Today we’re going to take a look at the saga of GameStop, which is an amazing story about a struggling little business which, according to our financial media has/had become a darling of America’s “little guy” investor and a tool of the rebellion against the Wall Street Death Star. So far, the best, most entertaining description as to what happened appeared before my eyes, surprisingly on CBS Sunday Morning just a few days ago….of course, to view the video clip you’ll likely have to make your way through a few targeted adds taking advantage of your predetermined subliminal product preferences and deepest subconscious desires known only to Google and Apple, but try to be strong, I think it’s worth it ….here it is:

Yes indeed, that’s the analysis. A bunch of really disgruntled young, swashbuckling American Investors, who have little/no idea what they are doing, got together on their smartphones, pooled their fractional shares, of their own volition and viciously, relentlessly ripped Melvin Capital to shreds, while, likely irritating a few other financial titans and generally causing an unprecedented level of disharmony in the global financial universe.

Makes perfect sense…sure they did. That’s exactly what happened.

In the spirit of this blog (i.e.) The enormous value added that I attempt to deliver post after post) we’ll keep up the customary format of providing a bullet point summary of my quasi-genius rantings in RED right out of the gate. As always, if you feel yourself nodding off, or your mind is wandering, you might consider skipping ahead to the next “RED” section/comment to rekindle your interest. If, however, you have the irresistible urge to burrow even deeper down this rabbit hole feel free to read on after the following bullets:

1.) Although, despite what you’ve read, the numbers tell us that it’s unlikely that the GameStop phenomenon was actually caused by knucklehead Muppet-Money coalescing into a market force because of rabble rousing Reddit/WallStreetBets exhortations. This silly brouhaha was likely nothing more than a convenient diversion. I will diagram the current “narrative” and discuss the numbers.

2.) I’ll also discuss the “amplifiers” of this phenomenon…. Options, Short Sellers, Passive Fast-Followers and… uhhumm….a “favorable” regulatory environment.

3.) I discuss and diagram a “Hypothetical Reality” where an imaginary company “Cowbell Global Capital” and its subsidiary “Cowbell Securities” become major players in the global financial system. I’ll Describe the $440 Trillion of global Financial Assets as a fungible commodity, like giant piles of grain or coal stored all over the planet, with anonymous trucks and barges picking up and dropping off loads with no way to determine who actually owns how much of the grain, coal or securities in each pile.

4.) Because of the above described structure, Financial Assets, regardless of where they are listed, can be traded anywhere in the world….by just about anyone in the world. (If you take anything away from this long-winded tome, please let it be that particular concept.)

5.) Behold DTCC, the relatively small global intermediary which is the financial engine making it possible for $9 Trillion of financial assets to fly around the planet every day. I’ll discuss their indefensible role, and risk concentration, in this mess.

6.) I’ll describe and diagram why “Know Your Customer” is no longer possible due to the structural “walls of anonymity ” which are built into the system. I also deploy our patented Dick Fuld Banker-Speak-Translator (BST) in an attempt to illustrate the folly of trying to solve what has become a national security issue, with conventional legal and regulatory weapons.

7.) I discuss a relatively simple solution consisting of a “real time” upgrade to our intentionally antiquated global financial system, requiring the assignment and tracking of serial numbers attached to each and every one of our $440 Trillion Financial Assets in existence today. The goal being to promote transparency, making sure that , for example, that I, and our regulators, know with certainty that the 100 shares of Microsoft I purchase with my hard earned money came from legitimate sources like perhaps, (I know this sounds crazy) from other legitimate US Shareholders, rather than 12 shares from VTBank, 21 shares from a Mexican Drug Lord, 7 shares from a Caymans PAC, 9 shares from a Honk Kong Merchant, 32 shares from an Iranian Sovereign Wealth Fund by way of the Bank of Cyprus and 19 Shares from an Al Qaeda front man in Guernsey. We have to somehow move away from this destructive type of “capital formation” that our SEC has become so fond of. The money (purchase/sale proceeds) should follow along with the transactions in real time, virtually eliminating all of the individual, cascading points of potential settlement failure and un-collectible “trust me I’m good for it” float inherent within the system.

8.) In conclusion, I identify the only possible bad actor that has the wherewithal and motivation to pull off what I can only describe as the greatest ongoing, cyclical Pump and Dump and destruction of Western Democracy ever attempted. Each cycle is worth hundreds of billions, soon to be trillions, of wealth transfer to this bad actor, with a resulting “Pavlovian Central Bank Dollar Debasement” recurring like clockwork in every cycle.

