26%). The ECB and the BOE were relatively constrained, given the circumstances. Their share of the expansion was at 7% and 5% respectively.

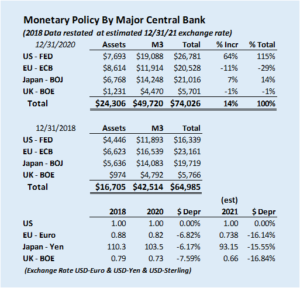

Now, let’s really take out the “wonky-stick” and put a whoopin’ on this M3 piñata. In order to illustrate this, we’ll just proffer, hypothetically, that the US Dollar, by virtue of the political trend/direction/expansion continues to depreciate against the other major currencies. With all else being equal, for illustration let’s restate the 12/31/2020 and 12/31/2018 figures in a constant “depreciated” US Dollar format. In order to accomplish this, we will further say that it would be reasonable that the roughly 6% depreciation over the last two years would accelerate and the dollar would depreciate by about another 10% by the end of 2021 (my IMHO relatively conservative adjusted current forecast). In other words, after record money printing, with the FED leading the pack, we are restating what happened through 2019 and 2020 in depreciated “constant” currency (Euro = .738 or -16.14%; Yen = 93.15 or -15.55%; Pound = .66 or -16.84%) rather than the “then current” exchange rate. Here’s the proforma constant “unit of currency” comparison and the restatement below:

When we examine the the table, adjusted for US Dollar weakness, we determine the “Rest of the World” is about $7 Trillion better off (…and America loses about $7 Trillion) in nominal terms due to dollar depreciation. The most striking thing about these calculations is that, when adjusted for hypothetical dollar depreciation, the FED has been responsible for virtually all (and then some) of the $10.4 Trillion(115%) of the $9 .1 Trillion increase in the “West’s” Money Growth. The dollar depreciation against the other three currencies, the Yen, Euro and Pound Sterling, was roughly 6% over the last two years. If this trend continues, based on expected US Money expansion and fiscal policy, when compared to the other major Central Banks, unless the other banks follow the FED’s lead, we can expect a silent, “boiling frog” style dollar depreciation over the next few years. In other words, when we replace the actual exchange rate with an “already depreciated”, constant exchange rate, we note that there is a $7.7 Trillion (relative) wealth transfer ($64.9 Trillion – $57.2 Trillion) from America to the rest of the world and we don’t even notice it happening. The FED is driving the world’s money bus, they’ve got their foot firmly on the accelerator and they are hoping the other Central Bank bus drivers will pick up the pace and join the parade. Note that China and the PBOC have no intention of joining in. The RMB remains closed, they continue to use Western Currency as their tool of choice for their targeted, controlled interaction with the rest of the world. Again, the USD/RMB exchange rate is strategically irrelevant because nobody uses the RMB. I discussed this phenomenon in context a few months ago, in my “Really, Really Great Rebalancing…” post but nobody understood it, they likely still don’t.

In contrast, the US M2 growth rate has been 8.2% over the last 10 years. The growth rate over the last 5 years is 9.6%. The rate over the last 2 years is now at 16.3%. US Dollars are flooding the world’s financial system. By way of comparison, US M2 grew at 3.6% from 1960 to 1980. If you had a mortgage or remember buying gasoline in the 1970’s, you’d likely recall that the 1970’s was the last real tussle the FED has had with inflation. You might also remember 15% mortgages, Paul Volker Speeches, Ronald Reagan, Jimmy Carter and gas lines? You likely remember your cost of living increasing much more quickly than your wages did. Yet, today, for a number of “gatekeeper” reasons, preventing all of this money from actually flooding “main street”, we’ve not had that “1970’s style vintage inflationary experience” rear it’s ugly head, at least not yet.

https://fred.stlouisfed.org/series/M2SL

Since this money is not hitting the streets, at least not yet, all indications are that it will remain locked in amber in the global financial system for eternity. i.e.) people aren’t earning it or spending it. Yet there seems to be a mad rush to create it and hoard it.

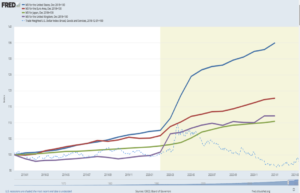

But the Dollar is Rock Solid!….How Can This Be?

