Well, after I had seen the thunderous, unanimous passage of HR-748 in the Senate on Friday, followed by Nancy Pelosi’s giddy “we worked night and day to get this bipartisan effort done…we’ve brought America together” speech on the floor of the House, just prior to the “no debate”, near unanimous passage via voice vote (save for a whimpering, nearly inaudible dissent, through muted microphones, by a few inconsequential, rogue legislators who were likely angered because their districts were left out of the pork-fest), further followed by a very public Oval Office press conference and signing ceremony where, Don, Mike, Mitch, Steve, Larry and the whole ebullient gang were all so congratulatory that you’d think they might have, at least for a moment, forgotten all about our country’s hospitals burgeoning with reluctant guests and that many Americans are on “lock down”, frightened and unsure of their futures. I became as curious, as I’m sure all of you, my dear readers are, to find out exactly what’s in this bill and what might be causing this level of unbridled, unified jubilation.

When I see an unexpected, accelerating convergence of dichotomous, “over-my-dead-body…not-on-my-watch” philosophy, bringing both Democratic and Republican leadership together, united in a common goal nearly overnight, like this, in a manner heretofore unimaginable, there’s only one possible explanation for a historic, unifying “come to Jesus” moment like what we’ve just witnessed…

…..that’s right.

The legislators who went along with, and silently acquiesced to, this disturbing piece of legislation, would be richly rewarded.

In other words, everybody got paid…..

I understand that this view is in the minority. I get it. Lots of people who claim to be much smarter than I am think that this legislation is somehow going to magically save the American Economy.

The only response I might have is that, if you really do believe that this legislation is good for the American people, then you didn’t actually read the bill and/or you don’t understand deficit spending and monetary policy. To that end, I spent the weekend wading through all 880 pages of HR-748, thinking it through, analyzing it’s cryptic language and “legislative code” as best I could, with my sole, unwavering goal being to provide my readers with a realistic assessment of what this $2.2+ Trillion bad-boy, the Coronavirus Aid, Relief, and Economic Security Act’’ or the ‘‘CARES Act” really is and does, and what the true purpose of the underlying language really is.

Context

The first thing we must understand is that our government, through both the US Treasury and our Federal Reserve Bank (an independent, autonomous entity) when directed by the White House and Congress, are fully capable of deploying a meticulously synchronized, carefully choreographed fiscal and monetary policy cocktail, unleashing the awesome power of American financial mite, proving once again that our leadership is, without question, capable of financing virtually any level of business activity while simultaneously growing the economy (levitating asset prices) with absolutely no systemic risk (or inflation) whatsoever. Here’s our former Money Printer in Chief , our guiding light through (while some might say the architect of) our last Great Financial Crisis, describing the process in layman’s terms in an interview with Scott Pelley on “60 Minutes” a while back……

See….it’s just that easy. “we simply mark up the size of the account in the computer…..it’s much more akin to printing money than borrowing money….”

I, for one, am really glad that our leadership is finally united in a common goal and all on the same page……

(For those of you who are new to my work…..that discussion of “context” is what we economists refer to as “dripping sarcasm”)

The ACT….so what’s in it?

Glad you asked! Here are the titles we’ll be discussing today…..did I mention it was 880 pages?

TITLE I—KEEPING AMERICAN WORKERS PAID AND EMPLOYED ACT

TITLE II—ASSISTANCE FOR AMERICAN WORKERS, FAMILIES, AND BUSINESSES

TITLE III—SUPPORTING AMERICA’S HEALTH CARE SYSTEM IN THE FIGHT AGAINST THE CORONAVIRUS

TITLE IV—ECONOMIC STABILIZATION AND ASSISTANCE TO SEVERELY DISTRESSED SECTORS OF THE UNITED STATES ECONOMY

TITLE V—CORONAVIRUS RELIEF FUNDS

TITLE VI—MISCELLANEOUS PROVISIONS

Here’s the link to the Final pdf of the CARES ACT:

https://www.pbs.org/newshour/politics/read-the-senates-full-coronavirus-aid-package-bill

Those headings/titles actually sound pretty good don’t they? At least, on the surface, it doesn’t look like the end of Western Democracy as we know it…..so there’s that. When I first read those Titles, it gave me hope and almost made me believe that our leadership actually gives-a-shit about the welfare of everyday Americans. That said, since most of the act is relatively benign or unintelligible, for brevity’s sake, I’m only going to touch on the really important concepts, that are frighteningly ineffective and/or detrimental to America in the body of this writing.