Let’s begin…

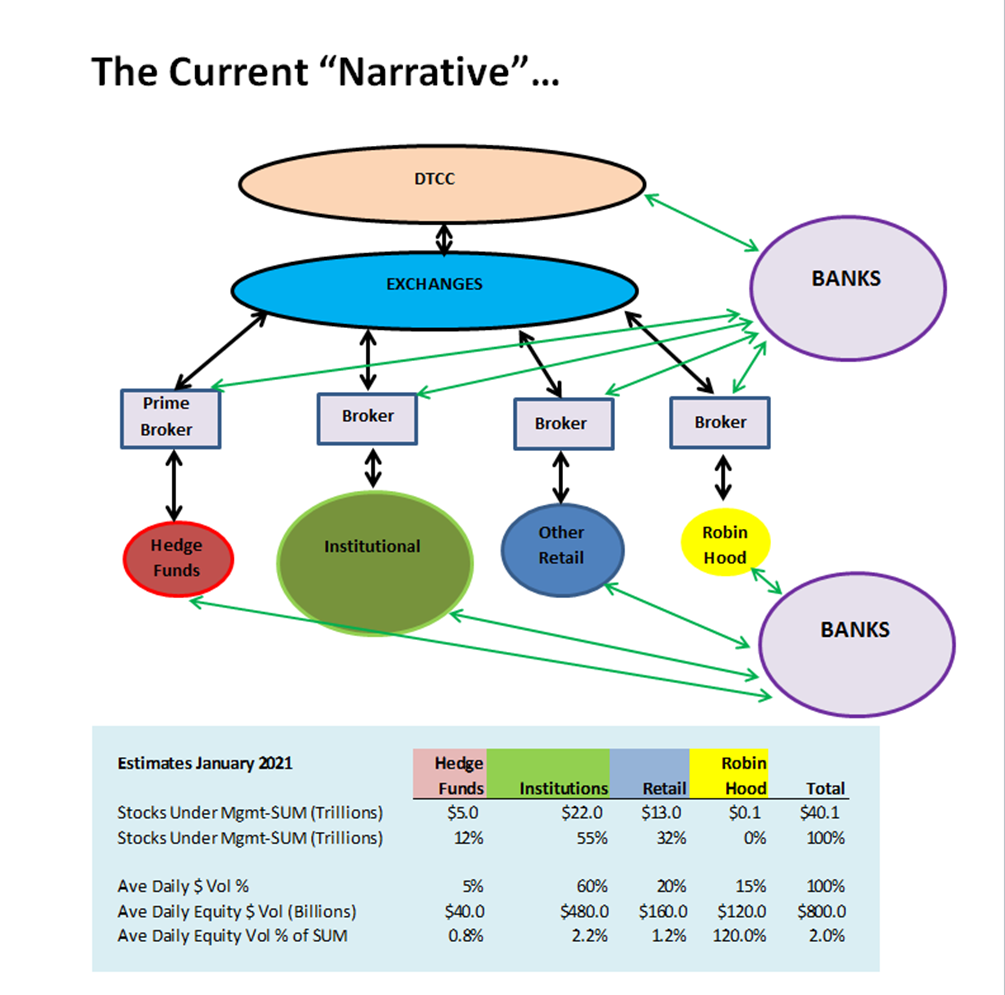

Being the inquisitive guy that I am, I thought I would take a few minutes and oversimplify the above, in order to prove, without a doubt, that this “GameStop Narrative” is exactly what happened (or not). I felt the first thing I had to do, so we can all understand what’s happening, is to take on the daunting task of diagramming the entire US Financial System on one (1) page. The graphic below is what I came up with….

I hope you are impressed….

Most of the figures I refer to above (and about to refer to below) are educated guesses/recollections assumptions based on publicly available data, media, filings, etc. so if you have better, more accurate data please feel free to substitute it, collaborate or rebut what I’ve prepared here, since forensic accounting often runs into a big thick brick wall without subpoena power, but again, I believe my charts and data are at least directionally correct.

So let me describe what you are looking at above:

- The four “ovals” on the bottom represent Hedge Funds, Institutional, Retail and Robin Hood (Robin Hood is part of Retail). These are the US buyers and sellers of US Stocks. Just like you and I sitting at our computers using our E-Trade, Schwab, etc. accounts, we all use some sort of judgement, computers, math, algorithms, gut feel, “hot tips”, AI, fear or greed to decide whether to buy or sell a stock. We place an order with our broker (I’ll use “broker” as a generic term meaning an intermediary who processes the trade and maintains the records and customer account details) Note that this graphic represents US Stocks (equities) and “funds” only. There are about 6,000 US Stocks, 8,000 Mutual Funds and 8,000 ETFs. So whether you are a Hedge Fund Titan managing billions or a Robin Hooder, these (or a subset of these) are your choices. Again, at the risk of oversimplifying, the only differences between the “titan & the hooder” is the size of the order, the decision process and the financing. i.e.) the “titan & the hooder” are doing essentially the same thing.

- The total US Stock market can be described, on any given day (recently), as $40 trillion of “potential choices” with roughly $800 Billion of “executed choices” (buying and selling) happening every day. Retail investors (you and me making choices) comprise about 32% of US Stock ownership (Robin Hood is included in that % and is a relatively small % (about $100 Billion) of all Retail AUM but a significant percentage of daily volume…(estimates are RH is 10-15% of daily volume). Institutional Investors (Pension Funds, Mutual Funds, Money Managers, Endowments, etc.) represent about 55% of all stock “ownership” with Hedge Funds comprising the remaining 12%. Keep in mind we are only talking about stocks for the purpose of this discussion (we’ll expand the universe further along). America has another $80 Trillion of Debt Securities and Financial Assets (bonds, loans, derivatives, swaps/fwds, commodities, etc.) available to buy and sell for a total of roughly$120 Trillion. So we Americans are responsible for issuing and managing about 1/3 of the worlds financial assets.

- Again, referring to the diagram above, the “thick black lines” refer to order flow. When you or I, a money manager or trader buy or sell a stock we send an instruction to our broker, the broker sends our order to the Exchange(s) and it’s matched/filled from the pool of the other buy/sell orders available, and the broker updates our account. They put a promise that we own that stock in our account (the stock remains in “street name” somewhere and title never actually transfers to us…apparently that would be a ton of bookkeeping). Our broker takes money from our account if we buy, or puts money in our account if we sell. It’s the brokers responsibility that we maintain an appropriate amount of money in the account. (there are rules for this). As an aside, I’ve always wondered if anyone ever matches up all of the shares/units of all of these stocks, securities and funds scattered all over the world, in all of these brokerage accounts and tries to match them up with the actual, legally authorized, issued and outstanding shares (the “certificates”). I would think that rather than spend all sorts of computing power trying to mine a few bitcoin, a bad actor’s time and effort might be better spent by trying to hack a brokerage account somewhere, putting a few million shares of stock in a network of “street name” accounts…..but I digress…

- Simultaneously, the Exchange sends your executed transaction along to a business which goes by the name of DTCC (Depository Trust & Clearing Corp) and the order is “matched” up with the “other side” of the order by DTCC member firms. Buyers matched with sellers and visa versa. DTCC is a relatively tiny (in relation to the amount of business transacted through their ecosystem) little industry sponsored service business which is responsible for “matching up” all of the financial transactions that happen all over the planet every day. (about $9 Trillion a day right now) again, with the securities held in a depository in “street name”. If I were a NASA engineer I might refer to this as a “single point of potential systemic failure” …but I digress.

- The thin “green lines” represent money flow and financing. Remember, every day, all of the buyers and sellers have money removed or added to their brokerage accounts every time they make a trade. The Hedge Funds, Institutional Investors, Retail Investors and Robin Hooders need a bank relationship to send cash to or withdraw cash from their brokerage account. Most large, sophisticated, credit worthy investors have lines of credit funding, (rather than cash on deposit) at their financial institution, keeping their money working in the market.

- The brokerages also have thin “green lines” representing bank relationships and lines of credit. Remember, brokerages net out all of the trades during the day and “settle” the transactions through a DTCC member, usually within a day or two (again, there are rules for this). Usually, since sales and purchases at a particular brokerage “net out” they have a relatively tiny cash need/excess on any “normal” day. Moreover, as cash requirements are relatively low on a day to day basis, brokers also tend to keep relatively little cash on hand. They invest customer cash balances and rely on bank lines of credit for emergency funding. Hypothetically, and this could never happen, but humor me here, just for fun, lets say all of a particular broker’s customers only wanted to buy stocks for a given week. i.e.) none of their customers wanted to sell. The immediate cash requirement at the brokerage, since customer funds are not in cash but perhaps something less liquid, would be enormous. This was likely the Robin Hood scenario, the “buy orders” overwhelmed the “sells” and Robin Hood had to settle the trades, allegedly maxing out their credit lines. This is why they had to limit the “buying”.

