A few years ago, probably sometime in 2016, I took some time to read The Great Rebalancing (published by Princeton Press in 2013), a wonderful work by Dr. Michael Pettis, who I consider one of the preeminent forward thinkers on what we’re about to discuss today. I highly encourage you to read it if you get the chance. We’ll be revisiting the concepts therein within the bowels of today’s tome. For those of you who are unfamiliar with this work, it’s an excellent macro discussion and assessment of what happened, what needed to happen next, and how the world was effectively self-medicating (economically) and moving forward from the 2008-2009 financial crisis, along with some predictions of what would actually happen and why. I consider Dr. Pettis one of the foremost authorities on the financial and political drivers behind US/China inter-connectivity and the macro economic relationship of same.

To be frank, the first time I read this book, I didn’t “get it”. I really didn’t understand it. Like most economics texts, I found myself reading paragraphs over a few times, trying to understand the concepts, and how they apply to the “real world” since much of it, is counter-intuitive and overly bereft with buzzwords and jargon. (Note, this is not a criticism, it’s simply an acknowledgement of what economics is and has to be.) I suppose if you happen to be working on your doctoral thesis or at least immersed in post-graduate macro economic study, I’d imagine that this book would be a light read. It’s only 200 pages and Dr. Pettis does his best to put everything in “plain English” and there’s very little math, but again, because the book represented a fundamentally different way of looking at the world, I struggled with it.

That said, because my dear Mom and Dad, as I was growing up, were always saying silly things like “you can do anything you put your mind to” and “keep working at it…it will come to you”… (despite my less than stellar SAT scores…I always seemed to run out of time while overthinking the questions…but, I digress), I’ve spent a good part of my life trying to solve time consuming, difficult puzzles that were, presumably, waayyyy beyond my pay grade….sometimes arriving at that elusive “eureka moment” and, of course sometimes (often) not.

Ok, now that that’s been said, after apparently having the chapters of this book randomly, subconsciously bouncing around in the darkest recesses of my cerebellum over the last few years, I can say, with great confidence, that I now “get it”. I’m also anticipatorially grateful you are apparently about to take the time to read what I have to say herein as well.

As you know, if you are a regular reader of this blog, I take great pride in condensing complex topics into easily readable, relatively entertaining, economic and financial value propositions. So today, for your pleasure, I’m going to take Mike’s brilliant book, condense it down to a few charts and paragraphs and fast forward his work from 2013, to where we are today in 2020 and finally, further down the road to where we may be in 2026. As always, the Summary Bullet Point, important concepts are highlighted in RED. So buckle up….get ready and try your best to keep up…

Where to Begin?

When in doubt, when seeking answers to complex questions, I’ve always found it’s best to start out by climbing up on the shoulders of the greats. Let’s start with one of my favorite passages. I refer to it as the “pump house analogy” from Bill Greider’s 1987 masterpiece The Secrets of the Temple (page 31)

When I first read those paragraphs more than 30 years ago, those words struck me as the clearest, most easily visualized, conjuring of what the FED, and indeed every Central Bank does for (and often to) the economy it portends to support and manage. The FED runs the “pump-house” in conjunction and concert with the other major Central Banks scattered around the planet. They are charged with the solemn responsibility, some more than others, of making sure that the system functions smoothly, adding fluid (money) where needed and taking it away when it’s not. They pick winners and losers, essentially deciding which ideologies, agendas, political parties and businesses move forward and which get swept into the dustbin of history, simply by pulling a few strings and pushing a few buttons. They are the men and women behind the curtain, the mysterious makers of kings and the phantom oppressors of the disheveled masses. These data-driven high priests of money spend their days meticulously analyzing their “pump house” and “fluid” pressure, balancing the system, turning valves, pushing buttons and doing what they believe is best for the world.

Chinese Menu Column #A: On the other hand, just thinking out loud here, there’s also a good chance that they might have absolutely no real understanding of what’s happening, and rather than figure out where the money is going and why, they simply resort to technocratically printing boatloads of it, following their models and indications, based on misleading assumptions, just to keep everyone happy. After all, it’s just easier …and it keeps the wheels spinning on the Global Economic Express….at least for a while.

Chinese Menu Column #B: Another school of thought might be that a few of these money magicians might actually have figured out the awesome power of their mechanisms, buttons, switches, flood gates and valves, and are currently deploying these tools in a financial/economic war game, to their advantage.

…..or, as they say at one of my favorite Chinese restaurants, choose one from Column A and one from Column B.

So, now, given that preamble, let’s get back to The Great Rebalancing. Dr. Pettis makes a compelling “when a butterfly flaps its wings in China” case, regarding fiscal and monetary policies, whereby policies implemented by one government which change the relationship between consumption and savings can (and often must) also change that relationship (in an equal and opposite way) somewhere else. He sums up his findings on these concepts (paraphrased by yours truly) in Chapter 9 – When Will the Crisis End?…..here are the 8 cliff-notes-style bullet points summarizing the entire book:

- Household Savings Rates are NOT a product of work ethic, personal preferences or lifestyle. Savings rates are a product of both domestic and foreign monetary and fiscal policies/constraints.

- Policies that impact the gap between domestic investment and domestic savings must automatically impact the balance of trade. Exporting Capital (Investing Overseas) is the equivalent of importing goods and services. (i.e. increasing Demand)

- Policy adjustment intended to increase/decrease large savings, consumption and investment imbalances in one country will cause equal and opposite adjustments, and policy responses in other countries, stressing their financial systems and currencies. Generally, deficit, open economy, countries, because of policy limitations experience economic and financial stress first.

- Large scale net capital imports can be positive for recipient reserve currency countries, like the United States, for a while, but otherwise, these accumulations are usually harmful.

- Recipient countries (like the United States) receiving growing net capital imports have limited policy choices. They can implement fiscal and monetary policies (stimulus) to 1.) Increase Investment 2.) Decrease Employment or 3.) Increase Consumption. A combination of these policy choices must result in a combination of 1.) Higher Investment 2.) Reduced Employment or 3.) Unsustainable Increased Debt. There are no other possible outcomes.

- For wealthy countries (like the United States) there is no interest rate benefit from foreign capital inflows via reserve accumulation. The influx of capital is superfluous/unnecessary.

- There are huge advantages for the world to have a liquid, easily traded, common currency like the US Dollar, there are also huge risks associated with same if there are no mechanisms in place to limit reserve accumulation from becoming excessive, and therefore destabilizing.

- The role of the US Dollar as the global reserve currency does NOT create an exorbitant privilege for the United States. America is more likely to suffer from an exorbitant burden.

Keep in mind that Dr. Pettis developed, articulated, wrote and published these relatively clairvoyant concepts sometime 2013

Based on the above analysis, in the final chapter (page 185), again, keeping in mind that this book was written in 2013, Dr. Pettis makes eight predictions as to how the world will “Rebalance” from the depths of the Global Financial Crisis …..Here they are (paraphrased):

- The Unites States, because of it’s open, flexible financial system will be the first to deleverage and work its way back to prosperity.

- German growth rates will decline as German banks deleverage, putting stress on the European Union.

- Without German support for a more perfect fiscal union, over time peripheral Europe will abandon the Euro and restructure its debts.