So, let’s take these sections one at a time, discussing what I perceive to be the biggest flaws in this legislation and threats to American survival, besides of course, that it was pushed through Congress, under duress, with no public debate or vote, so quickly that even if we had any capable/diligent legislators who were willing to put in the effort to understand this gobbledygook, that they wouldn’t have had time to actually read it and comprehend it anyway.

Out of respect for your time, as always, I’ll reference the important structural concepts at the end of each section in RED under the header: “Key Point:” or: “What We Should Have Done:“

Steve’s Bailout Binge….Coming to a Theater Near You!

I, for one, and I never thought I’d say this, am grateful that we have an infinitely successful, former Hollywood movie producer, capable of deploying the same skill-set in managing our money supply that he summoned and relied upon when producing and marketing such cinematic masterpieces as “How to be Single” and “Suicide Squad“. Moreover, his connections to and relationships with Chinese investors and film makers should also be extremely helpful, if not critical, in accessing the global economic landscape and the success of this legislation. That said, let me direct your focus to:

SEC. 4003. EMERGENCY RELIEF AND TAXPAYER PROTECTIONS – pg. 512

Generally, this provision gives Steve and the gang the authorization to make loans, loan guarantees, and other investments in support of eligible businesses, states, and municipalities up to $500,000,000,000 as deemed necessary. This authorization applies to just about any entity (public or private) that Steve wants to bail out. Of course there are all sorts of definitions, vague limitations and hurdles that can easily be met and overcome by proper construction of the transaction. Suffice it to say, it’s the “friends and family plan”. Steve can make loans or guarantees to just about any entity if he follows the prescribed deal structure, by taking back equity or or warrants as needed. Here’s the language on page 525 summing it up.

I can easily see troubled Hedge Funds buying businesses like broken down Hollywood movie studios at favorable prices using (not) taxpayer money, provided through Steve’s largess, to accomplish it.

I can also see big US Banks, obtaining these loans, with no restrictions on the use of proceeds, renting US Dollars to foreign, offshore, anonymous, ShellCos at spreads that would make any banker drool with envy.

Gotta help your buddies out when you can. It’s good to be king.

I’m also guessing that if Steve gets equity interests or senior debt in some of these illiquid/failed securities and dog-shit businesses, he should be able to package these instruments up, securitize them and auction them off as US Government Guaranteed Assets…..Oh wait…. He’s already doing that…. These securities are called “Treasury Bonds”.

Fortunately, tax payers are further protected by the language on page 526. No loan Steve makes under this program can ever be forgiven.

(3) PROHIBITION ON LOAN FORGIVENESS.—

The principal amount of any obligation issued by an eligible business, State, or municipality under a program described in subsection (b) shall not be reduced through loan forgiveness.

Again I’m really glad that we have some taxpayer protections built in (even though it’s just “printed” money and not “taxpayer” money) …. they must have gotten the “you owe it till the day you die….and then we deduct it from your estate in liquidation” idea from the Student Loan people.

Further, under the provisions of this section, Steve is really getting tough, smacking senior management around for their audacity, daring to ask for a government bail out.

After Steve gives them the money that Jay prints it (it’s not actually taxpayer money), Steve is going to cap their compensation at only $3 million plus 50% of the excess over the record compensation levels of 2019. So, for example, if they made $20 million in 2019, they’d only get paid, and have to scrape by on ,only $11.5 Million in 2020. I guess we all have a crosses to bear….(page 531)

(2) no officer or employee of the eligible business whose total compensation exceeded $3,000,000

in calendar year 2019 may receive during any 12 consecutive months of such period total compensation in excess of the sum of—(A) $3,000,000; and (B) 50 percent of the excess over $3,000,000 of the total compensation received by the officer or employee from the eligible business in calendar year 2019.

There is also a provision that while the funded/acquired business is in the Treasury portfolio that there will be no dividends and/or share buybacks until 12 months after the business is no longer under Steve’s direct supervision. After that, they are free to do whatever the hell they want. In all likelihood we can do this all over again in another decade or so. At least there’s that. (SEC 4003 – page 516)

SEC. 4026. REPORTS – (pg 579) Provides the following regarding Steve’s favorite companies. I have to say that I found this section oddly placed in a completely different section of the Act, some 60 pages later….must have been some sort of mix up. After all, they really threw this mess together in a hurry:

…..72 hours after any transaction by the Secretary under paragraph (1), (2), or (3) of section 4003(b), the Secretary shall publish on the website of the Department of

the Treasury (1) a plain-language description of the transaction, including the date of application, date of application approval, and identity of the counterparty; (2) the amount of the loan or loan guarantee; (3) the interest rate, conditions, and any other material or financial terms associated with the transaction, if applicable; and (4) a copy of the relevant and final term sheet, if applicable, and contract or other relevant documentation regarding the transaction.