- Now lets take that same operating methodology and extend it to DTCC and the banks as well. DTCC members operate the same as a “super broker”, sort of a broker for the brokers. The DTCC balance sheet generally consists roughly $50 Billion of assets, most of which, probably about $45 Billion today, consists of customer/member cash/deposits and “float” i.e.) the “netted” daily balances receivable from and owed to their clients/customers…except, again on a massive scale (more on that later). DTCC members also rely on bank lines of credit if they run a tad short at any given point in time. Of course, like any brokerage, if they determine the situation warrants, DTCC can require higher margin deposits, has the right to close out positions of a customer/member (just like your ETrade, Schwab or Robinhood account) if they feel that the particular customer has somehow violated their “user agreement” or there is some sort of funding issue. Of course the unwinding would be in billions, rather that thousands or millions. I would encourage you to read through the DTCC Annual Report from 2008. It’s a real page turner and describes the gory details of the Lehman wind down. Moreover, because of our fractional reserve banking system, if counter-parties of DTCC members start having “issues” and need money, they call their friendly neighborhood global bank for an advance on their lines of credit, which in turn causes those disturbing late night FED meetings and “don’t worry, everything is fine, we have all the liquidity we need” Christmas Eve Steve Mnuchin love notes.

Ok, now let’s get back to the initial question. i.e.) could Robinhood day-traders possibly have put that much stress on the market and had the Hedge Funds quaking in their boots? Well, lets take a look at the numbers….

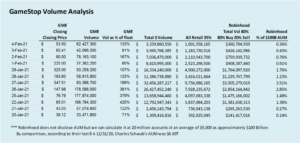

The above table represents the daily volume for Gamestop from January 20th thru February 4th, the daily closing price, and an approximation of total daily dollar volume (vol x closing price). We can make the following estimates based on the above described ratios.

- Share volume peaked on 1/22 at 197 million shares, 420% of float, or $165 Billion. Closing price was $65/share.

- Dollar volume peaked on 1/27 at $32.5 Billion, 93 million shares, 200% of float, with a closing price of $348.

- Volume “settled down” by 2/4 at 62 million shares at “only” 133% of float, $3.3 Billion dollar volume at $53 a share.

- When we look at the “All Retail 35%” column this figure represents an estimate of the daily share volume attributable to retail investors (35% today). Note that retail volume has more than doubled over the last few years with the rapid adoption of “app” brokerage services like Robinhood.

- The next column represents an estimate of the total “net” dollar transactions that Robinhood might be responsible for on any given day. We give the Robin Hood investors the benefit of the doubt, assigning 80% of all Retail GameStop transactions (netted against 20% sell transactions within the brokerage) to fellow Robinhooders. Notice, that in the grand scheme of things, if these estimates are even close to accurate, the figures are relatively insignificant when compared to % of total estimated AUM. The figure peaked at $3.5 Billion or approximately 3.5% of Robinhood’s AUM on 1/27. This coincidentally coincides with the “several hundred million dollar credit line draw down” as reported by Bloomberg

In summary, what the table above attempts to accomplish, is that even if we assign significant percentages of the total daily GME share volume to Robinhood investors it’s not significant when compared to total Robinhood AUM nor was there much Twitter or Reddit/WallstreetBets chatter on 1/21/21, the day prior to the quadrupling of volume (I’ve also I searched Twitter for “GME 1/21/21” there were only four posts referencing GME on that date.) If I’m missing something here please let me know, but it seems that most of the “chatter” took place after the bulk of the buying was already underway.

Moreover, a search of the two primary threads re: GME, the Daily Discussion Thread for January 20, 2021 and the GME MegaThread had a grand total of 32 mentions of the text string “GME” in the primary thread (i.e. comments flow from the primary thread, very much like Twitter. I randomly scrolled through a few of the sub threads and I have to say, at least from my perspective, there was nothing there which would have motivated me to go out and buy GME. i.e.) The significant chatter re: Gamestop began well after the 1/22/21 four fold increase in GME volume. So it’e unlikely that raw “chatter” had anything to do with this type of volume increase.

Now let’s take a look at some of the other potential factors which played a part in the GameStop saga.

Options – Let’s say hypothetically, that there was a concerted effort by Robinhood clients, or anyone really, who recognized that out of the money call options were under-priced. i.e.) The cost of an option to purchase shares of a broken-down company with little/no growth potential, for significantly more than the market price today, would, as expected be relatively cheap as the probability of the stock hitting the strike price would be relatively remote. So if Robinhood clients, et al, simultaneously decided (without doing any math….since they believe “Black-Scholes” is actually the proper color shoe insert to wear to formal events) to start buying these options, one might guess that a shrewd market maker would write these options all day if anyone would be dumb enough to buy them. They’d simply pocket the option premium that the Robinhooders paid them, as the probability of actually having to deliver the stock (cover) would again be slim.

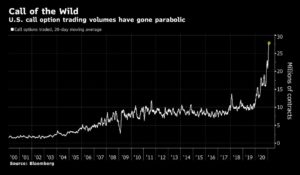

Oh look, what do we have here? Option volume skyrocketing?….so weird…

However, market makers are pretty smart and at least theoretically, they don’t write “naked Calls”. …although, it has been known to happen from time to time.

Anyway, what that means is that they have some rules (there are rules for everything) usually programmed into a giant computer somewhere (just about all rules are computerized now) where if the price of the stock starts to go up, getting closer to the strike price, they keep buying (covering) on the way up so in the case of GameStop, they don’t suddenly have exposure to deliver/cover a stock at $400 a share to someone when they had written a boatload of Calls at a $50 strike price, accidentally locking in a slightly less than a $400/share loss (cover less Option premium collected)….ouch. So what all of these options indirectly accomplish, and I have to say, I don’t remember seeing anything like this before (I seem to be saying that a lot lately) is to dramatically increase institutional/market-maker demand for the GME stock as well. Makes sense? If you are curious as to the mechanics and current pricing, here’s a link to the chain NASDAQ pricing for GME Options. I suspect that Option pricing and covering/hedging models will be heavily scrutinized after the GME episode. Market Makers have a habit of closing the barn door long after the livestock has run off.