The resiliency of the dollar, in the face of this money printing onslaught, has indeed been truly remarkable…and dare I say, theoretically impossible under basic supply and demand theory, yet the phenomenon exists. The chart below represents the growth of M3 for the USD, Euro, Yen and Pound Sterling compared to the FRED Trade Weighted Dollar Index (USD vs. weighted basket of Major Currencies). All data is indexed to 12/31/2018 as 100. We note that in the two year period ending 12/31/2020 the dollar has declined a mere 3.5% in relative value and actually increased by 10% at one point in August of last year. Conversely, USD M3 grew 35%, about twice the rate of Euro M3 and more than three times the rate of both Yen and Pound Sterling M3. Yet, the dollar declined in value by only 3.5%. Of course there are reasons for this, but again, any financial person or economist should find this phenomenon remarkable.

Investors around the world are speculating what the mysterious forces propping the dollar might be. Western Central Banks are printing levels of currency that their main street economies neither need nor want. Velocity is declining or at best flat. Unfortunately, most of these investors focus much less on the origins of these mysterious forces than they do about making a few bucks on their strength, direction and staying power. The emphasis seems to lean toward “how much and how long” rather than “why?”. Today, in big round numbers there are roughly $450 Trillion of Financial Assets on the planet with about 1/3rd of them denominated in US dollars. Most of this $450 Trillion asset value can be “cashed out” and converted to (or from) dollars, or any of the above currencies (Except, of course, the RMB) with the click of a mouse. The more dollars and Western Currency we print, the higher these asset valuations climb. Global M3 Velocity will continue to decline. Of course, as I had discussed in a recent post, it’s a terrible mistake to believe that Dollar Assets are owned by Americans for the benefit of Americans. Moreover, it’s also clear that Euro and Pound Sterling Assets are not necessarily owned by Europeans nor are Yen Assets exclusively owned and/or traded by Japanese people and businesses. As I had described, that’s not even close to reality any longer. Any person, business, LLC, ShellCo, Fund or Family office can buy or sell financial assets anywhere on the planet, without regard to where those assets are listed or the currency they are denominated in. The adjacent schedule shows the approximate current value of all Financial Assets located in major Tax Haven Jurisdictions. Note that the value of these assets ($73.4 Trillion), even though there is comparatively little GDP associated with these jurisdictions, approaches the total value of all Major Central Bank Assets and Money Supply and actually exceeded it by a wide margin prior to the historic Central Bank balance sheet and monetary expansion over the last year.

to believe that Dollar Assets are owned by Americans for the benefit of Americans. Moreover, it’s also clear that Euro and Pound Sterling Assets are not necessarily owned by Europeans nor are Yen Assets exclusively owned and/or traded by Japanese people and businesses. As I had described, that’s not even close to reality any longer. Any person, business, LLC, ShellCo, Fund or Family office can buy or sell financial assets anywhere on the planet, without regard to where those assets are listed or the currency they are denominated in. The adjacent schedule shows the approximate current value of all Financial Assets located in major Tax Haven Jurisdictions. Note that the value of these assets ($73.4 Trillion), even though there is comparatively little GDP associated with these jurisdictions, approaches the total value of all Major Central Bank Assets and Money Supply and actually exceeded it by a wide margin prior to the historic Central Bank balance sheet and monetary expansion over the last year.

So let’s go back to the really big question at hand. If America is going to issue all of this new Treasury Debt, who’s going to buy it? Working Americans and businesses? Foreign Investors? Foreign Central Banks? Will it all be absorbed by off-shore LLCs and ShellCos? If so, let’s say, for the sake of argument, there’s another $5 Trillion of US stimulus/infrastructure spending and consequently, $5 Trillion of US Treasury securities hitting the street in the next couple of years. Will global investors consider selling some of the current $450 Trillion assets they already own to buy Treasuries? If so, which ones? Will they be torn between the guaranteed returns, safety and security of investments like Tesla, Gamestop, Bitcoin and ARK as they ponder the relatively unappealing alternative of accepting the boatloads of return free risk that only 30 Year Treasury Bonds can provide? Will they decide to dump their blue-chip, P/E of 50+ Tech Stocks and Crypto-Currencies in favor of safer, yet depreciating, T-bills and notes? Will European and Japanese investors and Central Banks carry the torch, abandoning their own domestic stocks, bonds and markets in favor of US Dollar denominated investment as the US Money supply doubles in relation to their own currency? Are the world’s Central Banks going to step in, playing a never ending game of “I’ll buy yours if you buy mine?”