What they are saying here is that 72 hours should be more than enough time to allow all of the company insiders, government officials, Lobbyists, Senators, Congressmen and Executive branch folks (through their off shore, family office accounts) to get in on the right side of the trade before the information actually becomes public.

Also note that within the entire 880 pages of HR-748, despite the final 273 pages, labeled as “TITLE VI—MISCELLANEOUS PROVISIONS”(a vague listing and description of 143 Separate Appropriations, totaling $239,090,725,008) there is not one mention of increased funding for the Securities Exchange Commission. Looks like Jay Clayton has done his job and the SEC is finally closing down and/or becoming irrelevant. There’s obviously no need for enforcement anymore.

Finally, I didn’t see any provision in this particular Title which gave Steve the authority to remove executive management, even after they rode the bailed out company down the crapper. I find it strange that Steve wouldn’t want that clause/authority when deploying $500 Billion of “not taxpayer money”. Oh well, there’s a lot going on right now…. must have been an oversight.

What We Should Have Done: Rather than give Steve carte-blanche authority to buy/save just about any business he chose, at his whim, without oversight or repercussion, the Treasury should have established the $500 Billion fund (perhaps much more) in support of struggling businesses and use the Reorganization Provisions and Creditor Protections already available and in place under Chapter 11 of the US Bankruptcy Law. Every Businesses (remember the old “Railroad Reorgs” that took 30 years to complete?) would continue to operate under protection, employees would be paid, equity would be refinanced or wiped out, creditors would be paid according to individually negotiated/determined parameters and the businesses would emerge if deemed to be financially viable, with the courts making full use of Treasury Funding.

YAYYY! You Might be able to Stay in Your Home! (for a little while….)

One of the greatest fears Americans have today, after the vivid memory of (the prior) Great Financial Crisis, is the fear of becoming homeless. They remember the pain of watching their homes enter foreclosure and their sole source of net worth being packaged up and sold off to vulture investors (like the IndyMac bank deal) for pennies on the dollar. Let’s take a look at the relatively feeble attempt that HR-748 makes to alleviate that fear….

SEC. 4022. FORECLOSURE MORATORIUM AND CONSUMER RIGHT TO REQUEST FORBEARANCE. (Pg567)

In my humble opinion, this section of the Act should have been called “The Mortgagee, Mortgage Backed Securities, Bank and Landlord Protections and Support Section“. Here are the bullet points:

1.) The section only applies to Federally Insured Loans (Fannie/Freddie/etc.)

2.) There are roughly $16 Trillion of Residential Mortgages outstanding in America today, with about a third of them qualifying as “Federally Insured” under the terms/definitions of HR-748.

3.) For the other two thirds (the homeowner should consult with their mortgage processor to determine the status/eligibility) the protections don’t apply. In short, roughly 2/3rds of American Homeowners who have mortgages (or live in and/or rent homes that are not subject to forbearance) are left to their own devices and ingenuity to come up with a plan to stay in their homes once they are unable to make payments or they get behind on the rent.

4.) Moreover, roughly 37% of America’s residential real estate has no mortgage and is owned outright, so there would be no protections offered on any of these properties if they are rented.

5.) If you do indeed qualify for forbearance, the mortgage obligation is not absolved, it is merely deferred for 180 days for property owners (if properly requested) with the possibility of an additional 180 days if approved. Payments, principal and interest are not eliminated, but deferred. Generally, you’ve got up to a year to figure out how you are going to get caught up on your payments and stay in your home.

6.) If you are a renter and live in a qualifying property, as along as you were current on your rent as of 2/1/20 you are protected from eviction for the term of your landlord’s forbearance plus 30 days. (page 572)

7.) Further, if you are a tenant and you do not live in a “qualifying property” i.e.) Currently no mortgage, owned outright, or financed through non-qualifying means, there is no moratorium or protection from the landlord evicting you, throwing your stuff on the tree lawn and getting a more fortunate, well-heeled tenant into your prior residence, who has a better chance of paying the rent on time, in the sole opinion of your former landlord.