Short Sellers – For some reason, according to the “Media”, the folks posting on Reddit and WallStreetBets seem to hate short sellers like Andy Left (Citron) and Gabe Plotkin over at Melvin Capital….not sure why…they seem like decent, smart guys. Here’s Andrew Ross Sorkin with a recent take describing Gabe and his beloved company, Melvin Capital’s bumps in the road.

Short sellers, when something like this happens, find themselves in a similar (but worse) position as the above described Option Market Makers. As the price of a stock they’ve shorted goes up, they have to fund the difference on a daily/timely basis. (i.e. they get “margin calls”…if you’ve ever had these, they are no fun, you get a very abrupt email from your broker saying you have to pony up money pronto or they will close your position and lock in your loss…again there are those pesky rules again.) So let’s take a look at at the numbers….

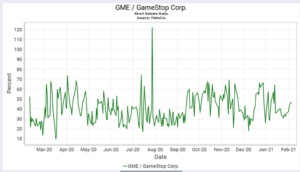

So, when we examine the above GME short volume (per Fintel), the activity in the 10 trading days ending on Feb 5th, although elevated, wasn’t all that exceptional when compared to volume. The Short Ratio was even less pronounced when compared to the prior year. (note the truly odd anomaly from July of 2020 that didn’t even make any headlines) Of course, this volume could be concentrated in just a few entities (i.e. Melvin Capital, etc.) so again, I guess it’s possible that Robinhooders could have caused all of this carnage, but not likely.

I agree with a number of points from Andrew’s video discussion above, that this is far from normal and that there will be a ton of yet to be determined fallout from this mess. Again, the narrative seems to be that some highly regarded, really intelligent, savvy folks just got caught on the wrong side of this totally unpredictable disgruntled-rogue-retail-trader tidal wave, that once again, nobody could have possibly seen coming, even though, as far as I can tell, Robinhood traders, on their own or in a coordinated effort, wielding their apparent resource level, probably couldn’t do the type of damage that we’ve seen. On the other hand, I do think that it’s really wonderful that Ken Griffin and Citadel came to Gabe’s rescue. I’m sure, like all of Ken’s deals, the capital infusion is likely enormously generous to the Melvin Investors given the circumstances. They don’t call Ken the Mother Theresa of Capital Formation for nuthin’. God bless Citadel.

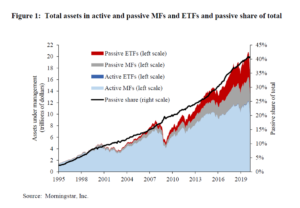

Passive Funds Flow …a 1.5 Jiggawatt Amplifier – Another significant structural change which begs discussion is the evolution and dominance of passive investing in America’s financial system. The Marketwatch chart below, as republished in a Boston FED white paper illustrates the evolution of active v. passive funds flow pretty well.

I’ll invite you to read four excellent, relatively short pieces of research discussing the phenomenon and the potential issues/risks inherent in the stealth metamorphoses of our financial system. The first is the aforementioned Boston FED working paper.

https://www.bostonfed.org/Workingpapers/PDF/2018/rpa1804.pdf

The second is a recent article in the Financial Times by Carson Block of Muddy Waters fame which is an excellent, less detailed variation of what I’m discussing and describing here today.

https://amp.ft.com/content/dbfc69df-7dbc-4338-a475-1432ffdc4056

Carson cites the excellent work of Mike Green at Logica Funds. One of the more stunning statistics Mike describes is that because of a number of multiplier factors, $1.00 of funds deployed by an nimble, flexible, active investor results in a roughly $2.50 increase in financial system Market Cap, while $1.00 deployed by a rules-based, fast-follower passive investor results in the creation of $17 of system Market Cap. (Mike will probably share the math on this if you ask him nicely.)

https://www.logicafunds.come /policy-in-a-world-of-pandemics

The last piece I’ll refer to below describes the risks and costs incurred by institutional managers attached to the retail phenomenon. Here’s a quote:

“Retail volume at the end of 2020 was approximately 35% of total market volume. Inaccessible liquidity is an issue that every institutional trader needs to understand. It is also an important facet of liquidity that Portfolio Managers need to factor in during portfolio construction and risk monitoring. Inaccessible liquidity exposes your portfolio to time risk and excess impact. The impact is clear when a mutual fund manager owns a meme name. While there is a potential for improved returns, the plane can also crash. Additionally, rapid increases in market capitalization can require reducing a position and depending on a fund’s compliance mandate, timing might not be favorable. We have already discussed the difficulty of trading these names, which can be compounded by the volatility of news. There is clearly a risk of owning these meme names, but the question is how does a manager predict which names are vulnerable?“

If I can summarize the theme of these relatively technical discussions, now that passive investing has become a dominant force in the global financial universe, unpredictable retail money, like a flock of starlings, can suddenly swerve in unison and get sucked into the passive investors jet engines, potentially crashing their financial airplanes, two things can, and likely will continue to happen.

1.) Rules based passive fund balancing has created a self affirming, momentum driven system of capital deployment, concentrating/removing funding momentum in stocks deemed to be financial darlings (or dogs), driving the price up (or down) relative to fundamental valuation. i.e.) the $1.00 Active manager investment (or withdrawal) would precipitate a $2.50 Market Cap increase/decrease, which would in turn cause the passive fast-followers to deploy/withdraw $2.50 of capital x $17 or $42.50 of increased/decreased Market Cap somewhere.

2.) Motivated, slightly-less-than-sophisticated, rapidly increasing waves of Muppet Money driven by heretofore unforeseen forces, combined with passive managers blindly-fast-following the herd, as required by their fund charters and prospectus/re-balancing guidelines, can launch massive amounts of passive money on a rocket ship ride to the moon or over a cliff, for no apparent, fundamental reason.

Note that these forces will work in a similar fashion and move both individual securities and markets accordingly….. on both the way up and the way down.