- China has already taken too long to address its own savings/consumption imbalances. Dr. Pettis expects a continuing but painful shift to slower growth and an increasing transfer of assets and wealth from the state sector to the household sector.

- Japan will continue to struggle with the legacy of its over-investment surge from the 1980’s, and is likely to trudge along the same path. They will continue to deficit spend, if possible, and increase efforts to finance growth through exports. In short, the Japanese economy will continue to muddle along for the foreseeable future.

- China’s eventual rebalancing and much slower growth will be a positive for both China and the World, although the benefits to the world will not be evenly distributed. There will be winners and losers based on their respective policy decisions.

- Growth in global demand will remain weak for many years and trade tensions will rise.

- The world will rebalance one way or another. Any policy that doesn’t result in the reversal of the deep debt, trade and capital imbalances of the last few decades is a policy that can’t be sustained. It could go smoothly, but will likely be more disorderly and painful than it needs to be because of policy mistakes and economic mismanagement.

Our Old Friend … C +I + G + Exp – Imp = GDP

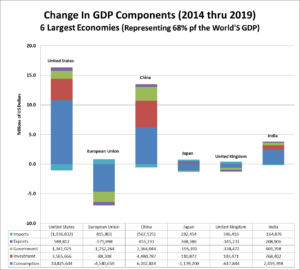

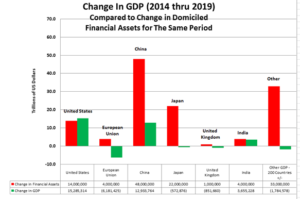

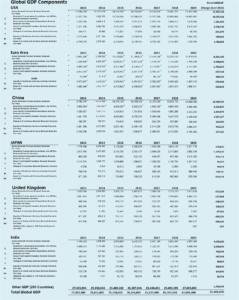

So, now that we have a handle on what Dr. Pettis wrote seven years ago, lets take a look at what has transpired since. In order to do that we need to examine the Components of GDP. Let’s take a look at Consumption, Investment, Government Spending and Net Exports (Exports less Imports). I have to admit, I struggled a bit trying to conjure up a visualization of what’s happened. The following graphic is what I finally came up with. What it describes is Dr. Pettis’s prediction that the recovery from the Great Financial Crisis would indeed be “uneven”. The graphic is derived from GDP data compiled by the IMF (link and data below).

Summary Data is shown in the Appendix below entitled Global GDP Components

https://data.imf.org/regular.aspx?key=61545852

The calculations described above are the summation of nominal GDP Component increases or decreases from 2013 through 2019. (i.e. pre-COVID) Nominal GDP is represented in US Dollars converted from the local currency using the IMF calculated exchange rate for that year. For example: If a GDP Component (converted to US Dollars) in 2013 was 50, and GDP for the next six years (2014 thru 2019) came in at 51 each year, the accumulated total would be 6. If GDP had been 49 for each year, the accumulated total would be -6. The purpose behind the calculations is to illustrate the currency/purchasing power change in economic output by economy/jurisdiction in US Dollars.

When we examine the graphic, a couple of things absolutely jump out at us:

- The two economies which grew significantly during the period were the United States ($15.3 Trillion or $2.5 Trillion a year) and China ($12.9 Trillion or $2.1 Trillion per year).

- The six largest global economies (i.e. America, European Union, China, Japan, the UK and India) comprise 68% of Global GDP and virtually all of the world’s GDP increase. The rest of the world’s GDP (200 countries +/-) actually declined by $1.7 Trillion during the period.

- European Union GDP declined substantially ($6.2 Trillion) roughly $1 Trillion a year from the 2013 base year. Japan’s GDP declined by roughly $600 Billion and the United Kingdom saw an aggregate reduction of $850 Billion during the same period on a US dollar basis.

- Increases in Consumption (C) (Primarily in the US and China) contributed roughly 1/2 of the global GDP increase. Domestic Investment (I) contributed 40% to the increase while Government spending was comparatively small 8%. ($1.8 Trillion)

- The change in Net Exports (Ex-Im) was a negligible $380 Billion, indicating that “Big 6” trade is dominant within the group, leaving the rest of the world without an invitation to the party.

- The Government spending (G) GDP component support for the respective “real economies” has been negligible.

What these figures, of course validate, is that Dr. Pettis’s predictions have largely come to fruition or are at lease directionally correct. By the end of 2019 America was indeed recovering. Europe, particularly peripheral Europe (Spain, Greece, Portugul, Italy, etc.) was struggling and Japan continued to muddle along. On the other hand, purely from a GDP perspective, if the figures are to be believed, China’s GDP has been a comparative favorable outlier, with significant increases in every GDP component, contrary to what Dr. Pettis had been expecting.

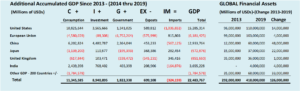

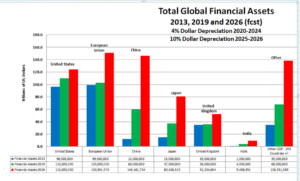

So now that we’ve examined what happened, let’s take a look at how it happened. The graph below compares the “Big 6” GDP increases to the financial asset growth within the respective economies. Financial Asset growth figures are derived from the Financial Stability Board’s annual Global Monitoring Reports on Non-Bank Financial Intermediation.

https://www.fsb.org/2020/01/global-monitoring-report-on-non-bank-financial-intermediation-2019/

The graphic above illustrates “what it takes” in money and wealth, in US Dollar terms, to finance the respective increases or decreases in GDP by country. Keep Dr. Pettis’s thesis in mind, that any change in the differential between the consumption/savings and investment relationship in an open economy must, by definition, be offset in by an equal and opposite increase in another economy. What we have been witness to over the last six years (and actually much longer) is a long game, “dueling policy” chess match. I look forward to updating these schedules once the 2020 data is available. It should be incredibly enlightening after the post-COVID data is known. Again, based on the format above, we can make the following observations:

- When we look at the broad definition of financial assets (Equity and Debt), we can conclude, simply put, one man’s (nation’s) asset is another’s obligation. These assets are created, theoretically, to finance economic growth and GDP. Of course, the owner of the asset expects a return and someone else, must provide it. The owner of the asset, whoever it might be, expects some sort of commitment to be honored, whether it be principal and interest payments, earnings, dividends, appreciation, etc. etc.. The world expects these promises to be kept.

- The only two economies of the “Big 6” with increasing GDP and commensurate/balanced Financial Asset growth are the United States ($15.2 Trillion GDP vs. $14 Trillion Asset growth) and India ($3.7 Trillion GDP and $4 Trillion Asset growth)

- The EU and the UK both suffer from declining aggregate GDP in dollar terms (a decrease of $7 Trillion Combined) with a modest/controlled asset creation of $5 Trillion. In other words, the BOE and the ECB had deployed significant stimulus to prevent their respective economic output from sliding further.

- When we look at the Japanese plight, the BOJ was forced to deploy stimulus (create money and assets) the equivalent of $22 Trillion with the result being to hold declining GDP to a $600 Billion reduction.