8.) Keep in mind that many landlords will qualify as a “Small Businesses” and therefore qualify for the SEC. 1102. PAYCHECK PROTECTION PROGRAM of the Act, administered by the SBA, whereby they would be entitled to “forgivable”, non-recourse loans, for which there is no requirement, at least that I could see, to pass along any of their “forgiveness” on to their tenants. (page 9)

What We Should Have Done: Rather than simply delay the problem, for a small portion of America’s households, HR-748 should have expanded the SBA loan program significantly from $349 Billion, with the intent being to broaden the facility and extend a lifeline to all landlords and homeowners (not just for a few months for “qualifying” mortgages) but for up to a year, while funding a 2 month “Payment Jubilee” i.e.) Rent or mortgage payments are permanently forgiven for two months on any property with a mortgage. The simple math here is $16T in outstanding mortgage debt costs us roughly $160 Billion in “not taxpayer” money. By not requiring these mortgage payments, the money could/would remain in the hands of the homeowners/tenants, recycled and put to work in the “main street” economy, continuing occupancy, providing stability and a lifeline directly to the people who need the relief most. Since many/most of these mortgages are securitized, the MBS would be repriced in the marketplace to reflect the non-payment of 2 monthly installments out of the 360 payments due on a 30 year note, for example. This is a relatively minor hit when compared to the cost of letting millions of homes go vacant….again.

3.2 Million Applications for Unemployment Last Week

Key Point: Without even blinking, SEC. 2102. PANDEMIC UNEMPLOYMENT ASSISTANCE state funding should have been increased to “not to exceed 52 weeks” rather than 39 weeks….as the Act currently states (page 90):

……an individual may receive assistance under this section shall not exceed 39 weeks and such total shall include any week for which the covered individual received regular compensation or extended benefits –

(B) an additional amount of $600 (in this section referred to as ‘‘Federal Pandemic Unemployment Compensation’’). Pg 100

Ideally, the funds would be provided to the states to administer and use as they see fit, amending their rules as needed. The purpose of the extension is that most states already provide for up to 26 weeks of unemployment insurance. Under the current conditions, for an unemployed worker nearing the end of his/her 26 week period, it would seem to be an undue hardship for that person to have his/her funds run out in just 13 weeks under current economic conditions.

Everybody Gets a Check!….aka Buying Votes!

This is probably the silliest aspect of this HR-748.

You get a Check!…You Get a Check!…..and you get a Check!…..Everybody gets a Check!

Generally, SEC. 2201. 2020 RECOVERY REBATES FOR INDIVIDUALS provides that the Treasury will mail out checks to households as soon as is practical: (page 146)

…….(1) $1,200 ($2,400 in the case of eligible individuals filing a joint return), plus

(2) an amount equal to the product of $500 multiplied by the number of qualifying children (within the meaning of section 24(c)) of the taxpayer.

…..shall be reduced (but not below zero) by 5 percent of so much of the taxpayer’s adjusted gross income as exceeds— (1) $150,000 in the case of a joint return, (2) $112,500 in the case of a head of household, and (3) $75,000 in the case of a taxpayer not described in paragraph (1) or (2).

The amount of the Appropriation wasn’t described in the Act, but based on big round numbers we can guess that this “one time” program will add roughly $309 Billion of (not taxpayer money) to the national debt.

So most of America is going to get a “one-time” check in the next couple of weeks, with adjustments, treating the amounts as a 0% interest loan for those recipients above the income thresholds. We’re reinventing and usurping the State Systems of Welfare/Assistance/Payment management for a one-time, relatively insignificant direct payment to be made in the name of the POTUS. If we really are going through all of this trouble, cost and administration to develop a “one time” payment system to send out “Trump Bucks“© it would seem to be a foolish waste of money and time, unless of course it’s not just a “one time” emergency tool, but designed to be used with more vigor every time there’s some sort of emergency, most likely right around an election when there’s a dire need to distribute “not taxpayer money”.

I would also imagine that this system will be designed to accommodate campaign literature and brochures stuffed in the envelopes with messaging something like “this payment was brought to you by your Senator/Congressman on behalf of the President of the United States….who is working tirelessly for you…..don’t forget to vote for us!”

It really is an absurd, costly, inefficient piece of marketing designed to reach people who don’t know any better….but when you really think about it…it’s absolutely going to work…..and become an integral propaganda tool, regularly reinforcing the “we’re here to help the little guy” message of the kleptocracy, while facilitating the distribution of “not taxpayer money” to the huddled masses.

What We Should Have Done: Certainly Not this..the money should have been appropriated to State governments to be distributed based on need per their own “boots on the ground” determinations.