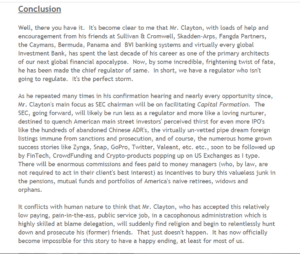

Regulation…or lack thereof… I’ve covered this for years, whether it be the continuous stream of Chinese IPO/ADRs, or the furthering of the anonymous and rapidly expanding influence and eventual strangle hold foreign money will have on our markets and eventually, our currency, the brazen nature of the silliness listed on US Markets is unprecedented. I’ve covered this phenomenon quite thoroughly (in my humble opinion) in a piece I wrote three years ago entitled Up the “Wasu”…..and why Jay Clayton will resign… It all became painfully obvious with Clayton’s confirmation hearing (as described through the lens of my patented Banker Speak Translator (BST), that under his guidance we were embarking on a period of financial chicanery, unbridled accounting enthusiasm and “capital formation” heretofore believed to be unfathomable. I’d suggest/beg/plead/cajole and hope that you take some time (and a momentary diversion) to read that piece just to get a flavor for what’s happened over the last three years. Here’s the conclusion:

https://deep-throat-ipo.blogspot.com/2018/03/up-old-wasuand-why-jay-clayton-will.html

Given all of the above, Muppet Money (you & me) Deployment Unpredictability , Option and Short Position Activity and Mechanics, Massive Passive Funds Flow, and Ineffective Regulation… I think I’ve made at least a perfunctory case that there might be something more going on here than what the media seems to believe meets the eye.

An Alternative “Hypothetical Reality”….

Cowbell Global Capital

If you are a fan of “Agricultural Global Financial Humor” (yet another new genre’ created by yours truly) you’ll enjoy this section, if not, feel free to skip over it.

Now, let’s talk about a hypothetical, far fetched scenario which actually makes a bit more sense than the narrative being pedaled by the financial media. Let’s discuss an alternative, slightly more plausible reality where this mess isn’t the byproduct of a bunch of crazy dudes on Reddit buying stocks and options in order to stick it to “the man”.

When I was a young boy, growing up on a farm in Wisconsin, my Dad… and all of the farmers, would put bells on a good number of our cattle. The idea was that cattle, being herd animals would stay together. When you attach clanging bells to them you could always hear where they were on the farm. They would stay together. You could tell, by the sound of the bells in the distance, which part of the farm they were wandering around on. You could hear when things were calm…very little bell clanging…and you could hear when there was some commotion, like coyotes or dogs chasing the cattle. One night, my Dad heard some ruckus, the cowbells were clanging away, he got on the tractor and rode into the field with his shotgun. He found and chased off, a bunch of high school kids (except for one who was injured) who were “cow tipping”. If you have never gone cow tipping (it’s a rural thing…kind of like hockey…but with cows and beer) cows sleep standing up…”tipping them over” with a running start wakes them up…you can make up your own scoring system and rules…. fun for the whole family. Protip: don’t try to tip a bull….just sayin’.

Anyway, getting back to our “hypothetical reality” let’s say that hypothetically, there was some enormous entity I’ll refer to as Cowbell Global Capital, with a huge hypothetical subsidiary which I’ll refer to as Cowbell Securities, which was a clearing broker (like a mini DTCC) plopped smack dab between Robinhood, many of the retail brokers and even a good portion of the institutional and hedge fund businesses. Cowbell Securities would provide lots of discount or even “free services”, and in some cases actually pay the other market participants for orders. (PFOF – Payment For Order Flow). Hypothetically, they were a benevolent business, willing to work for free, spreading the wealth, for the good of the industry. Good people.

(The following text and chart is relatively important. Please pay attention…there will be a quiz later)

Let’s say that Cowbell Global Capital hypothetically recognized the inherent value in knowing exactly where the “herd” is, how big it is, which way the herd was going, and how fast they were moving. They recognized the benefit of putting “technology bells” on the herd to both minimize risk and understand, with near certainty, where the herd, and consequently, global funds flow and security prices were heading. They might also focus on actually expanding the herd, like any good cattle farmer would do once he’s figured out how to run his business efficiently. Cowbell Global Capital might even try, through various means, to influence the herd toward one barn or part of the farm or the other. The key, of course is to know with certainty, where that big old expanding herd is headed. Some industry professionals or even regulators (remember “regulators”? we used to regulate things a long time ago..) might refer to this as “front running” if Cowbell Global Capital were to actually use this customer trend/flow information to make investment decisions, or influence other investors, but it’s all semantics and of course, really, really difficult to prove. Anyway, for the good of their clients, Cowbell Global Capital might be willing to invest heavily in the underlying technology at Cowbell Securities and deploy this “near certain” market intelligence in favor of their burgeoning client base. Moreover, this model, when properly communicated, would hypothetically allow Cowbell Global Capital, by virtue of its success, to raise even more boatloads of of additional money from all over the globe, rapidly opening offices in every major financial center and Tax Haven on the planet, giving previously, heretofore deprived global clients access to every nook and cranny of our cherished US financial markets . So let’s update the previous GameStop chart with this new “Hypothetical Reality”.

So, let’s see what we have above. We’ve added Cowbell Global Capital, Cowbell Securities, and Global Institutional Investors & Brokers to the prior chart. We’ve added another layer between some of the market makers and DTCC. We’ve also added another relatively large source of funding and capital from all over the planet. Per the Financial Stability Board, today, there are roughly $440 Trillion (estimated for 2020) of Financial Assets scattered around the globe. The most recent breakdown and estimates are contained and described in the December 2020 Global Monitoring Report on Non-Bank Financial Intermediation

It’s really important to understand this next concept.

Because of the above described structure, Financial Assets, regardless of where they are listed, can be traded anywhere in the world….by just about anyone in the world. (If you take anything away from this long-winded tome, please let it be that particular concept.)

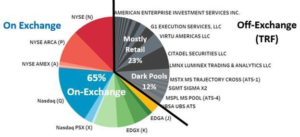

I’m not going to spend time on the buzzwords, acronyms, SIPs, TRFs, ATSs, the dozens of exchanges, trading systems and integrated “dark pools” and bilateral trading arrangements which somehow, by some miracle of technological magic, all feed together to provide bids/asks and settlements all over the globe in nano-seconds. The diagram below, assembled by NASDAQ a few years ago, describes, in general terms, how these exchanges are all linked together. The ecosystem and connections are apparently evolving even faster than anyone can actually document it, but nevertheless, it’s worthwhile to understand what’s happening.

For a summary of what all of the above means feel free to peruse the following couple of short links. Generally, again oversimplifying, brokers have access to many/some/all of these Exchanges, TRFs (Trade Reporting Facilities), “Dark Pools”and “bilateral agreements” (according to certain rules designed to make things “fair”) as sources of “liquidity” (“bids” & “asks”).

https://www.nasdaq.com/articles/abcs-of-u.s.-stock-market-acronyms-2019-06-13

https://www.nasdaq.com/articles/slicing-the-liquidity-pie-2019-02-11

From 2010 to today, Global Financial Assets have nearly doubled from $250 Trillion to $440 Trillion with a disproportionate level of growth occurring in the Tax Haven jurisdictions. I’ve long opined that this is worrisome since these jurisdictions have relatively little GDP and therefore, these Financial Assets must be “coming from somewhere else”. Of course the origin is a closely guarded state secret, but we know with certainty that these assets exist. The table illustrates how Tax Haven Financial Assets have grown as a proportion of US Financial Assets, representing the equivalent of 60% of all US Financial Assets today.