- Oddly enough, even though the “Other” 200 countries GDP actually declined by $1.7 Trillion, these economic juggernauts somehow generated/created $33 Trillion in Financial Assets. Of course, their central banks are generally not capable of sustaining this level of asset creation when compared to GDP. Note that the Caymans, Hong Kong, Singapore, Switzerland and all of the other tax havens are included in the “Other” figure. It sort of makes you wonder what’s going on….doesn’t it? i.e.) these “assets” weren’t created to support domestic GDP growth.

- Last, but far from least, we note that the Chinese Communist Party has, well, been throwing a “wealth creation party”. In six short years, if these numbers are to be believed, the Chinese have created $48 Trillion of additional Financial Assets (four times the amount of the GDP increase). As an aside, I discussed the veracity of these GDP and Asset increases in a writing a few years ago where I discussed how the Chinese Government suddenly, somehow discovered $50.1 Trillion of brand-spanking-new financial assets. https://deep-throat-ipo.blogspot.com/2019/01/keeping-it-simple-short-and-to-pointand.html

- The question that everyone is asking, and has been for quite some time, is: “How long can this go on?” …The surprising answer is “For a long time…”. More on that later.

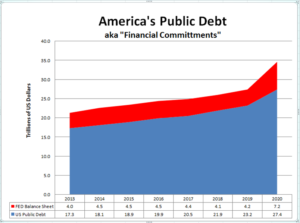

Keeping all of the above in mind, in preparation for the next section (just trying to build some suspense) we’ll take a look at the State of America’s public debt growth since 2013 in relation to the inferred impact on the US dollar. To set the stage, lets take a little, two minute trip back in time to 1965 and visit our good friend, former Illinois Senator, the honorable Everett Dirksen….

That’s right, at the time, Senator Dirksen was gravely concerned about America’s drunken-sailor spending habits, and the absurd proposition that the Congress would soon be called upon the increase the permanent debt ceiling by “colossal proportions” up to $332 Billion, an amount roughly equivalent of what the FED is currently, fully capable of printing (of finding in JayPo’s office couch cushions), without Congressional oversight, on a slow day…before lunch.

The chart below was created from the Daily Treasury Statement and FRED data:

https://fiscal.treasury.gov/reports-statements/dts/

https://fred.stlouisfed.org/series/WALCL

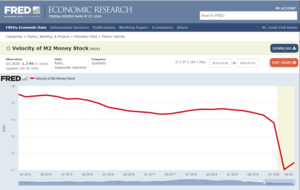

Money is like any other commodity, as more of it becomes available, given constant demand, the lower the price should go. What happens to the price of corn when there’s a bumper crop? What would happen to the price of oil if we could suddenly convert seawater to crude with minimal cost? What happens when there are lots of newly printed US dollars out there that nobody needs? The price should go down…correct? There are boatloads of US Dollars out there circulating in banks all over the planet now. You’d think that this might, literally, be more money than America and the world knows what to do with, when we look at domestic M2 as well as velocity.

We’ve increased M2 $4 Trillion (to $19.2 Trillion) in the last year and $8 Trillion since the end of 2013. Moreover, all of this money isn’t being spent. Velocity, the measure of dollar circulation in the economy is at its lowest level ever, or at least since the FED began publishing the statistic in 1960, and about half of what it was a decade ago. Simply put, American consumers aren’t spending money, they are saving it and it sits as idle “rainy day” deposits in the banking system.

Under normal circumstances you would think that by printing all of this new money, increasing the public debt $4.2 Trillion in the last year ($13 Trillion in the seven years), with likely another few trillion on the horizon for 2021, would put some pressure on the US Dollar.

So let’s see if that actually happened….Let’s take a look at the DXY ….

Well, so far it looks like the dollar has been relatively unfazed by the money supply expansion and what Senator Dirksen would have referred to as a debt of “colossal proportions”. We can see from the chart above that, although the world had lost a bit of its dollar enthusiasm during the fall of 2018 slide, culminating in the “Mnuchin Christmas Eve Liquidity letter” as well as the fleeting fall of 2019 Repo Apocolypse; and finally with the recent COVID fueled recession this year, even though it’s slid a little this past week, it looks like the dollar has held up remarkably well. How could this be?… you might ask. I know I have.

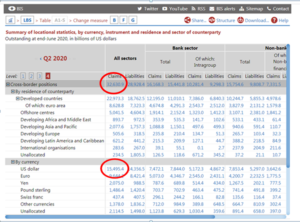

The answer, like so many things today, lies in the data. For an explanation we can turn to the Bank of International Settlements (BIS) data store. Unfortunately, the data is always several quarters in arrears so it’s a bit like driving a car by looking in the rear view mirror, but it’s all we have. The chart below describes cross-border claims on both banks and non-bank financial institutions, by jurisdiction, by currency as of June 30th, 2020.

https://stats.bis.org/statx/srs/table/a1?m=S&p=20202&c=

Note that “Cross border positions” of all claims and securities amounts to $32.6 Trillion for all currencies. Roughly half of that amount ($15.5 Trillion) are denominated in US dollars. The bulk of the remaining obligations are denominated in Euros (30%), Yen (6%), Pound Sterling (4%) and Swiss Francs (2%), all floating, easily convertible to other currencies. The RMB/Yuan isn’t listed presumably since it’s not floating or freely convertible. Any RMB/Yuan claims are included in the un-allocated classification/category as the amount is deemed to be insignificant and largely irrelevant. When we examine the trend over the years in the chart below, we can conclude that demand for cross border FOREX denominated (particularly US Dollar) assets remains strong.

Note from the above, the cross border, US Dollar denominated claims have actually surpassed the previous high water mark set just prior to the Great Financial Crisis. So what’s fueling this thirst for Dollars, Euros, Sterling, and Yen? Why is the currency of the “World’s Second Largest Economy” conspicuously absent from the worlds financial system?

There are generally only three things that a person or business can do with another country’s currency (FOREX). 1.)They can spend it on goods and services in/from the issuing country. 2.) They can buy assets (invest in stocks, bonds, luxury real estate, fine art, yachts, sports cars, businesses, etc. etc.) issued by and/or residing in the issuing country. 3.) They can pay back debts and interest if they had previously borrowed money in that currency. Because there is no meaningful amount of RMB/Yuan outside of mainland China, it’s safe to assume that the Chinese Communist Party is doing all three of these things. For example, if a Chinese Investor wanted to buy a $5 million luxury condo in New York City, he/she would probably want to pay with RMB/Yuan, but he/she can’t. The seller would likely want the sale to be completed in US Dollars. The transaction would be relatively straight forward. The Chinese buyer would go to his Chinese banker, pay the RMB equivalent of $5 million US Dollars to the bank, the Chinese bank would exchange the RMB with a US Bank (if they didn’t already have USD balances) and pay the seller of the condo with US Dollars. Since the US Banker can’t do much with the RMB, he would exchange the RMB/Yuan with another Bank, probably a money center bank like JPM, who needed/wanted the RMB, as the Sellers US Banker would likely prefer to hold dollars. The RMB/Yuan would likely remain as FOREX reserves at JPM (the money center bank), just as all of the other floating currencies (Euro,Yen, Pound, etc.) do. Interestingly enough, this can’t possibly be happening. China has become a “black hole” for US Dollars and for that matter, all Western Currency.