Small Business Loans….The Purge…

Although the sentiment is appreciated, the SBA loan program described under SEC. 1102. PAYCHECK PROTECTION PROGRAM (page 9), given the relentless tilting of the playing field over the last few decades, away from small business, by Wall Street funded behemoths, providing discounted capital to Amazon, Walmart, etc. and the woefully unprofitable “gig economy disruptors”, combined with ill-conceived state and local governments providing free land, tax abatement and subsidies, and the incessant drive for industry consolidation in banking, retail, insurance, services, grocery, etc. etc. relentlessly pushing to “do more with less” (referring to people)… small business in America can and should rightly view these CARES Act, non-recourse, “forgivable” SBA loans as as sort of severance, or at least a nice going away gesture as America’s small business owners approaching retirement actually decide to throw up their hands and give up, or those less fortunate might continue working, perhaps at Walmart as a greeter in their spare time, now that they’ve finally lost their businesses.

There’s a lot of terminology here, but the gist of the provision is “don’t close your business now!….wait a few months!” the SBA is making non-recourse, forgivable loans with no personal guarantee, up to $10 million (subject to the size of your payroll) for roughly 2.5x your average monthly payroll, if you don’t close down and continue to pay your employees. It’s an incentive to keep going for a few months with Uncle Sam funding at least a portion of the businesses ongoing expenses. I’d imagine that many small businesses will do the math, take the loans, stay open for the forgiveness period and reevaluate their longer term prospects in three months or so. Like so many things in life, we’ll see how it goes.

What We Should Have Done: Good idea, but too little too late…if we could go back in time and prevent Amazon, Walmart and Wall Street with their unlimited cheap capital, from destroying heartland America in the first place, that would have been preferable….but I digress. See: Amazon, Walmart….Chinese Potting Soil…. and the 34th Amendment…

CORONAVIRUS RELIEF FUND

Key Point: This is actually one of the few sections of this Act that I agree with, with a little modification, but as described above, I would have added the $300 Billion “You get a check!” – SEC. 2201. 2020 Recovery Rebates to this fund. I would also have added a “need based component” perhaps based on relative infection rates, to the pro-rata calculations, rather than simply population, i.e.) It’s likely that New York and Louisiana will need more assistance than Arizona and Texas (at least so far).

Again, all of the States have infrastructure in place to deal with and support their citizens in time of need. SEC. 601. CORONAVIRUS RELIEF FUND. (page 598) provides for $150,000,000,000 in relief for fiscal year 2020 to be distributed to state governments….

(A) IN GENERAL.—No State that is 1 of the 50 States shall receive a payment under this section for fiscal year 2020 that is less than $1,250,000,000. ‘‘(B) PRO RATA ADJUSTMENTS by population

Medical Provisions of HR-758

TITLE III—SUPPORTING AMERICA’S HEALTH CARE SYSTEM IN THE FIGHT AGAINST THE CORONAVIRUS

To be honest, I just don’t have the aptitude or training to analyze and/or discuss the merits of any part of this section. Here are a few of the confusing titles/sections that make me wonder exactly why these Appropriations are in an “Emergency Bill”:

TITLE III—SUPPORTING AMERICA’S HEALTH CARE SYSTEM IN THE FIGHT AGAINST THE CORONAVIRUS (297 pages).

SEC. 3855. ANNUAL UPDATE TO CONGRESS ON APPROPRIATE PEDIATRIC INDICATION FOR CERTAIN OTC COUGH AND COLD DRUGS

SEC. 3854. TREATMENT OF SUNSCREEN INNOVATION ACT.

Subtitle F—Over-the-Counter Drugs – PART I—OTC DRUG REVIEW – PAGE 415

PART 10—FEES RELATING TO OVER-THE-COUNTER DRUGS

SEC. 3302. PRIORITY ZOONOTIC ANIMAL DRUGS

SEC. 3702. INCLUSION OF CERTAIN OVER-THE-COUNTER MEDICAL PRODUCTS AS QUALIFIED MEDICAL EXPENSES – ‘‘(D) MENSTRUAL CARE PRODUCT

SEC. 505G. REGULATION OF CERTAIN NONPRESCRIPTION DRUGS THAT ARE MARKETED WITHOUT AN APPROVED DRUG APPLICATION

SEC. 3852. MISBRANDING

Again, all of the above, and many other provisions of this section, are probably really important to someone and may or may not be of much value to the American people and/or health care workers. There are all sorts of costs and dollar figures embedded throughout the text, but without a complete understanding of the nested headings and sub headings, or the ability to disassemble the intentionally complex language, it’s (at least for me) impossible to tell what the true funding level of this appropriation really is.

Key Point: One change I might consider, if I were a legislator, is to mandate the full amount of the Appropriation by Title, Section and sub-section, and mandate that that these figures actually add up to the total. That way, if I were a law maker, I might know what to focus my attention on. Oh, that’s right, this 880 page monstrosity was dropped on the House on Wednesday night, there was no hearing or debate, with a forced, bull rushed “the Aye’s have it!” voice vote on Friday afternoon. But I digress….