Based on both US Domestic, as well as foreign behavior over the last few months and recent “brutal” auctions we can assume that demand for Treasuries, and consequently US Dollars, might just be waning right into the teeth of a historic increase in dollar supply.

What about China? We’ve not even discussed Chinese Monetary Policy. Will the Chinese Government and Central Bank suddenly step in and provide a helping hand to a friend in need? Will the Chinese forge a new and lasting bond with America, providing a lifeline, buying our bonds in an abrupt about-face, even though they’ve been reducing their published PBOC holdings over the last few years? Alternatively, will the Chinese instruct their Shell Cos, Banks, LLC’s and surrogates to move their roughly $35 trillion of Stealth-Western Tax Haven Assets into “buy and hold” Treasury Bond and Dollar positions, rescuing the American Banks and financial system? …Well, if you’ve read any of my work from the past few years, you’d already know that this scenario is far from likely. It’s far more probable they continue to execute their cyclical “pump & dump” tilting the global financial table in their favor to the tune of billions, if not trillions of dollars with every cycle.

So What’s Going to Happen After April Fools Day?..

(…the SLR Exemption Expiration)..

Probably not much immediately….but, remember, we don’t have 3/31/21 Balance Sheet figures yet. Much has transpired since 12/31/20. So, now let’s get back to US GSIB Banks. Remember, Zoltan’s eight, globally interconnected, systemically important banks. which are, theoretically at least, too big to fail? These are the banks that should have no problem absorbing another $3.5 Trillion of US Treasuries before they have any balance sheet constraints and/or need to raise additional capital, at least as of 12/31/2020. Let’s further say that, hypothetically, we all agree that it’s a wonderfully good idea to have America’s private, systemically important banks levered 20:1 and relegated to the status of functionary conduits for US Monetary Policy, to be used as political footballs destined to be intermittent stealth-bail-out recipients as they stumble toward an undefined goal line, against a bigger, stronger, faster opponent. Going forward, we can expect them to work together as best they can, without truly understanding the rules of the game, as emissaries of FED, Treasury and State Department Policy. When they need to raise capital, they’ll issue additional equity, likely underwritten, sold and owned by the other banks or newly formed FED SPVs. Every trillion dollars of “equity” raised creates $20 Trillion of additional Ponzi scheme balance sheet capacity, ready, willing and able to absorb any and all of the brand new Treasury Debt Janet Yellen can whip up. They will rely on the New York FED for overnight financing when a “trillion or two” of deposits suddenly gets wired to Hong Kong, Luxembourg, and Cayman Islands branches of Chinese Banks and they need to replace the liquidity immediately during a cyclical “Repo-Apocalypse” .

So, to sum it up, if at some point, the auctions continue to resemble a monthly dumpster fire, and the only buyers are GSIB Banks/Dealers and the FED, using the Bank/Dealer and FED Repo funding to buy the bonds, the net effect is expanding M2 on a dollar for dollar basis, effectively financing the operation of our government using overnight payday loans rather than bonds which actually generate yield and (at least in theory) should pay at least some interest.

If I were a Global Financial Super Villian….

The details of my life are quite inconsequential…very well….where do I begin?