As far as I can tell, there are no significant RMB/Yuan deposits on the books of any big US Bank. After reviewing the 10-Ks of JPM, Citi and Bank of America, although there are references to total foreign exchange exposure (primarily loans and derivative contracts) any discussion of Chinese deposits, assets. loans and financial relationships is notably absent (Although, it’s comforting that Joe Tsai is listed as a JP Morgan “International Council” member along with Tony Blair and Henry Kissinger on page 302 of their 2019 Annual Report….so there’s that.) If anyone has any data on RMB offshore, I’d like to see it. GlobalRMB.com used to publish RMB balances by jurisdiction, but that data is no longer available. The last I checked it was holding at well under $100 Billion worldwide. Again, if anyone out there has data on off-shore RMB balances by jurisdiction (HK, LUX, London, Singapore, etc.) I’d be grateful if you shared your source.

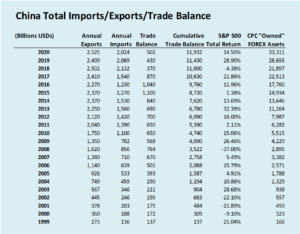

I first published the schedule below a few years ago and I’ve just updated it through 2020. Simply put, it illustrates the enormous, FOREX balance that must have been accumulated by the Chinese Communist Party through their trade balance, properly invested in Western Assets, over the last two decades as a result of their closed currency. Simply put, the Chinese Communist Party doesn’t need to exchange RMB/Yuan for Dollars, Euros, Sterling, Yen or Swiss Francs, etc.. They control roughly $33 Trillion in anonymously held financial assets scattered (mostly through Tax Havens through the Big US, European, Japanese and Swiss Banks). They don’t need to spend (or float) the RMB/Yuan.

To describe what you are looking at above, think of the Trade Balance as China’s annual “paycheck” which must be invested. I’ve presumed that the Chinese Communist Party, with the help of friendly Global Bankers, can, at least, earn the S&P 500 return on their investments. I’d also guess that since the Chinese Communist Party represents the quintessential definition of a “sophisticated Investor”, with proper advice from many of the “helpers” out there, there’s a good chance that they might have done even better. Consider the $33 Trillion to be a minimum value. To put this in perspective, the critical mass of this investment pool is approaching the value of the current Market Cap of all publicly traded US Companies.

Why and how is this happening? The first thing we need to be clear on, is that the Chinese Communist Party does not allow private “property rights” like we do in the West. Chinese elites might have signing authority and apparent ownership of assets, accounts, real estate and businesses, but make no mistake, they are simply custodians of CCP wealth. At any point in time, “the party might giveth….and the party might taketh away”. How did they accomplish this slight of hand prestidigitation? I had produced the chart below a few years ago, describing how the Chinese Government has managed to accumulate FOREX Assets over the years. It’s even more relevant today. I’ve used Apple as the most obvious example, but feel free to substitute any person or entity which needs to make a payment to China Inc.

What you are looking at is an illustration of what happens when Foxconn ships a plane load of iPhones to Apple here in the US. Apple has to pay for the phones so they wire payment to a US Bank (JPM is illustrated). JPM wires the money to the Bank of China, Foxconn’s Bank. BOC pays the money, in freshly printed RMB to Foxconn and the BOC keeps the US Dollars and “distributes” or “invests” them in Chinese Communist businesses/ShellCos/LLCs, which invest in US Dollar assets, most often with the assistance of US Bankers and “helpers”. If we extrapolate, today we can envision tens of thousands, perhaps hundreds of thousands of Chinese elites and their controlled shell companies and LLCs relentlessly repeating the “Boomerang Dollar” laundering and investment in Western Assets with the ultimate goal being to force the rest of the Central Banks around the world to continue to create money, in compliance with “The Theory of Financial Relativity” . The cycle continues until, apparently, we have Chinese Communist Party Members controlling at least $33 Trillion (and growing) of Western Financial Asset value. The PBOC is fully capable of pulling this off because they have no external currency exposure/requirements which can’t be met by their currently anonymous, hidden war chest scattered in the the dozens of financial/tax havens around the globe.

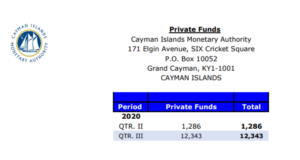

For example, there are currently 23,000 registered Mutual/Investment/Private funds in the Cayman Islands, of which 12,343 new Private Fund (Family Offices) were registered just this year, through September of 2020. Likely many of these funds are sporting Chinese sounding names and funded by mainland Chinese investors.

Generally, investors don’t set up “Private or ‘family office’ funds” in a tax haven jurisdiction, which they plan on funding with monthly payroll deductions, so the owners can day trade. They set these funds up, to avoid taxes and remain anonymous. It’s more likely that the New York, London, Luxembourg, Chinese and Caymans lawyers and bankers have been working overtime. There is significant funding flowing into these vehicles. My presumption is that if there wasn’t, they wouldn’t have been created in the first place. Just for fun, let’s say that there are another 12,000 funds created in the 4th quarter of 2020, so we have 24,000 newly established investment funds in 2020 alone. Continuing the “fun”, lets assume that each of these new entities receives initial funding of just $5 million, a relative pittance for a Caymans fund, so we have $120 Billion of brand new dry powder funding locked and loaded with full access to US Markets through US Banking relationships, free to buy/sell and deploy capital as they please.

Moreover, per the last available Cayman Islands Monetary Authority Annual Report, these sleepy little Caribbean Islands, home to just 60,000 citizens, are also home to domiciled Financial Assets amounting to $7.2 Trillion as of 2018. (Oddly enough, the annual report is usually published in April for the previous year, but they’ve not produced the 2019 report yet. Strange.)

If we apply a modest 15% growth rate for 2019 & 2020 there is a good chance that these assets could be approaching $10 Trillion now. As a point of reference, this figure is roughly 1/3rd of the Market Cap of all publicly traded US Equities. Our presumption, is that all of these funds as well as those established in every tax haven around the world are fully capable of operating as finely tuned symphony, with every financial musician meticulously playing their part, all conducted by their Chinese Communist party maestro.

Data is provided per the Cayman Islands Monetary Authority.

Caymans Summary Data::

Caymans Mutual Fund List:

https://www.cima.ky/upimages/commonfiles/QuarterlyListofallMutualFunds

Caymans Most Recent Annual Report (December 2018)

https://www.cima.ky/upimages/publicationdoc/AnnualReportandAu_1575903466.pdf

Is it SAFE?

In my post “How an Ineffective Bill Becomes a Ineffective Law” I discuss the 2,869 separate SAFE (State Administration of Foreign Exchange) investments. SAFE is, of course, China’s most prolific Sovereign Wealth fund making strategic investments all over the globe, most notably and recently in:

- The AES Corporation – NYSE-AES (376 investments)

- Blackstone – NYSE-BX (315 investments)

- Alibaba (BABA) (254 investments).

- Cheniere Energy, Inc. AMEX:LNG (43 investments)

- AirBnB (19 investments)

- The winner of the goofiest SAFE investment award is: Alpine Ridge Apartments, LLC (located in Flagstaff, AZ)

There is nothing about any of these investments that could possibly indicate that they are being made in the best interest of America.