DTCC – $2,400,000,000,000,000 ($2.4 Quadrillion) of risk

This next section is difficult, in fact, nobody on the planet understands it. This is the engine that makes global money laundering possible and has allowed the world to weaponize the US Dollar against America. You might want to take a break and grab a cup of coffee before continuing.

I had first discussed the inherent risk lurking in the bowels of the DTCC juggernaut back in March of 2016. My most recent post on the topic was in response to the 2019 DTCC Financial Statements released in March of 2020, in my tome entitled: DTCC….and other really, really HUGE!, complex, totally related stuff

If you have neither the time nor inclination to struggle through my previous work, here’s my commentary from January 2020 and it’s even more relevant today than ever:

My perspective is that this little tiny, privately controlled, industry-owned service provider, which handled and cleared roughly $2.2 Quadrillion in notional value (more than $8 Trillion per banking day) of securities/loans in 2019, is a bit like an Online Trading Platform (i.e. like your account at E-trade, Fidelity or Schwab, etc.) for MIT & Ivy League trained quant-money managers running algos at member firms. There are roughly 1,000 “Sponsoring Members” (Primarily Big Banks) who control access to the system and vet “Sponsored Members” who would be authorized to access the system/markets/platforms with the permission and authorization of the “Sponsoring Member“. Think of it as you (Sponsoring Member) giving your cousin (Sponsored Member who you know pretty well and trust) account access and your password to make trades. He/she makes the decisions but you, the Sponsoring Member, are on the hook if he/she screws up.

Of course, these digitized securities never actually go anywhere. They don’t move. They sit in a depository somewhere, perhaps one of the Four Horesmen, while DTCC/FICC processes the ownership change transactions and authorizes/remits netted funds based on the trades back to the buyers and sellers at light speed.

As an aside, I have to wonder, philosophically, why the global financial system actually needs quadrillions of US Dollars, rehypothecated repository collateral and the associated commitments to close/pay flying around the globe at light speed, between self regulated banks, fund managers and counter-parties “loaning” their reputation and credit worthiness out to international, ShellCo Hedge Fund customers and investors where recourse rights, recovery and resolution in the event of a default might be complex, if not impossible to define or enforce. Perhaps it’s just me. I’m sure everything is just fine and dandy.

Today, my forecast for 2020 DTCC notional clearing, based in increased financial asset inventory and accelerating global volume is somewhere north of $2.4 Quadrillion, or nearly $9 Trillion notional value, or roughly half of US GDP changing hands every workday. Put another way, the turnover represents the equivalent of the entire $120 Trillion US Financial Asset inventory turning over twenty (20) times during the year through DTCC. I guess “buy and hold” isn’t really a thing anymore.

Once they are allowed in the club, the Exchanges, Trade Reporting Facilities (TRFs) and DTCC platform gives the DTCC members, and by extension, their anonymous clients, access to buy and sell virtually the entire portfolio of the $440 Trillion of financial assets (about 1/4th are global equities with a third of that being US Equities) in existence on the planet today. Again, these “paper” assets never actually move, they sit in depositories as the ownership records are instantly changed through the magic of DTCC clearing as the “black line” ownership changes and “green cash line net settlement” and funding takes place. Theoretically, if everything works smoothly, and stays in balance, the system can operate with little or no liquidity (cash funding). For every entity in the chain, daily cash-in versus daily cash-out is about the same under normal, balanced equilibrium. As entities in the ecosystem (banks, brokerages, pension funds, hedge funds, retail customers, etc.) become more comfortable and trusting of the risk controls in the system, and nothing goes wrong, they become even more confident and trusting, keeping lower cash balances and increasing capital deployed. They know, with certainty, that if for some reason they need more cash, they can always get more somewhere.

The simple math is that you can double your profits if you double your leverage. Cash accounts become margin accounts, brokerages and their customers put excess cash to work knowing full well that if they need to draw on their credit lines they’ve got plenty of collateral. All the while, financial assets are changing hands anonymously at light speed to the tune of $9 Trillion a day. There’s no question that this system requires that we place enormous trust in DTCC to maintain strict controls over who’s in the club and that these market makers have adequate resources to honor their commitments. DTCC, as any industry sponsored self-regulatory organization is likely to do, is responsible for providing both adequate gate keeping as to which players are permitted to exercise the awesome responsibility and stewardship of our global financial markets, as well as an appropriate disciplinary process to reign in members who might, on rare occasion, get a bit out of line. (See: Gambino & Lucchese v Luciano, et al. as an excellent example of the self-regulation process)

Most of DTCC’s growth, of course, can be attributed to fulfilling the burgeoning foreign demand for access to the US Financial Markets. The 2018 financial statement illustrated the meteoric increase in both employees and offices around the globe.

We can see that over the years since the Great Financial Crisis (the most recent), DTCC has been rapidly expanding into exotic destinations like Hong Kong, Singapore, Manila, Tokyo, Brussels, Dublin, Seoul, etc. Unfortunately, in the 2019 Annual Report, there is absolutely no discussion of foreign offices, employees, transaction volume or any other related metrics that were paraded as the “crown jewels” of this business in 2018. I’d imagine that the 2020 Annual Report, once issued in March 2021, will be equally silent on the topic.

We can see that over the years since the Great Financial Crisis (the most recent), DTCC has been rapidly expanding into exotic destinations like Hong Kong, Singapore, Manila, Tokyo, Brussels, Dublin, Seoul, etc. Unfortunately, in the 2019 Annual Report, there is absolutely no discussion of foreign offices, employees, transaction volume or any other related metrics that were paraded as the “crown jewels” of this business in 2018. I’d imagine that the 2020 Annual Report, once issued in March 2021, will be equally silent on the topic.

So let’s take a look at some of the DTCC Member firms.

- Two big Chinese Banks, Bank of China and Industrial Commercial Bank of China jump out. By definition, these two banks provide the gateway and direct access to the entire system for the Chinese Communist Party anonymously.