Misc Provisions – Page 609 thru Page 880 – 271 Pages…..$239 Billion Dollars

Carrying on the theme from the TITLE III—SUPPORTING AMERICA’S HEALTH CARE SYSTEM, (i.e. this bill is far too complex, confusing and intentionally misleading for any legislator to fully analyze and understand what they are voting for in one working day), let’s look at the last, truly impressive, ginormous, “Miscellaneous” Section of this legislation. For those of you who are familiar with how legislation is drafted, the “Miscellaneous” section is usually where lawmakers hide all the “pork”. Pork is simply a cute, colloquialism for “buying votes”. It’s akin to taking (not) taxpayer money from people in one part of the country and making them pay for something, that may or may not be needed, wanted or necessary, in another part of the country, in order to get a law passed and hopefully, for the sponsor, effectively buy some votes in his/her district. This is how we get “bridges to nowhere”, “Big Digs” libraries, freeways, airport terminals, etc. etc. named after Congressmen and Senators. Simply put, if you are a legislator sitting on the fence in a close vote, if you play your cards right, you might get funding for a pet project, to be named after you, in your district, if you do indeed see the merit of the other pork-filled provisions of the bill and “get on board” to get it passed.

That said, listed below are the 144 separate, “Miscellaneous”, “emergency” funding provisions of HR-748 which total up to be $239,090,725,008.00. Again, I don’t have the background to determine if these expenditures are what the American people really want or need. I don’t understand the genesis of these appropriations, nor what the motivation is in including them in an “emergency” Bill like this. Again, I’m not questioning the value/importance of these ADDITIONAL Appropriations. I’m questioning their inclusion in an “emergency” bill like this.

For example, If I were a legislator, getting ready to cast my voice vote that nobody cares about, I couldn’t make any effective judgement or conclusion, because of the lack of specifics, on the merit of the individual Appropriations classified as an “Emergency Appropriation” for example:

The Kennedy Center ($25,000,000, pg 722)

African Development Bank – Share Purchase ($7,286,587,008, pg 827)

Senate – Miscellaneous Items ($9,000,000, pg 780)

Maritime Administration ($3,134,000, pg 842)

Institute for American Indian Culture ($78,000, pg 721)

Supreme Court of the United States ($500,000, pg 660)

Sargent at Arms & Doorkeeper of the Senate ( $1,000,000, pg 780)

Forest & Rangeland Research ($3,000,000, pg 715)

Foreign Agricultural Programs ($4,000,000 pg 616)

Howard University ($13,000,000, pg 768)

NASA ($60,000,000, pg 628)

National Endowment of the Arts ($75,000,000 pg 723)

National Endowment for the Humanities ($75,000,000 pg 724)

Here’s the complete list sorted from highest to lowest funding level ….page numbers are in the column on the right if you’d like to read about the specific appropriation:

What We Should Have Done: Keep $239 Billion of unnecessary “pork” out of the CARES Act. Unfortunately, this unprecedented level of pork is the primary political driver which allowed the most important and destructive piece of this legislation, the aforementioned “family and friends bail out” section of this act, to pass without adjustment, disclosures, a debate or a public/recorded vote.

Apparently the Debt Ceiling is No Longer a “Thing”?

Remember that goofy 35 Day government shutdown back in 2019, where our leadership couldn’t decide whether or not to spend a $1 billion dollars on “building a wall” on our southern border?….I’ll say that again….we CLOSED the government because our two warring political parties couldn’t agree on spending $1 BILLION or not. All non-essential government workers were sent home for a break (even though we were going to pay everyone full back pay, for not working, once we brought our government back on-line). To prevent that from happening, ever again, in our lifetime, our leadership had the foresight to enact 31 U.S.C. 3101(b). By the Bipartisan Budget Act, 2019, Public law 116-37. The legislation provided that the Statutory Debt Limit would be suspended through July 31, 2021. The thinking, at the time, was to kick the can down the road. In July 2021, we would undoubtedly have everything under control, Congress would again be united and everything would be hunky-dory. At that time, we would take stock of our position in the world, come up with a plan and reevaluate the whole thing. What could possibly go wrong?