Alibaba and the 40 Caymans Bankers….

Alibaba alone had more than 1,220 consolidated subsidiaries (with 700 subsidiaries and consolidated entities incorporated in China and approximately 520 subsidiaries and consolidated entities incorporated in other jurisdictions, primarily the Cayman Islands) as of March 31, 2019 per the 2019 20-F (page 115). The number of consolidated offshore entities had been increasing steadily since the IPO in 2014 even though Alibaba derives substantially all of its revenue and income from mainland China. Comparable figures were not disclosed on toe 2020 20-F, even though the information should have been presented on page 121 of the filing.

Moreover, ANT Group, LTD has a similarly disturbing Organization Structure.

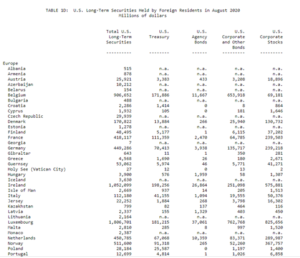

This Really TICs Me Off…

If we examine the Treasury TIC (Treasury International Capital) data we note what I’d consider, odd concentrations and anomalies and a disconnect. According to the report, ALL Foreign investors own US Financial Assets totaling $22.0 Trillion (as of the latest August 2020 Report), or about 20% of all US Financial Assets. Of that amount, corporate stocks and bonds make up roughly $14.7 Trillion, or about 2/3rds of the outstanding value. Interestingly, amounts attributed to China, the “Worlds Second Largest Economy” and by my calculations, currently investing $33 Trillion in Western Assets somewhere, are only investing $1.5 Trillion in America. Where are they investing the rest? These figures can’t possibly be accurate. Total Assets under Constructive foreign control MUST be much larger.

Of further interest, Cayman Islands investors, that tiny country with 60,000 citizens, 23,000 Shell Companies and Investment funds, is investing only $1.8 Trillion of its $10 Trillion in the US. Likewise, Luxembourg, a preferred investment locale for Chinese investors is also investing nearly $1.9 Trillion in America.

https://ticdata.treasury.gov/Publish/slt1d.txt

Again, the Chinese Communist Party and their elites must be investing the balance of the $33 Trillion somewhere. They MUST exercise constructive control over roughly that asset value…. somewhere on the planet. Why? because nobody on this big blue marble has control of any RMB/Yuan, except Chinese Communist Party members. Since China has accepted, and has been hoarding FOREX resulting from trade settlement/surplus for decades, rather than allowing their currency to float and/or open their financial markets, they are relegated to finding ways to invest their Western Currency spoils in Western Markets.

In my humble opinion, the transaction (and literally millions of transactions like it) that everyone is misunderstanding is as follows: i.e.) a Chinese Communist Party member owns a Hong Kong LLC. The Hong Kong LLC owns a Cayman LLC. The Cayman LLC owns LLCs in Nevada, North Dakota and Delaware. Funding flows through this chain and is invested/laundered by private equity and hedge funds. Private equity managers and hedge funds buy Western financial assets. The real question is… Who owns those assets?…. The US Hedge Fund? The Delaware LLC? The Caymans LLC?….Can the FED or the Treasury possibly trace this ownership all the way back to the Chinese Communist Party?….likely not.

I’d suggest that there are massive amounts of Chinese money masquerading as US Domiciled or “other” domiciled Tax Haven money, at least a significant chunk of the $33 Trillion described above, that MUST be invested in US Financial Assets. There is no other reasonable explanation for the “dollar shortage” and skyrocketing off-shore dollar deposits in foreign banks. Yet the FED and the Treasury seem to think that all of those foreign Family Offices purchasing/funding US Domiciled LLCs is a fortuitous blessing, a testament to the demand for US Financial Assets and dollars. As I’ve often said….this isn’t a dollar shortage….it’s “dollar hoarding”.

It’s Really Hard to Win a War……..If You Don’t Know You Are In One….

Now lets go back to Dr. Pettis’s book and the previous schedule comparing GDP and Financial Asset growth, focusing on Financial Asset Growth in the “Other” jurisdictions and China. We can infer with a significant level of confidence that China’s Financial Asset growth will continue, simply because it can, and must, to continue to roll-over debts and internally refinance their growth. They will succeed here, because they can. Remember, because they have no external debt, there are no “financial defaults in China”. There are only “political defaults” i.e.) if you are not a full fledged, politically anointed CPC Member, your financing can be redirected at any time. Again, there are no property rights, these managers are willing, obedient custodians of Party Assets, all at the behest of the Party…it’s that “giveth…taketh away” thing again. All the while, China’s FOREX “black hole” continues to expand, secretly, anonymously sucking in the world’s currency and wealth to be redeployed to its advantage.

Rhetorical Question: What is the proper exchange rate for a currency that nobody uses?

It’s been clear over the past decade or two that the PBOC is fully capable of moving their exchange rate anywhere they’d like to, again, because it’s isolated. The Chinese Communist Party, unbeknownst to our technocratic Central Bankers, has been moving financial chess pieces around the global board for quite some time. The world simply doesn’t care about the value of the Chinese currency. The RMB/Yuan is largely irrelevant, at least for now. The Chinese will continue their stealthy usage of tax havens, ShellCos and Western Bank “helpers” in order to continue their stealth assault on Western Financial Markets and the Dollar.

The “Real” Great Rebalancing….

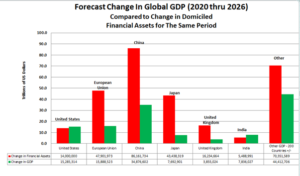

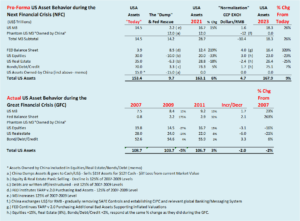

To that end, the next chart is an extrapolation of the 2014-2019 Financial Asset vs. GDP Chart. It represents the exact same changes in Financial Assets and GDP for the next six years. In other words, let’s presume all of the policies, mistakes, innovation, legislation, leadership, etc. in the last six years will exactly mirror the same policies and events that got us to where we are today. We’re going to repeat what we’ve done over the last six years over the next six years. We will presume central banks around the world will continue to provide the same levels of stimulus The only adjustment we will make, in order to show how significant and powerful this math can be, again hypothetically, we will depreciate the US Dollar by 4% in 2021, 2022. 2023, 2024 and 10% in 2025 and 2026. This depreciation “guess” would not seem to be unreasonable given the massive amounts of stimulus/monetization we will be undertaking. Please keep in mind that this is not a prediction (good grief …I hope not). The schedules below are simply intended to illustrate the massive impact that a relatively small “boiling frog” US Dollar currency depreciation might have on the economic balance of power around the world. Again, all of the figures below are in US Dollar equivalents, applying dollar depreciation by year, to the identical economic activity (GDP and Financial Asset Growth) as we’ve experienced over the last six years. So let’s see what the result looks like…

My first comment might be Geeezus H. Christmas….how could four years of 4% compound depreciation followed by 2 years of compound 10% depreciation change the global economic landscape to such a degree? Here are the observations:

My first comment might be Geeezus H. Christmas….how could four years of 4% compound depreciation followed by 2 years of compound 10% depreciation change the global economic landscape to such a degree? Here are the observations:

- Since the dollar remains constant, we note that both US GDP growth and Financial Asset values remain the same at $15 Trillion and $14 Trillion respectively.