- All of the big US, Swiss and London Banks and Brokerages are, of course, also members. They all have Branches and SWIFT access in every Tax Haven jurisdiction. As we all know, they treat market conduct and money laundering fines as recurring business expense items on their financial statements. “Know your Customer” means that they know the name of the authorized representative of the Delaware LLC, who has millions/billions of dollars on deposit at a US Bank but they have no enforced requirement or even the facilities to follow up on or understand the true source of the funds.

- Remember the $73 Trillion of Tax Haven Financial Assets? The owners of all that value have access to global markets, instantly. Perhaps, one day, they, collectively, don’t like a few particular US Stocks or securities? Let’s call them “targets”. They might sell these stocks and move money into Euro Sovereign debt or Japanese Bonds…. after all, hypothetically, that’s what all of the customers at Cowbell Capital could hypothetically be doing today….hypothetically of course.

Before we move along to the next section I’d like to repeat a statement I had written earlier in this post, again, in RED.

Financial Assets, regardless of where they are listed, can be traded anywhere in the world….by just about anyone in the world.

“Know Your Customer” …is no longer a thing?….in fact…it’s no longer possible

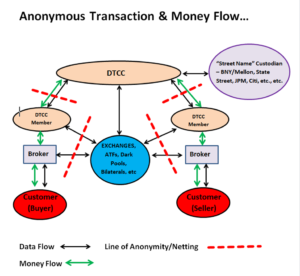

Now let’s discuss the privacy protections and the inherent anonymity built into the global financial system. Because of the aggregation of the data and netting of the money, each layer is “walled off” from the next. In the following example I’ll use “broker” as anyone placing a security order for any investor (Retail, Institutional, Hedge Fund, Bank, etc.)

i.e.) the Broker knows who their customer is. The exchanges and banks know who the brokers placing the orders are. The DTCC members and the depository banks know who their customers (the brokers) are. Since the securities are all held in Street Name at the depository institution, the security ownership can only be traced up (or down) one level at any point in the chain. For all of you old timers out there reading this, there was actually a time when, after you had an order filled, let’s say for 100 shares of IBM, you could actually tell your broker that you wanted possession of the actual “stock certificates” or bonds and the broker would retrieve your certificates and mail them to you. Normally, you’d put the certificates in a bank safety deposit box…..seems like 1,000 years ago doesn’t it? Of course, if we did it that way, most of the systemic risk would be removed from the plumbing, but the down side of course, would be that these DTCC members, traders and empowered bad actors wouldn’t be able to front-run and skim trillions of dollars from the system.

For example, let’s say that I buy 100 shares of Microsoft today. My broker has the obligation to know exactly who I am (whether I am an individual, LLC, Hedge Fund, Bank or Drug Dealer) and I would need to pass industry standard veracity/identity checks, which basically consist of verifying the proper jurisdiction government issued ID (SSN or FEIN in the US) and a banking relationship somewhere. When my broker passes my 100 share Microsoft order along to the exchange for matching, the exchange knows exactly who my broker is, but they have no idea that this particular order came from me. The order is matched/executed by the exchange and the broker is notified that “their” order was completed. My broker immediately takes the money out of my cash account and shows the position on my brokerage account. So the transaction is complete as far as I can tell. “Settlement” occurs between my broker and a DTCC Member overnight, or at some predetermined point in the near future. My broker’s orders are all combined and netted for the day (i.e. the net buy/sell orders for Miscosoft shares are submitted to DTCC along with the net cash to be deposited (for net “buys”) or withdrawn (for net “sales”). The process is extended to all securities transactions for that day for that broker. DTCC collects the funds and sends instructions to the various depositories (BNY Mellon, State Street, etc. etc.) to record the change in share ownership “street name” i.e. shares “belonging” to the brokerage with a promise that these shares are really in my account. Theoretically, the actual certificates of my 100 shares of Microsoft are sitting in some depository somewhere with my brokerage’s name on them.

So to summarize the chain:

1.) My brokerage and my bank know who I am. Nobody else does. In fact the only market participant who knows the identity of the person pushing the buy/sell button is the broker. As a point of reference, there are about 3,500 broker-dealers in the United States with roughly 625,000 licensed representatives.

2.) The Exchange knows who my brokerage is, as well as who the brokerage might be on the other side of my 100 share Microsoft purchase. It is not possible to match my particular purchase up with any particular seller as my purchase might be one of many “bids” which are matched to one of many “asks” at one of many brokers. All we know with certainty is that I bought 100 shares of Microsoft from “someone” and “someone” somewhere must have sold 100 shares of Microsoft to me. As an aside, I’ve always felt that it’s interesting that we track serial numbers, transactions and ownership meticulously on motor vehicles, which represents a relatively tiny amount of money compared to the $9 Trillion a day of securities changing hands, yet we refuse to track location, serial numbers and specific ownership and identification records for securities …and of course… firearms. Yup…makes perfect sense…but I digress.

3.) DTCC works with a select group of 1,000 or so trusted global members who are authorized to transfer depository/custodian share ownership/title to another DTCC member at the instruction of the Exchange and the confirmation of the DTCC Customers (brokers) on each side of the transaction. The DTCC Members keep track of which of their customer (brokers) “own” the securities in the name of the broker’s customers.

Sounds simple, doesn’t it? Here’s a quick diagram….

The relatively simple chart above illustrates the (general) flow of funds and data (order filling, settlement and record keeping) for every securities transaction on the planet. (Stocks, Bonds, Options, Futures, Derivatives, Swaps, Treasuries, CDOs, MBS, CLOs, Commodities, Currencies, etc. etc. etc) as well as the data barriers making it impossible to track any particular transaction between Seller A and Buyer B. If an investigator or regulator can’t even track the order flow from entity to entity how can we possibly determine “intent”, especially when these GameStop-esque tsunamis of capital movements are further masked and amplified by 1.) Fast-follower passive flows; 2.) Short Seller missteps (believing that financial statements, fundamentals and business prospects actually have some relationship to securities prices); 3.) Option price/volume impact and the resulting, improbable gamma squeezes; 4.) Social media and vested-interest talking heads selling influenced, uninformed blame assignment, indirectly absolving all of the real bad actors from any and all of the inescapable consequences.

Let’s further assume that these odd GameStop, AMC, Tesla, Blackberry, Bitcoin, etc.etc. dramas that keep popping up are simply, for lack of a better term, system tests. The Jurassic Park Velosiraptors are probing the defenses….they are learning. Let’s say, hypothetically, that there are coordinated bad actors, using data to determine depth, scope and breadth of market movements in reaction to coordinated efforts…like a cyber attack except using money, trades, options and assets. Let’s further say, like a battlefield deployment, each of these skirmishes are all part of a strategic symmetry, with platoons of financial warriors evaluating the technological terrain, looking for vulnerable, high value targets and analyzing enemy behavior and troop movements. As they hone their skills, they progress to bigger and more impressive targets, causing increasing disruption while simultaneously raking in trillions of dollars. The largest, most prolific targets should become painfully obvious at some point.