https://www.congress.gov/bill/116th-congress/house-bill/3877

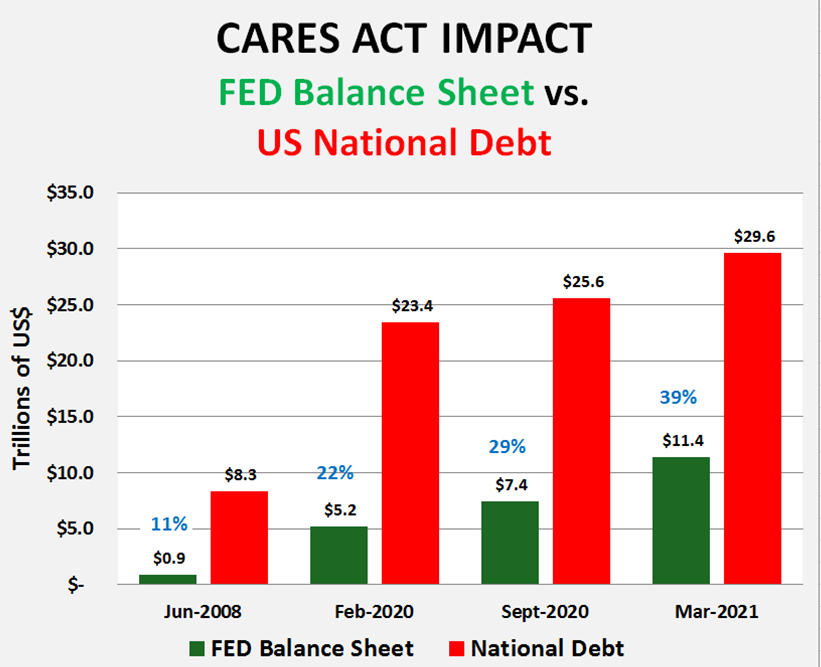

Even before the Enactment of HR-748, the CARES Act, the FED had increased its Balance Sheet by more than $1.2 Trillion in the last month, to $5.254 Trillion with an additional public commitment to do “whatever it takes”.

Per the Treasury (Report Summary Below), here’s where we were at the end of February, the US National Debt was at $23.409 Trillion, comprised of Government Guaranteed Treasury bills/notes/bonds. (debt). So over the duration of the CARES Act, as appropriations are expended, since our government is currently running a deficit (even without the Corona Virus crisis) the Treasury will continue to sell bonds, and presumably the FED (or someone) will continue to buy these securities, supporting asset values, using printed ($2.2 Trillion presuming 100% financing) by “changing the value of the accounts in the computer” rather than using “taxpayer” money. This would bring the National Debt to $25.6 Trillion, of which the FED, if it keeps the non-HR-748 accommodation policy-neutral, will have purchased Securities in the equivalent amount ($2.2 Trillion). This would take the FED Balance Sheet from $5.254T up to $7.454T. To put this in perspective, the FED balance sheet will have ballooned from roughly 22% ($5.254T/$23.419T) of the National Debt to 29% ($7.454T/$25.619) of the National Debt solely due to this legislation.

Key Point: If the Appropriation somehow can indeed morph to $6.2 Trillion, and the FED must buy the debt (because nobody else will/can), again, assuming constant inflation, a stable dollar and an otherwise neutral Monetary Policy (big assumptions), the FED Balance Sheet will balloon to $11.454T and represent ownership of 39% ($11.454T/$29.619) of all US National Debt outstanding. If accurate, we are entering into very dangerous uncharted waters.

The calculations above also assume that there will be no additional foreign funding/liquidity requirements necessary to both run the economy at baseline and support financial markets (and maintain asset prices). This is optimistic at best since we know with certainty that these forces were impactful well prior to the COVID19 outbreak. The FED was forced to increase its Balance Sheet by more than $500 Billion from the “Repo-Apocalypse” in September 2019 through February of 2020 primarily due to off-shore funding pressures. All of this “not taxpayer money” was required to be created during relatively prosperous or at least stable times….as I’ve often been told …we had been living in the “Greatest Economy in History” up until the middle of February.

Feel free to reread my latest two relevant works, first from October, 2019 entitled: Repo-Acalypse Now

…..and my January, 2020 piece: The Stealth Nationalization of America’s Banks…..an “Economic-Whodunit-Thriller-Novella”

There is no doubt, at least in my mind, that the US Financial System was decaying rapidly and on the ropes well before COVID19 ravaged our shores, economy and markets. The psychological and economic carnage brought on from this pandemic and resulting shutdown was an unexpected, one in a million, never to happen again in our lifetime (I hope) catalyst that unfortunately, dramatically exposed our structurally frail economy and the depth of our largely self-inflicted economic problems and missteps.