- We also note that annual GDP and Financial Asset values for the rest of the world increase significantly, generally by the summation of each prior years dollar depreciation. i.e.) the 2026 GDP is increased by 42% (1.04×1.04×1.04×1.04×1.10×1.10) Relative to US GDP solely because of dollar depreciation.

- We in America remain caught in our “boiling frog” currency trap. At some point we will be wondering what’s going on and why everything we import seems to cost so much more. We wonder why we can’t have dinner at a 5-star restaurant in Delhi or Jakarta anymore for US$20. We will wonder why all the stuff we used to buy at Walmart has increased 40% in price. We will be confused as to why foreign investors believe that US Real Estate has become a relative bargain, selling at a 40% (or more) discount in their respective currencies, than it did just six short years ago.

- Like so many other things in life, this income and wealth redistribution won’t be fair. As the FED prints more and more greenbacks to satisfy the worlds unquenchable thirst for same, the depreciation (in real life) won’t be spread evenly, depending on central bank action and response. If every central bank repeats its Deja Vu (all over again) policy direction, we see that the Chinese and the “Other” economies benefit greatly. While global assets increase by $284 Trillion to $701 Trillion in 2026, up from $418 Trillion now ($47 Trillion a year), more than half of that would be attributable to China ($86 Trillion) and “Other” (Tax Havens and Emerging Markets – $70 Trillion) which we’ve already described and identified as clandestinely/anonymously, largely attributable to the Chinese Communist Party as well.

- By the same dollar depreciation math, half of the worlds increase in GDP will be produced by China, and the “Other” 200 countries around the globe.

- Central Banks will continue to create money in relative lockstep, except, of course for the Chinese, who will keep the RMB/Yuan locked up on mainland China, unusable by the rest of the world. They will continue to use the rest of the world’s currency as their own…..because they can. The result of this Global print-a-thon on the World’s financial asset balances over the 12 year period ending in 2026 is described in the chart below. Global Financial Assets will have increased from $292 Trillion in 2013 to $702 Trillion (forecast) by 2026 in depreciated US Dollar Terms. Again, this math is accomplished solely through repeating the first six years of policy and applying a reasonable relative dollar depreciation to the same economic activity.

It’s been clear over the past decade or two that the PBOC is fully capable of moving their exchange rate anywhere they’d like to, again, because it’s isolated. The effort they’ve gone through to wall off the RMB/Yuan and disguise their real financial holdings and influence around the world is enormous, frightening and growing more ominous by the day.

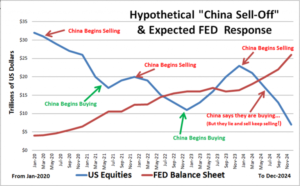

Choose the Form of the Destructor…

The primary tool the CPC will be deploying to accelerate the Global print-a-thon as described in my January discussion of the “Stealth Nationalization of America’s Banks….” is the “Pump and Dump” cycle. In a nutshell, because the Chinese Communist Party has reached disguised critical mass on their foreign financial asset holdings, they are fully capable of, along with their plugged-in Western “helpers” (I don’t want to name any names here, since I’d like to avoid any more nasty-grams from their lawyers, but you all know who they are), of starting and stopping these passive/algo driven buy and sell cycles. Every one of these cycles is worth hundreds of billions of US Dollars (give or take) depending on the depth of the cycle from peak to trough. Could you imagine how much money you could make if you were a plugged-in-to-China investor and could time, with certainty, the peaks and valleys of these Pump & Pump cycles? We’ve seen a couple of test cycles so far (December 2018, February & March of 2020, October 2020, etc.) Here’s the pro-forma illustration I had included in my “Stealth Nationalization” post from January….reality seems to be tracking, or at least directionally correct given overzealous accelerating FED response, when compared to what I had suggested would be transpiring at the time.

The charts and data above illustrate the monetary policy which the FED and likely the other major Central Banks, will deploy which will result in both the currency depreciation and the global financial asset expansion described above. There would seem to be no limit to Central Bank balance sheet expansion, as long as they all choreograph their movements. “Price discovery” will be little more than a fondly remembered academic concept as the FED and the other CBs keep buying Assets and replenishing the global liquidity trough.

Rhetorical Question: If you make a loan at o% (or lower) and guarantee refinancing forever, can the loan ever default?

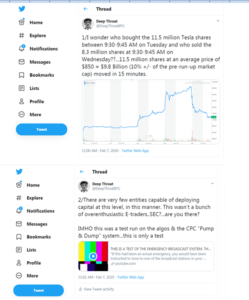

One of the more interesting “test cycles” took place in early February. When we examine the volume and price movement of Tesla on February 4th and 5th of this year we can’t help but be concerned with the integrity of our markets. Here’s my Tweet describing what happened….

That’s right a $10 Billion “pump” in 15 minutes, first thing Tuesday morning followed by a $10 Billion “dump” the first thing Wednesday morning on “no news”. If we had any doubt in the integrity of the markets we might just assume that:

1.) An entity or entities (I believe this is Chinese directed activity, although impossible to prove) took a run at chasing the shorts out of the stock, and it apparently worked even better than they could have imagined.

2.) This was a test of what the impact that volume spikes might have on the movement of passive/algo money. How big does the trigger have to be? How long does the response take? What sort of offset/bounce back can they expect.

That said, I’d expect, if my assessment is correct, we will be seeing more cycles like this with increasing frequency and amplitude.

Back to Dr. Pettis’s Assumptions on Rebalancing….

Given the context of the preceding analysis regarding the global weakening of the dollar, let’s elaborate on the Rebalancing assumptions described by Dr. Pettis. I’ve re-pasted them below so you don’t have to keep flipping back and forth. Mike’s analysis is in RED and my comments immediately follow in GREEN.

- Household Savings Rates are NOT a product of work ethic, personal preferences or lifestyle. Savings rates are a product of both domestic and foreign monetary and fiscal policies/constraints. AGREED without debate.

- Policies that impact the gap between domestic investment and domestic savings must automatically impact the balance of trade. Exporting Capital (Investing Overseas) is the equivalent of importing goods and services. (i. increasing Demand) The Chinese Communist Party has been exporting capital via boomerang dollars for decades. Because the mainland economy is “one way” i.e.) Western currency flows in temporarily, but RMB/Yuan does not flow out. The mainland economy is insulated from the global economy and can be financed domestically with no concern as to exchange rate implications.

- Policy adjustment intended to increase/decrease large savings, consumption and investment imbalances in one country will cause equal and opposite adjustments, and policy responses in other countries, stressing their financial systems and currencies. Generally, deficit, open economy, countries, because of policy limitations experience economic and financial stress first. AGREED…all Western economies will be impacted sooner and to a much greater degree than the Chinese economy. I’d add, again, because of the mechanisms described above, the Chinese economy will be able to sidestep any adverse exchange rate and capital flow impact and in fact benefit from the inability of Western policy makers to respond.