Of course, if I were a Global Financial Super Villain and I had sinister designs on total world domination, was in charge of the world’s second biggest, morally bereft government and economy, had a closed, locked-down currency and was in control of a $35 +Trillion, burgeoning and rapidly increasing war chest overflowing with Western Currency….and further had absolutely no virtuous predisposition against lying, cheating, stealing and committing any type of atrocity in order to accomplish my mission, it should be clear to nearly everyone by now that if this was indeed my plan to destroy Western Global hegemony, I really couldn’t have executed it any better than this. I would have created a mechanism, inherent within the system whereby I can cyclically position controlled “pump & dumps” on selected targets (i.e. the September 2018 “Repo Apocalypse”; the “Steve Mnuchin Christmas Eve 2018 ‘all is well’ Letter”; Tesla, Feb. 2020; Gamestop, February 2021; etc. etc.) to test my ability, along with Western “helpers” to pull this off and move stock or bond prices in unpredictable directions favorable only to me and my “helpers”. I would have created an environment where Western Central Banks were all forced, in unison, to flood their respective financial systems with money, warding off the systemic asset and bank collapse du jour, in response to something like, just thinking out loud, like an accidental “Wuhan flu” or something like that. I’d make sure that this accidental random, totally unexpected, accidental virus got into every nook and cranny of Western Civilization long before I thought to publicly announce and acknowledge our little “oopsy-daisy”…. and I’d, of course, be actively working on an accidental Wuhan 2, a Tianjin 3 and/or a Foshan 4, variant that just might accidentally escape my borders without my specific, provable, complicity…etc….coming soon to a Western Economy near you, since the first accidental science experiment accidentally worked so gosh-darn well. I would cordon off a section of my country to be used as a Disneyland-like re-education theme village for my loyal subjects who needed help understanding their place and role in my society. I’d be running coordinated, sponsored think-tank forums, buying political influence using offshore PACs and I’d send my agents to become actively involved with US Politicians, universities and consulting firms, making their lives much easier and careers much more lucrative if they promoted “win win” policies that would benefit them personally and by coincidence, my despotic regime. I’d make sure to get my spyware infrastructure, virus delivery software tools and technology deployed, approved, installed and embedded in Western communication and electrical grids and businesses around the globe by providing deep discounts to naive purchasers. I’d launch Trillions of dollars of fake IPOs on Western Stock Exchanges getting starry-eyed suckers to buy into largely exaggerated businesses issuing predominantly fake financial statements. I’d run social media campaigns and ads on all of the major media outlets, like the South China Morning Post, CCTV, the Global Times, Bloomberg, Facebook, TicTok, etc… which I have gained defacto “power of the purse” control over, in order to defend my positions and spread my “nothing to see here…head-in-the-sand…hey we didn’t do it…we’re just trying to help” destructive, diversionary messages.

You’ll further notice, as a Global Financial Super Villain, I would have my currency locked up as tight as a tanggu, and it would be conspicuously absent from participating in this global print-a-thon, primarily because my economy is an isolated financial black hole and I can do whatever I want to my loyal subjects without reprisal or repercussion. I would be using Western Currencies as weapons to destabilize Western Banks and asset values by creating seemingly random flows from one asset, asset class and/or institution to another in the blink of an eye. I would be using all of these destabilizing tools in my arsenal to sew the seeds of class inequality, political discontent and despair throughout Western Civilization….and I’d be succeeding.

Today, dump trucks full of Western Currency flow into Chinese Banks via their Trade Surplus and “boomerangs” back into Western Currency denominated Financial Assets which they’ve weaponized against us. Nobody uses their pegged Yuan, RMB, CNH, CNY or any variation of their controlled, closed, locked down currency in any meaningful amount. Less than 2% of global FOREX transactions have the RMB as one side of the pair. Yet, we wonder where all of this offshore wealth denominated in Dollars, Euros, Yen and Sterling is coming from?

There should he no question now, that the Chinese Communist Party, because they hoard, invest and spend Western Currency rather than their own, is the primary mysterious driver behind all of this monetary expansion and dislocation.

Our inept political leadership, institutions and technocrat bankers can’t begin to understand or are willfully ignorant of the dilemma. They fail to ask the simplest questions, such as, where is all of this money going?…who needs it?….what is it really being used for? They look at their models in disbelief and conclude “well…I guess we need more money!….let’s print some up!”. The Chinese Communist Party, through their army of ShellCos, surrogates, LLCs and “helpers” are hoarding Dollars, Euros , Yen and Pounds, hiding them in plain sight in Western Financial Institutions and Tax Haven vehicles. At some point, Central Bankers must come to grips with, and plan for, not only who is going to buy all of the new bonds they intend to issue, but more importantly, who might want to sell them, when they might consider doing it….. and at what price?