Key Point: Make no mistake about it, the The CARES Act -HR-748 is exactly the legislation that the Chinese Communist Party would have designed and implemented had they wanted to assist our legislators in destroying the American economy. The act creates a massive, first wave of band-aid “not taxpayer money” printing, with little sustainability for working Americans. The unaddressed, primary flaw in the legislation is that the Act continues to leave the flood gates for US Dollars flowing off-shore through the Big Banks wide open. These dollars will continue to be weaponized, out of reach of our main street economy, used as a store of value by the Chinese Communist Party and the rest of the world, until, of course, those dollars have a purchasing power much less than they have today….or, as a Las Vegas dealer I know often says as I’m leaving his table…..”Thanks for playin’….”

The Victory Lap

If you’ve not seen Don’s Friday presser extolling the virtues of this Bill, I strongly urge you to watch it. (below) It really is historic. Don says, paraphrased, that, like most of the things he’s done, it’s the biggest, best, most amazing thing that has ever been done to the American people. Indeed it is.

Although the numbers discussed in the presser don’t exactly add up, he mentioned that the Bill was a $2.2 Trillion Appropriation, possibly expanding to $6.2 Trillion. The detail he recited and read off of his note sheet in the presser/celebration/signing ceremony were (beginning at 1:10 of the video clip) $300 Billion for Paycheck Protection, $350 Billion for SBA Loans and Grants, $250 Billion for State Unemployment funding, $500 Billion for Steve’s “friends and family” bail out shopping list, $100 Billion for Health Care Worker Support, $45 Billion for Disaster Relief, $27 Billion for Vaccine Development, $16 Billion to replenish the Medical Supply Stock Pile, $3.5 Billion for Child Care and $1 Billion for the Defense Production Act. The Appropriations he described total to $1.5925 Trillion, not $2.2 Trillion….$607.5 Billion short…..perhaps he didn’t include all of the “Miscellaneous Pork”? …and even then, the numbers would not get to anywhere close to $2.2 Trillion.

I also particularly enjoyed the President’s very informative discussion on the subtle difference between “Billions”, “Millions” and “Trillions” at minute 6:40 of the video. That “math stuff” can get really confusing sometimes.

The CARES Act – HR-748, is indeed one of the most important documents in history. Like the Magna Carta, The Treaty of Versailles, and even our own, increasingly more irrelevant Constitution of the Unites States of America, The CARES Act – HR-748 will forever be remembered as the document which signaled the end of a golden era, ushering in a disturbing, inevitable change in the world order.

The transition of economic and financial power, away from America, with the dollar as the world’s reserve currency, because of our government leadership’s collective failure to understand the global financial landscape, the financial shell game and the Chinese Communist Party’s role in it, is now underway. Just as the Dutch Gilder gave way to Britain’s Pound Sterling and the Sterling eventually acquiesced to the greenback, we have been flung headlong into a period of financial disruption, driven by our own ineptitude, destined to eventually emerge, like a long lost prairie dog, disoriented, stuck underground in the dark, searching for sunshine and finally popping out of a hole into a new world, wondering where we are, how we got here and what happens next.

That said, we live in confusing times. One man’s “saving the country” is another man’s “end of the democracy as we know it”. The CARES Act, HR-748 is the greatest roll-up and consolidation of political power in the history of our country, yet it’s marketed to us as the “greatest lifeline for the little guy” in the history of mankind. Unfortunately, ignorant, uninformed, “head in the sand” voters tend to believe in, and rally around the guys who are sending them tiny, little, irrelevant in the grand scheme of things, checks.

They know not what they do.

When developing our “go forward plan” after this mess blows up and our freedoms are being assaulted, eroded and taken away by the kleptocracy “for our own good”, let me first say that I’m not an advocate of prison terms and/or long drawn out, time consuming partisan trials and hearings for members of our Executive Branch, Senate and Congress. We know that they are now and have always been flawed human beings, following the money, developing, designing and using their own corrupt system to enrich themselves, “friends and family” and their constituents, while somehow retaining their political power at a level heretofore unimaginable. We need to move on and let the country heal.

If we do indeed have an election this fall (Make no mistake about it, I can easily see the elections being “postponed” through more “emergency legislation”, in order to preserve “continuity” for the “good of the country in these difficult times”) the only effective way to deal with this is to start over. I’ve said this before, but at least for me, anyone on a ballot with the word “incumbent” associated with their campaign needs to go. We need transparent leadership who will put the American people first, rather than a distant second or an afterthought. We need legislators who will make, draft and pass intelligent, transparent laws that will benefit us, not them. By definition, any Executive, Legislator or elected official who was involved in the design, drafting, acceptance and/or passage of HR-748, is either corrupt, complicit, gutless or woefully incompetent.

God Bless the People’s Republic of America….because that’s exactly where we are headed….