- Large scale net capital imports can be positive for recipient reserve currency countries, like the Unites States, for a while, but otherwise, these accumulations are usually harmful. AGREED. They will prove to be the precursor and catalyst for the downfall of Western democracies, primarily because Western Central Bankers don’t understand the scope and ramifications of the anonymous ownership, influence and direction of Western Assets by the Chinese Communist party. Anonymous Chinese “financial management” earnings will soon exceed and eventually supplant the Chinese trade surplus, if it hasn’t done so already.

- Recipient countries (like the United States) receiving growing net capital imports have limited policy choices. They can implement fiscal and monetary policies (stimulus) to 1.) Increase Investment 2.) Decrease Employment and/or 3.) Increase Consumption. A combination of these policy choices must result in a combination of either: 1.) Higher Investment 2.) Reduced Employment or 3.) Unsustainable Increased Debt. There are no other possible outcomes. AGREED….America, as the recipient of all of this disguised capital, continues to create Financial Assets (investment), employ a lower percentage of our population with quality jobs and increase both public and private debt to what will likely be unsustainable levels. i.e.) Nobody is going to bail out America.

- For wealthy countries (like the United States) there is no interest rate benefit from foreign capital inflows via reserve accumulation. The influx of capital is superfluous/unnecessary. AGREED…as we’ve seen, because of global dollar demand, at least at this point in time, America has more capital flowing in (whether we know it or not) than we know what to do with. Near ZIRP interest rates would be the expected outcome.

- There are huge advantages for the world have a liquid, easily traded, common currency like the US Dollar, there are also huge risks associated with same if there are no mechanisms in place to limit reserve accumulation from becoming excessive, and therefore destabilizing. AGREED…this single sentence summarizes the primary issue we’re facing today. Because the US Dollar is so ubiquitous and fungible it can move around the globe and is readily exchangeable for “something else” at light speed. The $64,000 question is, what will the “something else” actually be.

- The role of the US Dollar as the global reserve currency does NOT create an exorbitant privilege for the United States. America is more likely to suffer from an exorbitant burden. AGREED….I think Cousin Eddy said it best…

So What Does Ray Say?

A few years ago when I was fishing for Mahi Mahi in the Bahamas, I was so inspired by Ray Dalio’s book, the “Big Debt Crisis” which I had read on the trip….that when I wasn’t hooking fish, I took some time to review his work in my post entitled:

Dalio’s “The Big Debt Crisis”….the FSB Report & Financial War Games

Here’s the opening salvo from my post:

Although Michael and Ray come at this from different perspectives, i.e.) Dr. Pettis is a highly regarded macro-economist and reputed to be one of the foremost experts on the inner workings of the Chinese economy, while Ray is one of the greatest money managers in history, building an empire, accumulating billions of dollars of capital while openly betting on the Chinese Communist Party. I, on the other hand, am a simple, although highly educated and experienced, cerebral bystander with no skin in the game, other than my unrelenting, burning desire to make sure that my children, and theirs, have a better life (than I think they are going to have) if we are to continue down the economic path we’re on, Western Democracy collapses, and we all end up answering to Beijing in some form or another.

Ray seems to think, and again I don’t want to speak for him, that we are about to find ourselves in a “big debt crisis”. My first clue, was the title of the book itself, which, oddly enough, is:…. “The Big Debt Crisis“. Ray’s very general, one sentence, recommendation, again I don’t want to speak for him, is that Central Banks MUST continue to provide liquidity and support Western asset prices through the entire cycle to avoid a cataclysmic global depression. In short, Ray’s advice, and again, I’m still not speaking for him here, would seem to be to do exactly what the Chinese Communist Party would want the West to do.

The main reason I’m including a reference to this relatively ancient post (February of 2019) is that this post describes and documents the epiphany I had when I first fully understood the grand economic master plan of the Chinese Communist Party. My theoretical assessment seems to be diverging from a mere theory and evolving into more of a cold-hard reality by the day. I of course invite you to reread this tome in its entirety if you have the time, but in order to give you a flavor of where we’re headed, I’ve simply reattached the graphic below to give you a visual of where the Western Financial System is headed if we don’t change course soon.

Pretty graphic, don’t you agree? The big differences between “then” and “now” is that this time, because of the size of the economic power shift, this transfer of wealth and power from the West to the the Chinese Communist Party will likely be permanent and irreversible. The second difference is that they will have accomplished this transfer of wealth and power by using our own systems against us. They will have lied, cheated and stolen their way to global dominance.

Things that Make You Go….Hmmmmmm……

As we examine the seemingly incessant stream of recent “bad luck”, odd happenstance and inexplicable events taking place on a nearly daily basis, even though we’ll never be able to prove, with certainty, the genesis of any of it, here are just a few of the “never been seen before” gyrations that have popped up in just the last week or two that are likely linked to or influenced by Chinese financial engineering. Of course, the following are over and above the already discussed absurd Tesla volatility and the surprise 12,400 Caymans family offices showing up in just the last few months. Here are but a few of the very strange anomalies rearing their ugly little heads over the last week or two.

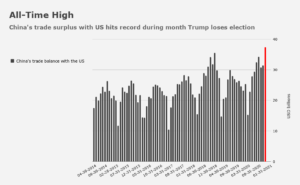

Record China Trade Surplus in the Midst of a Trade War

We’ve been in a trade war with China for over a year (or so I’m told) yet China’s Trade Surplus with the United States his an all time high in November…..hmmmm

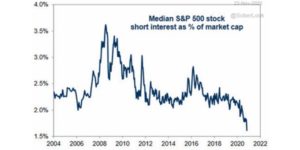

Record Low Short Interest

We’re witnessing significant stock market appreciation and apparently, very few of us believe that there’s any possibility that stocks could actually lose value. S&P 500 Short Interest as a % of market cap is at record lows….hmmmm

h/t @MichaelGoodwell

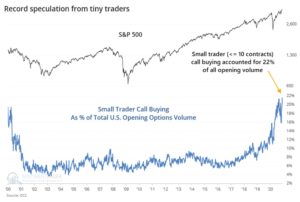

Record Call Option Volume

One of the simplest, easiest, common hedges, is to purchase a Call Option to cover a short position. Even though shorts are at an all time low, Call Option volume has gone through the roof….hmmmmm

h/t @corptrader

Record Small Trader Participation/Option Speculation

Small investors (Chinese/Caymans LLCs??…..a few contracts at a time?) are buying (presumably purely speculative/naked) calls at a record level….expecting that the market euphoria will continue…. hmmmmmm

h/t @sentimentrader

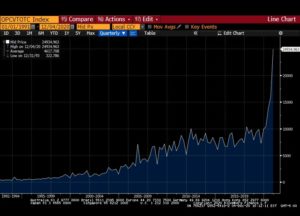

Record Global Exuberance

The exuberance seems to be global in nature…..Global equities are now sporting a valuation of more than US$100 Trillion……up roughly US$40 Trillion from $60 Trillion six short months ago….in the middle of a global pandemic……hmmmmm

h/t @Schuldensuehner

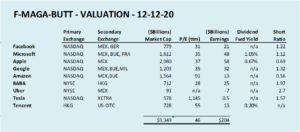

Record Concentration and Valuation

I could be wrong, but I don’t recall any time in history where there has been this level of concentration in so few stocks. A few months ago, my little niece and nephew were playing a game of “potty words we can’t say” which inspired me to come up with the moniker F-MAGA-BUTT Stocks (Facebook, Microsoft, Apple, Google, Amazon, Baba, Uber, Tesla and Tencent). $9.4 Trillion, or the equivalent of roughly 25% of the entire market capitalization of all US Stocks, is tied up in these 9 tech stocks. The P/E of these stocks is a remarkable 46, or the stock price represents 46 years of the current earnings of these businesses. Now with the IPOs of Air B&B and Door-Dash we can add another $169 Billion to this perceived F-MAGA-BUTT value. Both businesses are producing losses and are currently valued at 29 x revenue.