The idea that the Federal Reserve, and 8 US GSIB Banks with a few trillion dollars of firepower can somehow control and support the price and by definition, the yield, of $130 Trillion of Dollar denominated Assets, a full 1/4 of which are actually issued directly by Uncle Sam is bordering on preposterous. If the FED hasn’t already lost control of the dollar and Treasury yields, if they continue on this path, they will. It’s just a matter of time.

At some point, on the current trajectory, there will be a point where investors won’t want to own risk assets or the longer end of the curve, they will likely stay in comparatively “safe” Western currency until asset prices reach some sort of equilibrium. These cycles will continue until either investors eventually see value in depreciated dollar denominated assets, or put their money in “something else” whatever that “something else” might be. It could happen next week, or it could take years, but the gravity of the math at the current trajectory is inevitable.

The above is so obvious, at least to me, that I’m dumbfounded that our leadership hasn’t publicly addressed it. Perhaps they are just really nice, descent, naive people who just don’t know what they are doing? I hope not. I’ve been secretly hoping that they are cunning, brilliant strategists who have concocted some diabolically brilliant, carefully choreographed grand “gotcha” counter measure scheme which, when the Chinese Communist Party least expects it, they will spring their trap, saving the world from eventual Chinese domination, a’ la the way the Normandy Invasion, the Battle of Gettysburg or the defeat of the Spanish Armada changed the world’s geopolitical landscape. Unfortunately, as I watch events unfold, I’m more convinced by the day that we are in for another half decade of policy blunders with an incessant parade of Congressional investigations, finger pointing, discord and ass-covering culminating with the usual blameless conclusion that “nobody could have possibly seen this coming….this whole thing is a real bummer …it really sucks that America is in the shitter…” as our financial system and democracy get swept into the dust bin of history as a result of incompetent leadership.

I guess the real purpose of this blog, and the satisfaction I derive from it, to be blunt, is that if our leadership has indeed failed to recognize this threat, and does nothing about it, whether they were willfully ignorant or not, It’ll at least make me feel as though I tried my best to do something about it….in summary…

“You clowns should have known….and you should have done something…may you rot in hell..”

(Ok…that was a little strong….but I’m on a roll….now where was I?)

Oh yeah….of course, I’ve never been a Central Banker or run a large hedge fund, but I’m academically aware that it would be infinitely more difficult and complex to unwind a large position, with minimal market impact, than it would be to unwind a smaller one. (…and if we’re talking about unwinding trillions.. ..well.. ..that’s never been attempted before). i.e.) Most Central Bankers and Institutional Managers don’t simply log into their Robinhood or E-Trade account, locate the price they’d like to sell at and press the “sell at market button” on a $100 Billion dollar transaction. Ideally they’d like to unwind the position slowly, stealthily over time, for fear of setting off a stampede while standing on the edge of the cliff, with the fear of being pushed into the abyss by the throngs of panic stricken former bulls at top of mind, once they realize there are no bids for what used to be a portfolio darling. A crowded trade can become pretty lonely relatively fast.

Of course, if your goal in unwinding a position is not “financial” per se and are actually trying to cause cyclical “Pump & Dump” market disruption, you just push the “Sell Button” on your huge position, hope you’re the first one out, and see what happens…buying it back when the smoke clears and/or the yields rise.

To further, finally, unequivocally sum it up, there’s nothing in Zoltan’s report that is inaccurate or misleading. He’s a really smart guy, making a judgement on what’s going to happen and why. Just like we all do, on many topics, every day of our lives. Moreover, with his experience, understanding and in-depth knowledge of these markets, he’s probably dead-on accurate and once the exemption expires, absolutely nothing will happen. Smooth sailing. Even though, based on my son’s way of thinking, Zoltan is mildly handicapped by being really smart, talented and experienced, he will also, have been “right” (at least for now).

That said, would I be shocked, dismayed and dumbfounded to later find, at some point in the future, that Credit Suisse has been actively unloading US Treasuries with the logical belief and anticipation that they will likely be able to buy them back at a much better price/yield in the relatively near future, just as Zoltan’s commentary was being researched, edited, typed and eventually sent out to clients?

Unfortunately….no….no, I wouldn’t be shocked at all….