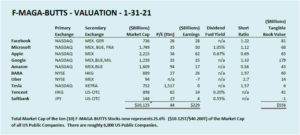

(Note: The F-MAGA-BUTTS moniker originated from my little nieces and nephews playing a game of “potty words we aren’t allowed to say..”)

The Ultimate Bad Actor….

As you all know, if you’ve read my work at all, you might suspect that there is only one bad actor that we can, with near certainty, definitively, attribute virtually every unfortunate, destructive, event, trend, happenstance and “Ooopsy Daisy” that might be going on in the world today (including this one) to.

Whether it’s the hundreds of billions of dollars of annual IP Theft; mountains of fake securities and fraudulent financial statements issued; closed mainland markets and a non-floating/manipulated currency; continuous sophisticated systemic cyber crime and the hacking of Western Institutions; Uighur, Tibetan, Hong Kong, et. al .human rights violations and crimes; Taiwan saber rattling; monumental social media propaganda efforts, systematic infiltration of Western government, educational institutions and organizations through financial support, payola, blackmail, threats and lobbying….. there is one and only one bad actor capable of pulling something like this off.

This next Banker Speak Translator (BST) section is pretty funny, but if you are a financial person with no actual sense of humor (at least that you are aware of) feel free to skip ahead since you won’t “get it” and you will think that it’s “dumb”.

My thesis has long been that financial assets around the globe are being weaponized by geopolitical forces that would eventually harm America by eroding US Dollar Hegemony i.e.) the ultimate Pump & Dump. The following hypothetical transcript, courtesy of our patented Dick Fuld inspired Banker Speak Translator (BST), is intended to illustrate how things might go if the Treasury, FBI, Justice Department, SEC or any of our other financial regulators got involved in trying to solve this complex kettle of fish that America’s financial wizards have gotten us into, by using ineffective, conventional tools and the rule of law.

Unfortunately, it now appears to me we are long past the point where any of our impotent financial regulators are capable doing anything about this. They have proven that they are excellent at catching and prosecuting bank tellers and clerks to the full extent of the law, but what we’re up against now is way above their pay grade, as they say. Moreover, the FED, and dare I say every Central Banker, has been fully trained and capable of going “full-Pavlovian” at the slightest hint of a sell button click, making the transition to the world living under Chinese Communist rule nearly inevitable if we continue down this path.

A Modest Proposal…

The world will continue to willfully ignore this threat, even though all of the signs have been there staring us in the face for years, because it’s easy….and the “willful ignore-ers” are tickled pink and profiting quite nicely from their ignorance. As frightening as it is, they’ve apparently chosen the right side of history, at least in their lifetime. Unfortunately, our last chance as a democracy will be to completely overhaul and restructure our financial system now that it has been weaponized against us. Time is of the essence. The FED must become a branch of the Pentagon and we will finally turn the management of money over to people who understand financial war games. The Defense Department and the CIA who are not constrained by crazy concepts like property rights, laws, rules, courts and public opinion will finally be able to defend America in the war that nobody seems to know we’re having.

We will need to stop treating financial assets as piles of grain or coal scattered all over the planet, to be moved from pile to pile by bad actors with no repercussions. When I sell a financial asset or buy a financial asset, I need to know exactly who I’m selling it to or who I’m buying it from. We need to know exactly where that asset is, in real time. Surprisingly, this isn’t rocket science. We track trillions of credit card transactions and bank transfers every day. We follow and monitor terabytes of text messages, emails, social media posts and petabytes of phone conversations and GPS location data in real time, all archived and available for concerned authorities and regulators to review when the need arises. Again, we track vehicle serial numbers and know the exact owner and garaging address of every car on the planet. We know, within centimetres exactly where our Mars Rover is landing, 128 million miles away, exercising precise control over every aspect of the device. Almost all of the new vehicles manufactured (as well as the smart phones of the operators) today have GPS location capabilities which make it possible to track, locate and if necessary “shut down” these devices. We deploy simple AI tools based on prior behavior to make sure that I’m not suddenly using my credit card to accidentally buy tens of thousands of dollars of women’s designer clothes at a mall in New Jersey, and that AI can actually stop that transaction and notify the mall cops while that transaction is taking place. (true story). The point I’m making is that the relatively simple solution (mild exaggeration) to this whole mess would be to assign the (already in existence) stock/security certificate numbers to every transaction so I, and our regulators, know that the 100 shares of Microsoft I purchase with my hard earned money came from legitimate sources and verified to the actual owner/seller of the asset, like perhaps, (I know this sounds crazy) from other legitimate US Shareholders, rather than, as an example, 12 shares from VTBank, 21 shares from a Mexican Drug Lord, 7 shares from a Caymans PAC, 9 shares from a Honk Kong Merchant, 32 shares from an Iranian Sovereign Wealth Fund by way of the Bank of Cyprus and 19 Shares from an Al Queda front man in Guernsey. We have to somehow move away from this “street name” record keeping and the destructive type of instantaneous, nanosecond “capital formation” that our SEC and the FED and every Central Banker have somehow become so fond of. The money (purchase/sale proceeds) should follow along with the transaction, linked and identified in real time, virtually eliminating all of the individual, cascading points of potential settlement failure and un-collectible float in the system. DTCC’s role would be relegated to managing/tracking/ documenting and reconciling the transactions with the physical securities (AUC – Assets Under Custody) in the depositories. There would be no need for DTCC to handle $2.4 Quadrillion (and rapidly growing) of annual financial transactions and associated funds flow and credit/default risk…DTCC members would become diligent bookkeepers rather than accidental arsonists.

I’ll leave it to your imagination to come up with good reasons as to why the convoluted, anonymous, out of control financial system we have today has evolved the way it has. I can think of many, many reasons. Unfortunately, none of them are actually “good”.

When we really think it through, perhaps Double Impeachment Deleterious Dynamite Donnie Doofus, despite all of his odd, nasty, self-aggrandizing, delusional, incoherent oratory and lack of any reverence for, or basic understanding of, our government, history, the Constitution or America’s cherished Democratic institutions, if not from his actions, at least from his rhetoric, might actually have been onto something.

I guess even a blind POTUS can somehow find a global-financial-doom-loop -nut once in a while.