I’m sure there are a lot more of these “Hey…I don’t think this has ever happened before….” data points out there. They seem to be popping up every day….

Ok DT….Let’s say you’re right….What can we do?

As I described above, we Westerners have been in a war for quite some time, yet we haven’t believed, understood, acknowledged, accepted or done anything about it. We’ve let the burglars in the house thinking they were our friends, endorsed by the “helpers”, yet we continue to rationalize different theories about how the silverware and jewelry might have gone missing. We wonder why our family members have been bound, gagged and locked in the closet as the Chinese are loading our furniture into the moving van. We can’t believe that this could possibly be happening. We had thought that we had reformed the criminals and that they were becoming honest, Westernized, helpful global citizens. When we politely ask the Chinese about these indiscretions, they deny that they’ve had anything to do with anything, and insist that even if they did, that we can’t possibly prove it. Delay, Deny and Defend….right out of the McKinsey playbook. (Note: I’m using McKinsey in a generic sense here, I could have easily used any large consulting firm as a reference) We’ve taught them well….

- The first thing we need to do is to get a handle on the Tax Haven money, specifically the Caymans. We need to take surgical, targeted steps, working with the CIMA, and other foreign tax haven monetary authorities and banks and US Bank overseas branches, culminating in the overnight freezing, seizure and confiscation of illegitimate offshore Chinese money. In matters of financial and economic security we must presume guilt until the owner of the funds proves their innocence. “No Ticky!…No Laundry!!”

- We must strictly enforce Anti-Money Laundering (AML) and “Know your Customer” laws, not only for US Banks and Money Managers, but their foreign Counterparts. “Knowing Your Customer” does not simply mean knowing that the wire transfer is coming from an account owned by a Caymans “Private Fund”. It means knowing who the actual owners, managers and funders are, where the money came from, and the purpose of the funding. There must be significant jail time, sanctions and penalties actually handed down to violators who flaunt, subvert and take advantage of the open nature of US Capital Markets. Again, the laws are already on the books. All we need to do is enforce them.

- We need to tighten up Exchange rules which give foreign frauds a free pass to list in the United States. I’ve long opined that our lax rules (much less rigorous than those for domestic listings…the NYSE rules are absurd, they generally require a lawyer, a banker and a letter from the promoters mother to list) invite these frauds with no reasonable remedy available to defrauded investors. Worse, there are never any meaningful sanctions to the promoters and underwriters of these frauds. The industry views any slap-on-the-wrist penalties resulting from this engineered, repetitive, systemic fraud as a reasonable cost of doing business. We need to actually, immediately (Rather than wait three years as is now the new “law” pending POTUS signature, per the current get-out- of-jail-free legislation S.945) de-list Chinese stocks that don’t comply with updated US Exchange rules, mirroring the same rules/hurdles and reporting requirements expected from US listings. We need to hand out stiff “example making” penalties, including jail time and personal asset seizure/forfeiture for the bankers and promoters who had actually marketed and sold these stocks and investments. The irony is, that the laws are already in place. All we need to do is enforce them.

- We need to immediately increase the FDIC insurance limit to $2 million for US individual and small business depositors to instill confidence in our banking/financial system and limit exposure for most depositors and households .

- We need to immediately (if not sooner) reevaluate the access and usage of SWIFT and DTCC environments by Chinese banks, specifically those branches operating in the US and the tax havens.

- We need to stop blindly accommodating global dollar flows without truly understanding where the money is going. Again, there is no “dollar shortage” there is global “dollar hoarding”. We have to stop funding those who would do us harm.

I think Alan Grayson said it best ….”so who got the money?”

Ben Bernanke didn’t know then….and Jay Powell doesn’t know now….in fact, he can’t possibly know…that’s the essence of the dilemma.

We have to stop relying on accomodative, technocratic jargon, and ridiculous analysis, bad, misrepresented TIC Data, and silly Banker representations like “Oh my….we seem to be out of money again…..the world needs liquidity and we must supply it or life as we know it will cease to exist….”.

If and when one of these big banks gets itself into trouble (like they likely are now) we need to treat them like the FED treats any smaller/mid-sized US Bank. The FED swoops in on a Friday night, fires the management, auctions off the assets (usually at a discount), unwinds the mess and opens up the next week under new management with a new logo on the door. The shareholders of the failed bank would be wiped out (as they should be….as I recall, this process is a wonderful, cleansing aspect of capitalism).

Of course, the argument against “wiping out” the equity of a TBTF big bank has always been based on credibility grounds (until Lehman). We’re told that the markets simply couldn’t survive the shock of a big bank going under. I disagree. 1.) The underlying assets will still exist, they will simply be properly priced and end up in the hands of another investor/bank. 2.) Today, the Market Caps of these banks (JPM, BAC, WFC, MS, GS, C, etc.) are about the same value (or less) individually as a modestly successful tech stock or IPO, like the Air B&B and Door Dash IPOs last week. (i.e. there’s plenty of capital out there.) so we shouldn’t be concerned about a forced restructuring and a perp walk or two. 3.) I might also argue that much of the global market making of these banks is actually destructive to the US Main Street Economy, forcing my grocer and hardware store owner to compete with the Chinese Communist Party for capital.

These banks, money managers and law firms have been the knowing, facilitators and architects of this “heads I win tails you lose… pump & dump”. They are actively working as “helpers” and hired guns… for the highest bid, commission and fee, without regard for or the consideration of the carnage and destruction their actions are forcing on America and Western financial systems.

That’s it. That’s all we need to do. Like so many challenges America has faced before, we need to come together, understand the threat and take intelligent, prudent steps to eliminate it. To put it all in perspective, this isn’t rocket science, landing on Omaha beach or the beginning of a world war. This is simply distancing ourselves from a bad, bad spouse and ending the marriage. There isn’t anything that the Chinese Communist Party brings to the table that the West can’t do without. We need to understand that, come to grips with it and get this wayward spouse out of our collective life so we can move forward, heal and minimize the financial impact of the divorce. Once we take the steps described above, the Chinese Communist Party will falter, stumble and eventually whither away like a the creeping, aggressive garden weed it is. We just need to ignore the self-interested, destructive advice of our embedded, profiteering “helpers”… ….and do it.

Additional Data

GDP Component Data – IMF

BIS REPORT – bis.org/publ/work851.p